Understanding the workings of the CPI

Updated: 2012-05-18 11:20

By Rabobank International (China Daily)

|

||||||||

|

For China's policymakers and the general population, the consumer price index is one of the most-watched indicators. But how the China CPI actually works is not readily transparent.

The CPI for March was released on April 9, showing a rise to 3.6 percent, down from 4.9 percent in January 2011.

Food inflation dropped to 7.5 percent from 10.5 percent in January 2012. Although these two indicators show that this round of inflation may have come to an end, concerns remain regarding the direction of the CPI and its volatility.

The CPI's high volatility can severely affect consumers' standards of living as the mismatch between income growth and expenditure growth continually causes consumers to rethink their spending decisions.

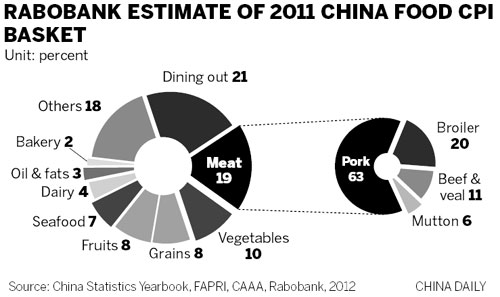

In China, the media and the general public ironically refer to the CPI as the "China pork index." On the surface, official figures make it clear that the meat CPI is behind much of the volatility in the overall CPI.

While the CPI is an official figure, the calculations behind the index are not publicly available. In July 2011, the CPI reached 6.5 percent, an alarming level that drove the government to take actions including putting price caps on some edible oils and releasing stocks from its pork reserve.

In China, food purchases account for 35 percent of urban household expenditure and 41 percent of rural household expenditure. Over the past decade, food expenditure for urban households has accounted for an overwhelming 62 percent of the CPI on average.

Clearly, the food CPI is a major driver of changes in the overall CPI. The CPI measures the weighted average of price changes of a basket of consumer goods and services. The two main components are the weighting of items composing the basket and their price fluctuation.

The food CPI basket remains mysterious as no official data on the breakdown has been released. While some have tried to estimate the basket by using complex regression models or by extracting information from official documents, Rabobank has fundamentally approached the mystery by using official data on food expenditure per capita.

According to the National Bureau of Statistics, the food CPI is composed of 16 major categories and includes 262 products. Although the weightings of food products in the food CPI are not disclosed to the public, the food expenditures within these categories are published on an annual basis.

By extrapolation, Rabobank assumes the weighting of items in the food CPI basket are equal to their weighting for food expenditures on an annual basis. Given the relatively high per capita meat consumption in China, the food CPI basket is a "meaty pie", which explains why the pork price matters.

Based on the CPI definition, price movement is reflected only if prices fluctuate. Rabobank tracked the monthly price volatility from the past decade of the major components of the food CPI. The most volatile item was the pork price.

Based on the official food item price movements and Robobank's food CPI basket estimation, the bank modeled the contribution of each major item in the food CPI. The model includes price movements of the major food items with a weight allocation system to track the contribution of the major food items.

Comprising a large proportion of consumers' food expenditures, meat plays a large role in determining the overall direction of the CPI. Pork was a major contributor to CPI hikes in July 2004, February 2008 and July last year.

Declining prices outweighed the uplift in CPI from other major food categories between February 2009 and July 2009.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|