Hotels buck weak global economy

Updated: 2012-10-29 09:02

By Hu Yuanyuan (China Daily)

|

||||||||

Average daily room rate still growing across major locations

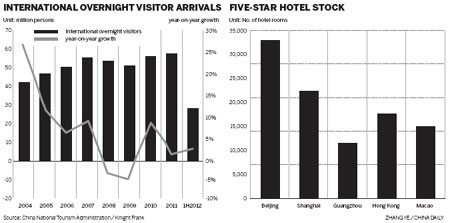

The average daily room rate - an index to gauge the prosperity of hotels - in Beijing, Hong Kong and Macao continued to grow despite the weak global economy, international real estate service provider Knight Frank said in its latest report.

|

|

|

The Oriental Plaza in Wangfujing, in downtown Beijing. Robust economic development and growing numbers of tourists in China make it an attractive hotel market in need of more rooms. [Photo/China Daily] |

Hong Kong experienced the largest year-on-year growth among the five cities in the first half of 2012, with ADR gaining 12 percent, followed by Beijing with a growth of 11.4 percent, according to the report.

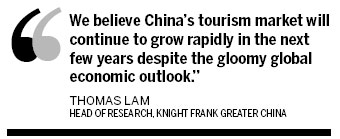

"We believe China's tourism market will continue to grow rapidly in the next few years despite the gloomy global economic outlook," said Thomas Lam, head of Research at Knight Frank Greater China.

Around 425 million people visited tourist sites around the country during the Golden Week holiday starting on Sept 30, up 40.9 percent over the same period last year. Revenue from tourism hit 210.5 billion yuan ($33 billion), an increase of 44.4 percent year-on-year, figures from the National Tourism Administration showed.

Robust economic development and growing numbers of tourists in China make it an attractive hotel market in need of more hotel rooms. International hotel operators have shown strong confidence in China's market and are pursuing aggressive expansion plans.

For example, Accor's upmarket brand Pullman is planning to open 25 hotels in the country by 2015, on top of its 14 existing hotels. Club Mediterranee plans to open five new resorts on the mainland by 2015, which will make China its second largest market in the world.

Starwood Hotels & Resorts has opened 40 hotels in China over the last five years, with an additional 90 in the works. InterContinental, which now operates 162 hotels in China, has an additional 143 under development.

"Sentiment in the Greater China hotel market is set to remain strong, with demand for hotel rooms being driven up by the increasing numbers of both local and international visitors," said Lam.

"In our judgment, the hotel market in all the five major cities - Beijing, Shanghai, Guangzhou, Hong Kong and Macao - will benefit from increasing demand from tourists and business travelers, including those coming from the MICE (meetings, incentives, conferences and exhibitions) and corporate segments," Lam added.

In the first half of 2012, hotel operators continued to expand in the Greater China region. Among the five major cities covered by this report, Guangzhou was the most active market in the first half of 2012, with more than 300 rooms added in the city.

The bi-annual Canton Fair is the largest trade fair in China and attracts more than 400,000 visitors every year. Given its position as a major Asian business and exhibition center, Guangzhou should continue to generate a steady stream of business visitors.

Shanghai's hotel market, in particular, is expected to benefit from the completion of major tourism projects, such as Shanghai Disneyland in 2015.

Meanwhile, Shanghai is to be developed into a regional transportation hub for the Yangtze River Delta region with infrastructure projects in the pipeline such as Hongqiao Transportation Interchange linking the Huning Intercity High-Speed Railway with air and municipal public transport lines.

A number of large convention and exhibition centers in Pudong, including Shanghai New International Expo Centre and Pudong Expo and Shanghai International Convention Center, will be holding many major international exhibitions in the coming years.

The hotel markets in Hong Kong and Beijing, according to the Knight Frank report, are expected to grow steadily.

Although already well developed, they offer unique competitive advantages that cannot be easily substituted. Also, both cities have a number of tourism projects in the pipeline that should further boost hotel demand. Beijing would benefit from the expansion of the MICE industry in the country and the central government's plans to develop the tourism industry into one of the pillars of the Chinese economy.

New hotel supply is expected to be limited in Beijing in 2012 and the ADR and occupancy rate should increase steadily and rebound to pre-2008 levels, according to the report.

Demand for hotel rooms in Hong Kong is expected to grow further, with a number of tourism-related projects in the pipeline, such as the expansion of Ocean Park and Hong Kong Disneyland as well as a new cruise terminal in Kai Tak.

huyuanyuan@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|