Social security fund reports healthy investment return

Updated: 2013-04-03 09:48

(Xinhua)

|

||||||||

BEIJING - China's social security fund manager said Tuesday that its investment revenues hit 64.5 billion yuan ($10.2 billion), with a realized rate of return on investment of 4.38 percent, a three-year high.

The fund's managed assets topped 1 trillion yuan for the first time at the end of 2012, up 27.5 percent from a year earlier, according to statistics from the National Council for Social Security Fund, or NCSSF.

In 2012, the fund received central fiscal capital totalling 52.6 billion yuan, up 9 percent from the previous year, the statistics showed.

The NCSSF said it also registered a healthy investment return on Guangdong's urban resident pension fund, which was worth 100 billion yuan in 2012. It did not offer hard data.

Founded in 2000, the fund is designed to serve as a solution for the country's aging problem, as well as a strategic reserve to support future social security expenditures.

More SOE profits will go to social security fund

Social security fund's annual return at 8.4%

Social security fund opens stock market accounts

China should appropriate more to social security: Dai Xianglong

Qingming Cultural Festival opens in C China

Qingming Cultural Festival opens in C China

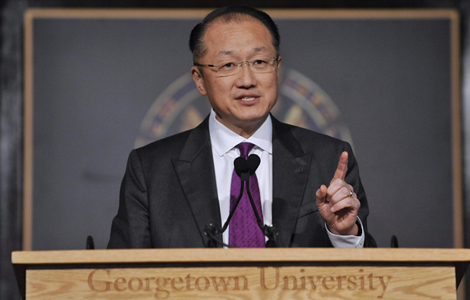

World Bank seeks end to extreme poverty by 2030

World Bank seeks end to extreme poverty by 2030

World Trade Center rises again

World Trade Center rises again

UN General Assembly approves Arms Trade Treaty

UN General Assembly approves Arms Trade Treaty

Xi gives green light for planting

Xi gives green light for planting

Sotheby's to hold Spring Sale in HK

Sotheby's to hold Spring Sale in HK

Cities urged to step up drainage improvements

Cities urged to step up drainage improvements

Opening up on autism

Opening up on autism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China, US to deepen military ties

BYD to build electric bus assembly plant

Chinese becoming US citizens decline

Beijing calls for DPRK talks

Kerry reaffirms defense commitment to ROK, Japan

Caroline Kennedy may be US envoy to Japan

New Chinese Ambassador arrives in US

Apple revises warranty terms

US Weekly

|

|