China's firms bigger but not necessarily better

Updated: 2012-08-14 14:28

By Zhu Ning (China Daily)

|

||||||||

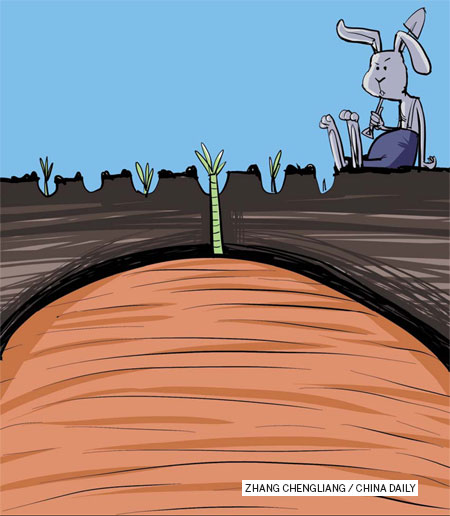

Enterprises must chart focused corporate strategy to encourage investment and benefit economy

With 79 companies in the Fortune 500 list for 2012 published last month, China was the second most represented country in the rankings.

While many Chinese business leaders and managers feel excited about further growth of the corporate businesses and their increasing influence among international counterparts, some are concerned.

First, most of the leading companies from the Chinese mainland come from monopolistic or semi-monopolistic industries, where entry barriers are high and competition is limited. Second, among such large companies, their rankings will drop if ranked by their profits instead of the revenues, the common standard used by Fortune magazine.

Also, private companies feel that the further increase in the size of State-owned enterprises will hinder the growth of private ones and eventually crowd out their own businesses.

Such fears seem to coincide with some of the comments made by the World Bank earlier this year on the sustainability of Chinese economic growth over the next two decades. Based on their research, the World Bank and the State Council Development Research Center of China together recommend that, to make Chinese SOEs more competitive, an SOE's size should be limited, its growth model modified, and its dividend payout increased.

Such diagnoses and recommendations seem to be in line with the feelings of common people. More and more college graduates target SOEs as their ideal employer. "Even though the nominal salary is not as high, SOEs provide unparalleled benefits, and the work is not that demanding," as one put it.

At the same time, more private company owners are voicing their concern that SOEs are growing so big that they remove growth potential for private enterprises, many of which start at a disadvantage in resources, financing, and government support.

Senior officials from the State-owned Assets Supervision and Administration Committee admit that, with their increase in size, SOEs' operational efficiency and profitability have not improved accordingly.

So what has gone wrong? One answer may lie in corporate strategy. With the committee's objective of reducing the number of SOEs, the remaining ones have not only become bigger, but also more complex. By acquiring other smaller ones, remaining SOEs ventured into more sectors and businesses that they were not originally familiar with.

Investors in general are not keen on such diversification. Reviewing the corporate strategy of Western firms in the past three decades, scholars find a clear trend that companies from the US, Europe and Japan show a pattern of becoming more focused in their line of business. The number of conglomerates, defined as companies with at least five major lines of business, has decreased steadily over those 30 years. In contrast, the number of specialized companies, whose revenues come from no more than three lines of business, has increased.

Corporate managers have quoted operational and stock market performances as major reasons for the trend. Investors tend to favor companies with clear business models and competence to excel in them. For example, Warren Buffet is famous for sticking with his investment philosophy of picking simple businesses with clear competitive advantages in the long run.

A most recent case reflecting such a trend is the announcement of a split-up by News Corporation. As one of the largest media companies in the world, News Corp has been facing challenges in how to manage its stagnant traditional publishing business, in contrast with the fast growth of the video and Internet businesses. Although the publishing side still commands the majority of the corporation's assets, its contribution to profits has been decreasing steadily to about one-third of its profits.

The publishing business is also facing investigations over illegal eavesdropping, which not only blemished the company's public image, but also shook investors' confidence in the business and caused its stock price to under-perform.

To revive growth and restore investors' confidence, the Murdochs and News Corp decided to split the company into two, one focusing on publishing and one on video and movies. News Corp's share price shot up by about 30 percent within a week of the announcement.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|