China dodges major shadow banking default

Updated: 2014-01-28 09:46

(Xinhua)

|

||||||||

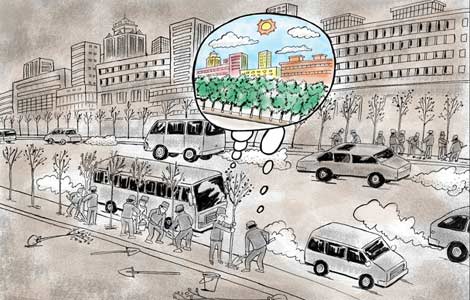

Shadow banking has expanded rapidly in recent years. For instance, trust assets surged to about 10 trillion yuan by the third quarter last year, up 60 percent on the previous year.

Chinese banks are only allowed to offer official rates to depositors, and those rates are flat with inflation, which has left Chinese savers ready to turn to other investments.

Banks are banned from lending money to industries with overcapacity or local government financing vehicles. When borrowers from these categories knock on a bank's door for money, they will be offered a high interest loan from other funding channels. The money is often raised through banks' networks.

As a chunk of non-banking products are due later this year, fear of default is weakening investor confidence in shadow banking system and clogging money pipelines.

As people become less willing to buy shadow banking products, it will likely lead to less liquidity and a credit crunch, said Wang Tao, chief China economist at UBS.

Wang said liquidity would most likely flow back to the banking system, but banks could not automatically expand their balance sheet to offset the shrinkage in shadow banking, as they are constrained by loan quotas, lending restrictions and high reserve requirements.

Some analysts, however, believe borrowing costs in the shadow banking sector may not necessarily rise on default.

"Investors will become more cautious, so they will retrieve their money invested in high-risk areas and purchase more products with lower risks," Ding said. "High-risk projects may see a spike in borrowing costs while low-risk ones can enjoy less costs."

While the high-profile trust incident nerved the market and could lead to tighter regulation on non-banking financing, few expected the authorities to reverse the efforts to liberalize China's financial system.

"Policymakers' ultimate intention is not to halt the trust business, but to ensure clear separation of responsibility between borrower, fund-raising channel and investor, and to prevent risk contagion," wrote Helen Qiao, chief Greater China economist at Morgan Stanley.

If partial defaults can help restore the risk pricing mechanism, financial liberalization will improve efficiency in capital allocation by introducing more competition, and should be encouraged instead of reversed, according to Qiao.

Putin pays tribute to Siege of Leningrad victims

Putin pays tribute to Siege of Leningrad victims

Chinese ace Li Na before she was famous

Chinese ace Li Na before she was famous

Xi visits soldiers on frozen northern border

Xi visits soldiers on frozen northern border

Premier calls for action to relieve poverty

Premier calls for action to relieve poverty

Tough Guy event in England

Tough Guy event in England

Syria talks bring offer of exit from siege of Homs

Syria talks bring offer of exit from siege of Homs

Anti-World Cup protests wane in Sao Paulo

Anti-World Cup protests wane in Sao Paulo

India celebrates 65th Republic Day

India celebrates 65th Republic Day

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

South China Sea archives open in Hainan

Some good US advice for Japan on comfort women

Border control for H7N9 tightens

Int'l hacker got caught in China

Party to reform discipline system

Talent returns to China, but progress slow

300 ill on Royal Caribbean ship

US mall shooting gunman identified

US Weekly

|

|