China dodges major shadow banking default

Updated: 2014-01-28 09:46

(Xinhua)

|

||||||||

|

|

|

Chinese investors avoided a high-profile trust default on Monday, easing worries that the economy may be about to tip the first domino of shadow banking defaults. [Photo/icpress.cn] |

BEIJING - Chinese investors avoided a high-profile trust default on Monday, easing worries that the economy may be about to tip the first domino of shadow banking defaults.

China Credit Trust reached a last-minute deal with investors to repay their investment in the three-billion-yuan ($500 million)product, deflating concerns that default would pound investor confidence in shadow banking and trigger credit crunches.

"This offer comes as a compromise given rising concerns over a full default, but it is likely that investors have become more cautious on trust products in general," said Zhang Zhiwei, chief China economist at Nomura.

The trust product, launched in February 2011, attracted some 700 private bank clients of the Industrial and Commercial Bank of China to invest in a private coal miner in North China's Shanxi province. Shanxi Zhengfu Energy Group went bankrupt last year, unable to repay the loans it secured through the trust product.

Investors retrieved their principal after agreeing to a return of 2.8 percent on the product in the third year, according to documents seen by Xinhua reporters. The annual returns in the first two years were 9.5 percent and 10 percent respectively.

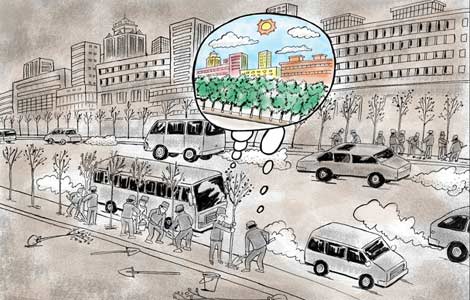

The incident alarmed a market already nervous that China's ongoing financial liberalization will mean millions of people pulling their money out of savings accounts and buying alternative financial products that yield interest more than double that on bank deposits.

While investors have dodged default this time, there may be more bad news from the shadow banking sector.

"Similar incidents will occur more often in 2014," said Ding Shuang, senior China economist at Citibank. "The regulators have become more tolerant of partial defaults as they intend to rein in the shadow banking and raise investors' awareness of risks."

Putin pays tribute to Siege of Leningrad victims

Putin pays tribute to Siege of Leningrad victims

Chinese ace Li Na before she was famous

Chinese ace Li Na before she was famous

Xi visits soldiers on frozen northern border

Xi visits soldiers on frozen northern border

Premier calls for action to relieve poverty

Premier calls for action to relieve poverty

Tough Guy event in England

Tough Guy event in England

Syria talks bring offer of exit from siege of Homs

Syria talks bring offer of exit from siege of Homs

Anti-World Cup protests wane in Sao Paulo

Anti-World Cup protests wane in Sao Paulo

India celebrates 65th Republic Day

India celebrates 65th Republic Day

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

South China Sea archives open in Hainan

Some good US advice for Japan on comfort women

Border control for H7N9 tightens

Int'l hacker got caught in China

Party to reform discipline system

Talent returns to China, but progress slow

300 ill on Royal Caribbean ship

US mall shooting gunman identified

US Weekly

|

|