The future global economy

Updated: 2012-12-28 07:28

By Christine Lagarde (China Daily)

|

||||||||

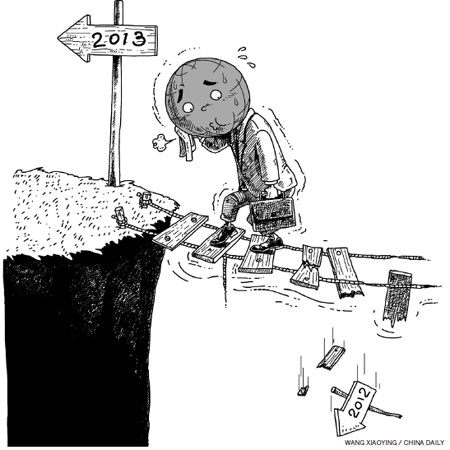

As the world enters yet another year in the shadow of continued financial and economic crisis, a broader view of the contours of the future global economy is required.

The longer-term trends are clear. Dynamic emerging markets from Asia to Latin America are rising in prominence. The United States and Japan remain important drivers of the global economy but face major debt and deficit challenges. Europe is going through a difficult but historic process of re-engineering and integration. The Middle East is transforming before our eyes. Sub-Saharan Africa is breaking through to sustained development, creating a new frontier of growth after decades of stagnation.

These changes are shaping our future in a positive way. Yet there are still considerable roadblocks to overcome. The global economic recovery remains too weak. With more than 200 million unemployed around the world, prospects for job creation are still too dim. And the gap between rich and poor, exacerbated by the crisis, is still too wide.

There is a tough road ahead if we are to turn optimism into reality. I see three key milestones.

First, and most obviously, we need to put the crisis behind us, once and for all. And we know how to do that: accommodative monetary policy; fiscal adjustment in all advanced economies that includes concrete and realistic plans to reduce debt over the medium term, but does not undercut short-term growth; completing the banking-sector cleanup; and reforms to boost productivity and growth potential. All of this should be complemented by a rebalancing of global demand toward dynamic markets, including emerging economies.

Perhaps the greatest obstacle will be the huge legacy of public debt, which now averages about 110 percent of GDP in the advanced economies, the highest level since World War II. This leaves governments highly exposed to subtle shifts in confidence. It also ties their hands, especially as they seek to build the physical and institutional infrastructure of the 21st century while respecting social promises. The needs of aging populations will add to these pressures.

History offers two clear lessons: reducing public debt is incredibly difficult without growth, and increasing growth is incredibly difficult with a huge burden of public debt. So we face a twofold imperative, securing growth while reducing debt. The key now is not only to move from deliberation to action on the policies that we know are needed, but to move together and on all fronts.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|