Ping An to raise $8.09b in subordinated debt

Updated: 2013-04-24 21:52

(chinadaily.com.cn)

|

||||||||

The Shenzhen-listed Ping An Bank said on Wednesday that it plans to raise up to 50 billion yuan ($8.09 billion) in subordinated bonds in the next three years to supplement its tier-two capital.

The lender said the terms of the subordinated bonds will be at least five years, and that the bonds will carry a write-down provision.

According to the lender's first quarter report of 2013, the bank's Capital Adequacy Ratio was 10.17 percent, and its Core Capital Adequacy Ratio was 8.25 percent.

The lender's CAR was 11.51 percent and its CCAR was 8.46 percent by the end of 2011.

By the end of March, the balance of Ping An Bank's non-performing loans was 7.37 billion yuan, and its NLP rate was 0.98 percent.

The proposal is subject to the approval of the bank’s shareholders' meeting, which will be held on May 23, according to the statement.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Sluggish growth takes its toll on foreign lenders

Investors find a home in overseas real estate

More Chinese travel overseas, study reveals

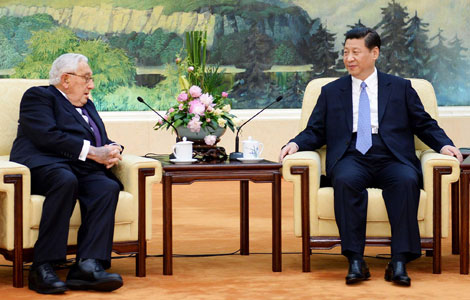

Xi meets former US heavyweights

Li in plea to quake rescuers

Canada to return illegal assets

Beijing vows to ease Korean tensions

Order restored after deadly terrorist ambush

US Weekly

|

|