Local governments 'need adequate funding'

Updated: 2012-02-28 09:47

By Zheng Yangpeng (China Daily)

|

||||||||

BEIJING - China must ensure that local governments have the fiscal capacity to meet their spending commitments, while it also must contain the growth of government expenditures, a report jointly issued by World Bank and the Development Research Center of the State Council said.

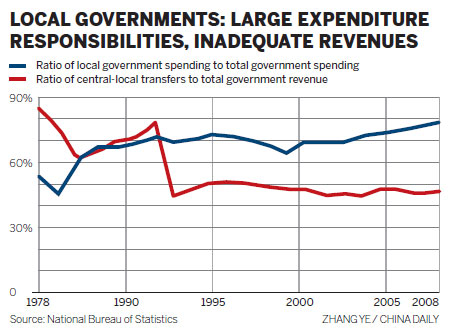

"Local governments are responsible for 80 percent of government expenditure responsibilities but receive only slightly more than 40 percent of tax revenues as transfers from the central government," the report issued on Monday said.

It said that there should be a link between fiscal capacity and spending responsibilities.

China's fiscal revenue hit a record 10.37 trillion yuan ($1.64 trillion) in 2011, up 25 percent year-on-year, according to the Ministry of Finance.

Fiscal revenue includes taxes as well as fees, penalties and other items.

Fiscal revenue grew faster last year than the overall economy, which expanded 9.2 percent. The contrast aroused public concern about the surge in government income and the high tax burdens faced by individuals and companies.

Xie Xuren, the finance minister, has said that the ratio of fiscal revenue to GDP and the level of per capita fiscal capacity (the ability to generate revenue) were low by international standards.

China's fiscal revenue was equivalent to 22 percent of GDP in 2011, calculated using officially released figures for fiscal revenue and GDP. The ratio in 2010 was 20.9 percent.

Scholars said the report's suggestions came at an opportune time, as local governments faced a grim fiscal situation because of central government property curbs.

"China's local governments have relied on land transfer fees more and more heavily since the fiscal system reform in the mid-1990s," Huo Deming, a professor at the China Center for Economic Research of Peking University, said.

"If this category of revenue is eliminated, local governments would encounter great problems," Huo said.

A major overhaul in 1994 revamped national-provincial fiscal relations. Changes in the responsibility to collect taxes increased the central government's revenues and its ability to redistribute money.

The report said the most serious disparities occur among governments at the sub-provincial level, which were not included in tax-sharing arrangements in 1994.

Governments below the provincial level, however, are responsible for more than 50 percent of total public spending.

Fiscal transfers to sub-provincial levels remain largely at the discretion of powerful provincial governments and are subject to negotiations, leading to high disparities among sub-provincial governments, according to the report.

The report also called for containment in the growth of government expenditures.

The report said China's total government budget and off-budget expenditures as a share of GDP were about the same as some upper-middle- and high-income countries.

"It would be inappropriate to push it higher," it said.

The composition of government spending should also be altered, the report said. China could potentially aim to increase public expenditures by 1 to 1.5 percentage points of GDP for education, 2 to 3 percentage points for healthcare and another 3 to 4 percentage points to fully finance the basic pension system.

"Part of these incremental expenditures could be met through efficiency improvements in current expenditure programs and the rest through reallocation away from lower-priority investment budgets" such as infrastructure, the report said.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|