Manufacturing PMI seen moderating in Nov

Updated: 2013-11-21 23:46

By Chen Jia (China Daily)

|

||||||||

Factories turn cautious on output as new orders rise more slowly: HSBC

|

|

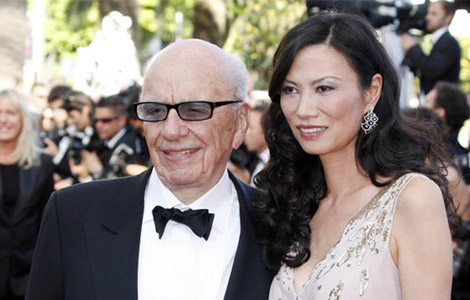

Workers assemble molybdenum refining equipment at a Citic Heavy Industries Co Ltd plant in Luoyang, Henan province. The output sub-index of HSBC Holdings Plc’s manufacturing Purchasing Managers' Index is estimated to rise to 51.3 in November. HUANG ZHENGWEI / FOR CHINA DAILY |

China's manufacturing Purchasing Managers' Index is likely to decrease to 50.4 in November from the seven-month high of 50.9 in October, as exports eased and factories put off restocking due to weaker demand, HSBC Holdings Plc said on Thursday.

The bank made the estimate in a preliminary reading released one week before the final PMI data.

The above-50 figure represents an expansion of the country's manufacturing sector for four consecutive months.

Overall new orders continued to increase in November but at a slower pace, while new export orders decreased after a rise in October, showing weaker overseas demand, HSBC added.

The PMI sub-index that measures the factories' restocking activities also slowed, suggesting less willingness by plant owners to boost production.

On a positive note, the output sub-index increased further to 51.3 in November from 51.1 in October, the highest level since April.

Qu Hongbin, chief economist in China at HSBC, said that although the manufacturing sector's growth momentum sagged moderately, it was still the second-highest PMI reading in seven months.

"The muted inflationary pressures should enable Beijing to keep policy relatively accommodative to support growth," he said.

Meanwhile, logistics demand figures — another gauge of the country's industrial production levels and the whole economic situation — were released by the China Federation of Logistics and Purchasing on Thursday. The data reflected a steady growth in the first 10 months amid an improved economic scenario.

From January to October, total goods worth 163.3 trillion yuan ($26.7 trillion) were transported, up 9.6 percent year-on-year, the CFLP reported.

Employment in the logistics sector increased in line with the rising demand, as shown by the logistics employment sub-index level of 51.3 in October, the third consecutive month above 50.

The official manufacturing PMI, released by the National Bureau of Statistics in October, was at 51.4 in October, an 18-month high, confirming that the country's economy is rebounding after a slowdown earlier this year.

Zhu Haibin, chief economist in China at JPMorgan Chase & Co, said that according to the leading indicators, economic activity remained solid after the strong third quarter, which is likely to mark the peak of the recovery, though growth momentum eased somewhat going into November.

Some of the reforms mapped out by the Third Plenary Session of the 18th Central Committee of the Communist Party of China will likely drag on economic growth in the near term, said Zhu.

"We expect no change in policy rates or the reserve requirement ratio, and credit tapering will continue," he said. "In addition, we expect regulators to strengthen regulation and supervision on speculative financial activities for shadow banking and banks' interbank assets, which may lead to a more cautious attitude by financial institutions in the interbank and credit markets."

A report from Standard Chartered Bank Plc said that compared with other emerging countries, China is leading the way on reform, and its success will be critical.

"We forecast that China's growth will average 7 percent from 2013 to 2020, and the rate is likely to be 5.3 percent during the 2012-30 period," the report said.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Family planning policy change too late for some

US must seize opportunity of China's reforms

China confirms visit by US envoy for DPRK

Rice lays out US Asia-Pacific agenda

China's GDP to overtake US in 2022

When should startups think global?

Butterfly Lovers tour concludes in New York

Chinese pros lured by local firms

US Weekly

|

|