Coming weeks are 'crucial'

Updated: 2012-04-05 08:05

By Chen Jia (China Daily)

|

|||||||||

|

The Ministry of Commerce building in Beijing. High-level sources said the government, especially the Ministry of Commerce, is working to stoke consumption but that the policies needed for that purpose will still take some time to formulate. Nelson Ching / Bloomberg |

The coming few weeks will be the most crucial time for the country's economy in all of 2012, say Chinese economists.

Many observers say the country's economy is decelerating too quickly. The biggest question facing government officials now is whether they will be able to bring that slowdown to a gradual halt, said Wang Jun, senior economist with the China Center for International Economic Exchanges, a government think tank.

In an ideal scenario, the economy would bottom out in April and then remain stable for a couple of months before slowly growing faster in the second half of the year, he said.

The economy is close to having slowed down enough, economists said.

The latest data from the National Bureau of Statistics show that large Chinese industrial companies - defined as those that do more than 20 million yuan ($3.2 million) in business a year - earned 606 billion yuan in profit in the first two months of 2012, down 5.2 percent year-on-year.

Of those, State-owned companies faced the stronger headwinds. Their 179.1-billion-yuan profit for the two months was down by as much as 19.7 percent year-on-year.

Companies owned by overseas investors, meanwhile, earned 141.9 billion yuan in profit in those months, down by 18.9 percent year-on-year. Only companies under collective or domestic private ownership continued to report increases in profit.

The statistics bureau has not released a comparable report for March yet.

The government set the country's target for economic growth at 7.5 percent in 2012, a much more moderate pace than the 8 percent or more it has set in recent years. The goal was lowered in part to pave the way for an economy that relies more on domestic consumption rather than exports.

Even though some slowing down is expected, the economy is losing speed faster than some observers expected - a tendency that has been reinforced by sluggish demand from both home and abroad.

In coastal cities, export-oriented industries are slowing down across the board as a result of dwindling orders from the heavily indebted eurozone and surging production costs.

Throughout the country, retail outlets have seen their business slow down as the government allowed stimulus policies to expire without replacing them with new ones.

High-level sources said the government, especially the Ministry of Commerce, is working to stoke consumption but that the policies needed for that purpose will still take some time to formulate.

The Ministry of Commerce recently designated April as the first "month to promote consumption". But policies meant to support buyers have yet to be introduced nationally.

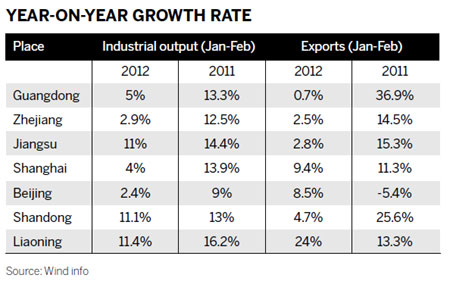

In January and February, industries in Guangdong, China's largest exporting province, saw their output increase by only 5 percent year-on-year, the slowest rate recorded in 18 months. That meant the companies' growth rate had lost two-thirds of its speed from the same period last year.

The province's exports increased by only 0.7 percent, according to the Guangdong bureau of statistics.

Meanwhile, retail sales came to 366.8 billion yuan for the two months, a year-on-year rise of 10.4 percent, compared with 16.1 percent in the same period last year, provincial statistical officials said.

In Zhejiang province, which contains one of the largest clusters of private businesses in China, industrial output increased at a record low rate in January and February, going up by only 2.9 percent year-on-year. In the same period a year ago, the comparable figure had been 12.5 percent.

Zhejiang's growth rate for export increase came down to 2.5 percent year-on-year in the first two months from 14.5 percent in the same period of 2011, according to the provincial statistical institution.

Retail sales, meanwhile, climbed by 12.7 percent in the province in the first two months, a rate that was 2.3 percentage points down year-on-year.

Other provinces and municipalities in China's more industrialized belt, including Shanghai, Beijing and Tianjin, all saw a marked slowdown.

As the economy decelerates consumer spending has also not been moving on at a very fast clip, noted Peng Wensheng, chief economist at China International Capital Corp Ltd.

According to the statistics bureau, the value of China's retail sales of consumer goods increased by 10.8 percent in real terms in the first two months this year, lower than the 13.8 percent growth recorded in December and the 12.8 percent in November.

It is unlikely that, in the next few months, the central government will allow the slowdown in GDP to hinder the job market and dampen consumer confidence, Peng said.

Cao Yuanzheng, chief economist of Bank of China Ltd, forecast that Beijing will increase the credit supply in the second quarter of the year and spend more on government-subsidized housing projects.

Making growth more stable will not be easy. For one, the lingering effects of inflation continue to dampen buyers' enthusiasm, said Yuan Lei, an economist with the Chinese Academy of Social Sciences' institute of industrial economics.

Although the nation's consumer price index, an indicator of inflation in the retail market, fell to 3.2 percent year-on-year in February from 4.5 percent in January, food prices still rose at a much higher 6.2 percent. Worst of all, pork prices jumped by as much as 15.9 percent, according to data from the statistics bureau.

And more dampening came from the central government's decision to raise gas and diesel prices, announced in late March, said Yu Bin, director of macroeconomic research at the State Council Development Research Center.

That, he feared, will put pressure on the cost of transporting farm products and result before long in still higher food prices.

Yu, for his part, did not appear to be greatly concerned.

"The increase in rural people's incomes will help people buy more basic consumer items," he said.

chenjia1@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|