Home price falls to continue

Updated: 2012-01-10 09:27

By Hu Yuanyuan and Wang Ying (China Daily)

|

||||||||

Experts foresee hard time for the nation's real estate market in first half of 2012

BEIJING / SHANGHAI - Property prices in China will continue to decline in the first half of the year before gradually stabilizing in the second, and real estate investment will plummet, industry analysts said on Monday.

|

|

|

A property fair on Jan 1 in Haikou city, Hainan province, attracts a lot of potential consumers. Industry insiders say the value of property sales and prices will come under huge pressure this year, but a sharp decline is unlikely.[Photo/Xinhua] |

"The economic slowdown, increased capital pressure on property developers and the growing supply in the market all point to a further fall in home prices this year, especially in the first six months," said Yue Sen, a researcher with REICO, a research institution affiliated with China Real Estate Chamber of Commerce.

Liu Xiaoguang, chairman of Beijing Capital Land Ltd, said the value of property sales and prices will both come under huge pressure this year, but a sharp decline is unlikely.

"The real estate market will feel a real chill during the March-April period," said Liu.

According to the China Enterprises Development Report released by the State Council's Development Research Center, the market will undergo a fundamental change this year.

"With more economically affordable and low-rent homes entering the market, government-subsidized housing will dominate half of the market, helping to cool prices," said the report.

The government's ongoing tightening measures, including a rise in the level of downpayments and restrictions on the number of homes a family can purchase, have begun to bite.

The average price of properties in the country's 100 biggest cities continued to decline in December, sliding 0.25 percent from November, according to the China Index Academy, a Beijing-based real estate research institution.

December was the fourth consecutive month in which the average home price weakened across the country. Of the 100 cities monitored, 60 saw a month-on-month drop in prices.

|

|

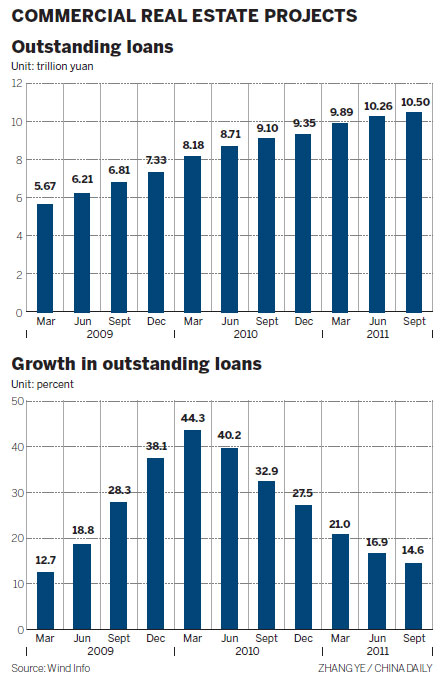

For Zhou Xiaochuan, the governor of the People's Bank of China, the central bank, the risk of mortgage default is under control at present, given the size and proportion of home loans in terms of overall lending.

"However, we should also be aware of relevant potential risks arising from small enterprises, because they usually use their property as collateral for loans," said Zhou in an interview with Xinhua News Agency on Sunday. "As property prices decline, the size of mortgages will also drop, affecting overall bank lending."

However, the ongoing correction in the country's real estate market is raising concerns for some international investors. Although the central government has reiterated its determination to maintain its rigorous policies, some industry insiders still expect a gradual loosening in the second half of the year.

The country's property market will collapse if the government maintains its tightening policies, according to Chen Li, head of China equity strategy at the investment bank UBS AG.

"The government may relax its curbs on the real estate market before the fourth quarter," Chen said, according to quotes published by Bloomberg on Monday.

James Macdonald, head of Savills China research, part of the real estate information provider, Savills PLC, held a similar viewpoint.

"It is widely believed by market observers and experts that the policies will be loosened in the second half of 2012," said Macdonald.

The worsening international economic situation means that central government policy is likely to focus on sustaining growth in the domestic economy and on employment levels. Therefore, the central government is likely to loosen the current tightening policy. An initial step was the reduction of the reserve-requirement ratio for lenders by 50 basis points, he said.

At the same time, the government is wary of loosening the restrictions too early or too quickly, Macdonald added.

The loosening of the restrictions is likely to be slower and not as comprehensive as in 2009. The temporary hard-line restrictions will be replaced by softer policies designed to be more flexible. Those measures could include replacing the home-purchasing restrictions with a property tax, which - rather than forbidding investment in multiple properties - would discourage investors by increasing the cost of ownership and diminish returns.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|