Appeal of bling dims

Updated: 2013-07-05 07:04

By Zhu Jin (China Daily)

|

||||||||

Brands must raise their game if they want to win over China's growing number of middle-class consumers

Purse strings are tightening in China as the economy cools, which is hardly good news for those overseas luxury brands that have been banking on selling the signifiers of status and an upwardly mobile lifestyle to Chinese consumers. However, it is likely to be only a short-term setback.

Although the number of middle-class buyers of luxury goods in China has grown from 1 million in 1995 to 37 million today, many of them are expected to stop spending on luxury items now the country's economic growth has slowed.

In January, the consulting company McKinsey estimated that the annual consumption growth in China will be between 12 to 16 percent a year from now on, down from around 20 percent in recent years. Another survey, carried out by Bain and Company, even predicts a drop to 6 to 8 percent this year.

Gucci, which is owned by PPR, is the latest luxury brand to report slower sales growth in China, and its disappointing performance - disappointing in that it didn't meet the high expectations - was echoed by other brands under the PPR umbrella. The LVMH group, which owns many luxury brands, such as the popular Louis Vuitton and Bulgari, recently announced its earnings report for the first quarter of 2013, showing year-on-year growth of only 6 percent, a huge drop from the 25 percent for the same period last year. Moreover, Hermes has also said sales in China have cooled, while Cartier quietly closed 10 stores in China last year.

However, their falling sales are not just a result of China's economic slowdown, the government's crackdown on extravagance and graft has also hit sales of luxury goods in China. Business gifts, mainly for men, used to account for 20 to 30 percent of the total luxury goods consumption in China.

However, with the government's crackdown on officials receiving gifts, this segment has fallen off dramatically, and the luxury brands will need to focus more attention on female consumers and seek to increase their brand loyalty and service levels to compensate for the lost gift-giving revenue. Besides, huge and obvious logos are no longer welcome attention-grabbers for officials, thanks to the online fighters against corruption. But this will be a good change since the consumption growth will be led by the more sustainable demand of individuals consuming more lower-cost items rather than a small number of sales of higher-cost items.

Meanwhile, there are also increasing signs of changing consumption patterns in China, one of which might lighten the gloom for the luxury brands, as it suggests that they are still selling their goods to Chinese consumers - only not in China.

A survey conducted by KPMG found that 71 percent of respondents traveled abroad in 2012, up from 53 percent in 2008. And while 35 percent of Chinese people purchased luxury goods when traveling overseas in 2010, 62 percent did so last year, according to McKinsey. Moreover, some Chinese customers believe overseas boutiques offer a better service and more choice. By improving their service and providing only-available-in-China items the brands would be able to attract more consumers to buy in China.

Many surveys have found that Chinese consumers are using social media platforms and online forums to discuss and research luxury brands. Data from KPMG show that around 70 percent of potential consumers search for luxury brands on the Internet at least once a month. And while Cartier's axing of stores might seem like a retreat, it could merely signal a reduction in costs, since online shopping is increasingly popular, especially among younger customers.

McKinsey reported that the percentage of online buyers in China has increased from 2 percent in 2010 to 8 percent in 2012, and the number is expected to continue to grow, which means the traditional strategy of opening more retail outlets and spending big on advertising may be less effective than before.

It is estimated that the middle class in China will increase based on a compound annual growth rate of 14.1 percent, which means there will be 256 million potential customers by 2025. China remains the priority market for luxury brands, but they will have to change their business models if they are to succeed. However, with the changing consumption patterns of a growing middle class, less official gift giving and a better quality service from the brands, the luxury market in China will be more healthy, becoming a sustainable source of consumption that can help drive the economy.

- Highlights of luxury China 2013

- Foreign companies seek partners at Luxury China

- Luxury brands evolve with exhibition

- Luxury China 2013 kicks off in Beijing

- China's national brand Hongqi luxury sedans

- Beijing luxury property market rebounds in May

- HK's new cruise terminal receives luxury liner

- China's luxury consumption shift to quality

Chinese fleet arrives in Vladivostok for drills

Chinese fleet arrives in Vladivostok for drills

Joey Chestnut wins 7th contest with 69 dogs

Joey Chestnut wins 7th contest with 69 dogs

Lisicki, Bartoli to vie for new Wimbledon crown

Lisicki, Bartoli to vie for new Wimbledon crown

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

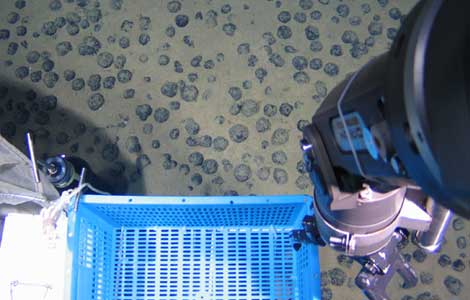

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Mandela on life support, faces 'impending death'

Missouri govt's veto won't stop Smithfield deal

ROK to discuss Kaesong normalization with DPRK

Gunman shoots two, commits suicide in Texas

Baby formula probe to shake or reshape industry?

Passenger detained over bomb hoax in NE China

High rent to bite foreign firms in China

Egypt's prosecution imposes travel ban on Morsi

US Weekly

|

|