Missouri govt's veto won't stop Smithfield deal

Updated: 2013-07-05 11:43

By Chen Jia in San Francisco (China Daily)

|

||||||||

Chinese pork manufacturer Shuanghui and America's largest pork producer Smithfield remain committed to their potential acquisition deal, despite Missouri Governor Jay Nixon's veto Tuesday of two bills that would have allowed foreign ownership of the state's farmland.

"I read the news talking about acquisition setbacks, but I think people should also note that Smithfield said that Missouri governor's veto will not create any obstacles to the acquisition plan," Liu Jintao, the vice-general manager of Shuanghui Group, said in a statement posted on his Chinese blog on Thursday.

The proposed acquisition of America's largest pork producer Smithfield would be the biggest Chinese takeover deal of a US company.

On May 29, Shuanghui International and Smithfield jointly announced their merger agreement - Shuanghui will acquire all of Smithfield's outstanding shares and its debt valued at $7.1 billion.

For the acquisition, Shuanghui has received loans of $7.9 billion from the Bank of China and Morgan Stanley.

Bank of China will use the assets and property of both sides as collateral for its $4 billion loan to Shuanghui.

Shuanghui will solve Smithfield's debt with the $3.9 billion loan from Morgan Stanley. It is supposed to use $750 million in revolving credit instruments, a $1.65 billion term loan and a $1.5 billion bridge loan.

On Tuesday, Governor Nixon vetoed Senate Bill 9, which includes a provision that eliminates the existing ban on foreign ownership of Missouri agricultural land.

As an amendment, the provision earlier had been rejected by a legislative committee despite opposition from leading agricultural groups, according to the governor's office.

"Not only was this provision inserted into the bill without a public hearing, it was done so after the provision was rejected by at least one legislative committee on agriculture, as well as publicly opposed by leading Missouri agricultural groups," Nixon said in a statement on Tuesday.

Hao Junbo, an international merger and acquisition law expert, told China National Radio on Thursday that Shuanghui could take other measures to realize its target even though the state law will not allow foreign company purchasing of agricultural land.

Nixon vetoed the bill and destroyed an opportunity to cancel the ban, but it doesn't mean the opportunity will be gone forever, Hao said.

He said Nixon's attitude would not result in the acquisition failure and there are other ways to go through the legal procedure for the two companies, such as leasing.

The state government doesn't have the right to stop the deal between Shuanghui and Smithfield, he said.

It also reported a Missouri council staff said that state lawmakers still have a chance to overturn Nixon's veto in September.

Hao said the real challenge for the acquisition is to get approval from the Committee on Foreign Investment in the US. In recent years, Chinese enterprise acquisitions of US companies have suffered many setbacks because of denials by that committee.

In 2010, Huawei lost its acquisition bid for a US company because it was called a security risk by US politicians. In 2012, Trinity Group's acquisition of four wind power projects in the US also failed for similar reasons.

chenjia@chinadailyusa.com

(China Daily USA 07/05/2013 page1)

Kobe Bryant reportedly has highest net worth in NBA

Kobe Bryant reportedly has highest net worth in NBA

Chinese fleet arrives in Vladivostok for drills

Chinese fleet arrives in Vladivostok for drills

Joey Chestnut wins 7th contest with 69 dogs

Joey Chestnut wins 7th contest with 69 dogs

Lisicki, Bartoli to vie for new Wimbledon crown

Lisicki, Bartoli to vie for new Wimbledon crown

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

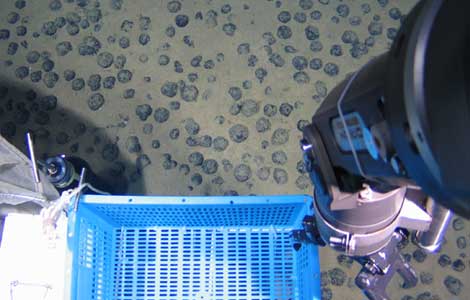

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Missouri govt's veto won't stop Smithfield deal

Canadian potash deal shows trend among Chinese

Asian Americans more upbeat on home finances

Mandela on life support, faces 'impending death'

ROK to discuss Kaesong normalization with DPRK

Gunman shoots two, commits suicide in Texas

Baby formula probe to shake or reshape industry?

Passenger detained over bomb hoax in NE China

US Weekly

|

|