Chinese shoppers less loyal to brands

Updated: 2012-07-06 12:27

By Wang Zhuoqiong (China Daily)

|

||||||||

|

Master Kong instant noodles on display at a supermarket in Binzhou, Shandong province. Wen Wu / for China Daily |

Cookies, tissues, detergents draw least allegiance

Faced with a multicolored array of packets on the supermarket shelf, Li Weili had difficulty deciding which brand of detergent she wanted.

Suddenly, one with the words "Buy one and get one free" caught her eye, and she put it in her cart.

"I was overwhelmed by the number of brands on the shelf," says Li, 55. "The simplest thing to do was to go with the one that had a deal on it."

Li is not the only shopper who has struggled to choose a brand when shopping for daily necessities. According to a recent survey, Chinese consumers exhibit little brand loyalty toward goods that tend to be used up quickly, even though they buy such goods frequently.

The study, named the 2012 China Shopper Report, conducted by Bain & Company, an international business consulting firm, and Kantar Worldpanel, a provider of consumer research, dispels several misconceptions about how Chinese shoppers respond to product brands.

The researchers in the study divided shoppers' behavior into two categories, "loyalist" and "repertoire". Interviewing shoppers from 40,000 households in urban China, they found that the vast majority tend to exhibit repertoire behavior, meaning they do not stick to one brand when shopping for the goods they buy most frequently.

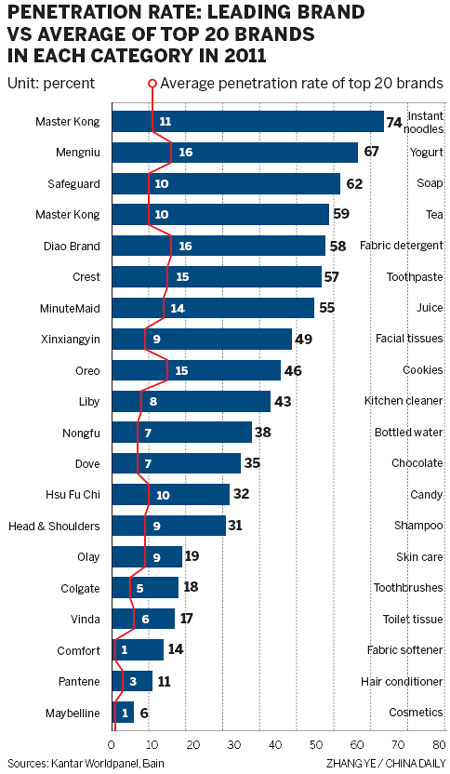

Shoppers showed the least loyalty to individual brands of cookies, fabric detergent, juice and facial tissue.

The findings also suggested that Chinese customers tend not to be entirely forthcoming when talking about their shopping habits.

More than 60 percent of the respondents said they first look at brands when trying to decide what products they want to buy. But, when it comes to making a purchase, other considerations take on greater importance, the study said.

"Marketers must pay attention to what Chinese shoppers do, not what they say in the survey," Bruno Lannes, partner of Bain & Company, says.

"Otherwise, they risk spending money on trying to drive behaviors that simply are not possible in this market."

The survey looked at the 26 categories of consumer goods that are most commonly sold in China, including packaged foods, beverages and personal care and home-care products. Barcode scanners were used to track the respondents' purchases.

"Chinese shoppers are pampered by having an abundance of brand choices," says Jason Yu, general manager of Kantar Worldpanel China. "Hence it is increasingly difficult for big brands to stand out from the clutter.

"It is essential for marketers to understand the nature of the categories they are competing in and make the right growth plans."

Lannes says brands that are likely to enjoy the least loyalty should run TV commercials inside stores and use similar methods to remind shoppers of their products.

Sun Tianzhen, spokeswoman for Hsu Fu Chi International Ltd, a confectionery maker, says the findings can give companies hints about how to become stronger competitors.

"Chinese people show a lot of variety in their food tastes," she says. "To inspire shoppers with brand loyalty, you have to constantly improve the quality of the food you are selling and introduce new products with fresh flavors."

Sun says it is very important to communicate with shoppers when they are in stores. To that end, the company has set up television screens in stores to inform shoppers about its production lines and food safety.

Strong loyalty

Chinese shoppers also exhibit strong brand loyalty when they buy infant formula, diapers, milk, beer, carbonated soft drinks and chewing gum, the study found.

Wang Jing, the mother of a 1-year-old, always purchases the same foreign brand of formula milk and same brand of diapers.

"There might be a risk in trying a new brand of milk powder or new brand of diapers," says Wang, 33. "As long as my son is comfortable with what he's using now, I'm not going to switch."

Another Bain study looked at shoppers who routinely buy infant products and found there was often no compelling reason to change brands. Babies, it explained, are incapable of opining about a product and mothers tend to think that continually using the same brand benefits their child's health.

For that reason, a company should try to ensure that shoppers are familiar with its brand as soon as they start shopping for a particular product.

And the strategy should be similar for companies that sell goods for which brand loyalty tends to be stronger. They also should try to encourage shoppers to try their brands first and try to ensure that their brands are easy to find in stores, Lannes says.

"Winning brands are those that are better at attracting new shoppers day-in and day-out, and that keep increasing the number of shoppers who buy their goods," he says.

Lin Shuang, a maker of traditional Chinese dresses, says she dislikes change.

"If I find a brand I like, I stay with it," she says. "But most of the time, people are forced to change brands because they aren't satisfied with what they are buying now."

wangzhuoqiong@chinadaily.com.cn

(China Daily 07/06/2012 page22)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|