Major lenders beat expectations with strong jump in earnings

Updated: 2013-04-26 11:01

By Gao Changxin in Hong Kong (China Daily)

|

||||||||

Galaxy Securities Co Ltd forecast an average 9.6 percent increase in lenders' earnings in the first quarter. The investment bank was more optimistic than Guotai Junan Securities Co Ltd, which forecast 8.9 percent, and Shenyin Wanguo Securities Co Ltd, which forecast 7.23 percent.

The gloomy market sentiment over Chinese banks stems from worries that their heavy reliance on net interest income may hurt profitability as regulators push harder for interest rate liberalization and funding channel diversification.

"Banks are set to play a smaller role in the long term as the country diversifies away from its reliance on bank loans," said Khiem Do, Hong Kong-based head of Asian multi-asset strategy at Baring Asset Management Ltd, in an earlier interview.

Heads of the "Big Five" banks reached a consensus at a meeting earlier this year that the banking sector's high growth will be unsustainable as net interest margins shrink due to fiercer competition, Caixin Online said in a report in January.

A property market rebound in the first quarter helped the banking sector. The central bank said this week that Chinese financial institutions extended a total of 710.3 billion yuan in mortgage loans in the first quarter, more than double the figure in the previous quarter.

Zhang Dawei, research director at real estate brokerage company Centaline Group, said that regulatory loosening last year resulted in a jump in mortgage loans in the first quarter.

"This was especially the case in March, when homebuyers rushed to make deals in the face of looming tightening measures," said Zhang.

Consumer loans also surged in the first quarter. The "Big Five" commercial banks' credit card loans, for example, jumped 51.04 percent year-on-year to 878.3 billion yuan.

- Minsheng Bank Q1 net profit up 20%

- Chinese banks see NPL ratio drop in 2012

- Sale of financial products in banks to be monitored

- Industrial Bank net profits up 32% in Q1

- Loan guidance is good for banks, report says

- Further executive reshuffles made at nation's major banks

- Bank regulator urges more rural loans

- Chinese banks' forex purchases increase

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Phone bookings for taxis in Beijing

Chinese consumers push US exports higher

Seoul delivers ultimatum to DPRK

Boston bombing suspects intended to attack NYC

No let up in home price rises

Bird-watchers undaunted by H7N9 virus

Onset of flood season adds to quake zone risks

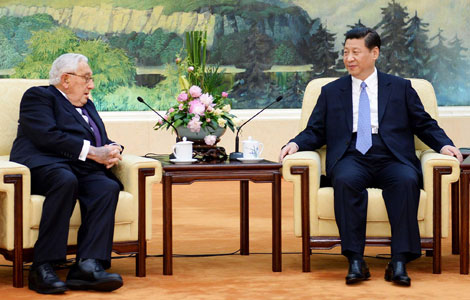

Vice-president Li meets US diplomat

US Weekly

|

|