Trade activity lifts outlook in maritime sector

Updated: 2013-10-30 07:33

By Zhong Nan (China Daily)

|

||||||||

In the wake of increased trade activities and international summits that have bolstered regional economic cooperation, new data indicate that the fourth quarter should be a turning point for the recovery of China's shipping sector.

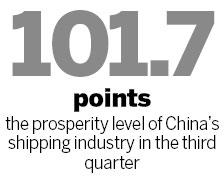

The Shanghai International Shipping Institute's latest index shows that the prosperity level of the country's shipping industry in the third quarter rebounded by 15 points to 101.7 points, quarter-on-quarter. It is the first time that the index surpassed the 100-point neutral reading since the third quarter of 2011.

Due to weak demand, depressed freight rates and price wars, China's shipping industry has been stuck in a recession for more than four years.

But Han Yichao, an industrial analyst with Changjiang Securities Co, said new signs reflect a shipping recovery, as both emerging and developed economies are eager to adjust their policies to boost trade.

"Thanks to new measures to stimulate exports and promote trade - such as creating bilateral ties to a comprehensive strategic partnership and signing free trade agreements with countries such as Indonesia, Iceland and Switzerland - China's shipping market will continue to grow in the fourth quarter and beyond," Han said.

The Shanghai Containerized Freight Index, which measures outbound container rates, rose to one of its highest points of the year. The current cost of sending a container to Europe is about $765, which reflects a rise of about $45 since the start of 2013.

"With growth gaining impetus in the third quarter, regional trade among China, Europe, Southeast Asia and South America will be more dynamic," said Zhou Zhicheng, deputy director of the research department of the Beijing-based China Federation of Logistics and Purchasing.

Zhou said the ongoing rebound of the US manufacturing industry and real estate market is another factor that will fill vessels on shipping routes between the world's two largest economies.

Meng Lingru, an industry analyst with Shanxi Securities Co, said demand for shipping commodities and raw materials should rise at a fast pace, especially in developing countries.

"Countries in Southeast Asia and Africa are planning to launch more infrastructure and urbanization projects, so the dry bulk shipping market should see decent growth over the next three years or even longer," Meng said. "Dry bulk tonnage will definitely grow faster than in 2012."

Meng said diversified development in the China (Shanghai) Pilot Free Trade Zone also will boost China's shipping sector amid a slow regional economic recovery in other parts of world. Transit trade and near-sea shipping will share a large proportion of the freight volume.

Even as demand rises, Chinese shipping companies continue to grapple with overcapacity and high operating costs. They have slowed container and bulk ship investments after years of losses, and many are scrapping high-cost vessels and selling off assets to improve their financial position.

In August, China Cosco Holdings Co decided to sell some of its assets to its parent company, China Ocean Shipping (Group) Co, for 3.73 billion yuan ($605 million).

China Shipping Container Lines Co, the nation's second-largest shipping company by capacity, put in a $700 million order to purchase five container vessels, each with a carrying capacity of 18,400 20-foot containers, from South Korea's Hyundai Heavy Industries Co.

Liu Bin, a professor at Dalian Maritime University in Liaoning province, said that both Chinese and foreign shipping companies are bowing to current conditions by ordering larger vessels with low-carbon-emission engines.

"As vessel sizes grow, transport costs of these mega carriers are dropping," Liu said.

"This will put huge pressure on small and medium-sized shippers," he added.

Aggressive moves already are being made: Cosco Shipping, a listed company within China's Cosco Group, is developing new routes to capture market share and save fuel costs. In September, a multipurpose vessel completed its maiden journey in 22 days, using a new shortcut to Europe and North America via the Arctic Northeast Passage.

(China Daily 10/30/2013 page16)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Beckham picks Miami for MLS franchise

UN urges end of US embargo on Cuba

IMAX: Coming to a home near you

SUNY recruits students in China

NSA denies reports on US spying in Europe

US approves chemical probes against China

China and the US can learn from each other

Experts detail risks to growth

US Weekly

|

|