Funds for canceled IPOs 'hard to cash out'

Updated: 2013-04-25 11:07

(China Daily)

|

||||||||

Venture capital and private equity funds totaling 3 billion yuan ($485.6 million) will be difficult to cash out, with 88 Chinese firms supported by VC and PE companies canceling their IPO applications, ChinaVenture Group said on Wednesday.

The 88 companies, out of 166 Chinese firms that have stopped their IPO examination and approval processes, are backed by companies such as Fortune Venture Capital, CSM Group, Jiuding Capital and Shenzhen Capital Group.

Another 714 companies are awaiting examination and approval by the China Securities Regulatory Commission, with about 300 involved with VC and PE funds.

- PE, VC firms not allowed to invest in public funds

- Siemens launches renminbi VC business

- VC, PE sector sees strong growth in numbers

- VC, PE eyes intl firms about to enter China

- PE, VC firms face battle for 'survival of fittest'

- PE, VC firms hit by economic slowdown

- Minimums set for PE, VC investing

- Social security fund has scope to expand in VC, PE

- VC, PE firms show appetite for food industry

- Mainland remains popular with PE, VC firms

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Sluggish growth takes its toll on foreign lenders

Investors find a home in overseas real estate

More Chinese travel overseas, study reveals

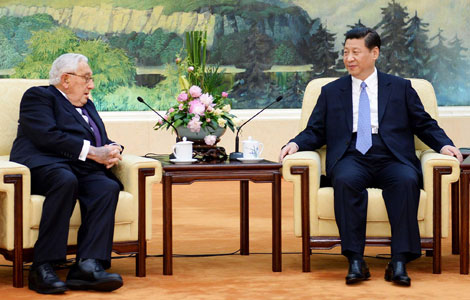

Xi meets former US heavyweights

Li in plea to quake rescuers

Canada to return illegal assets

Beijing vows to ease Korean tensions

Order restored after deadly terrorist ambush

US Weekly

|

|