China, US to discuss yuan, monetary policy

Updated: 2014-07-08 08:03

(Agencies)

|

||||||||

|

|

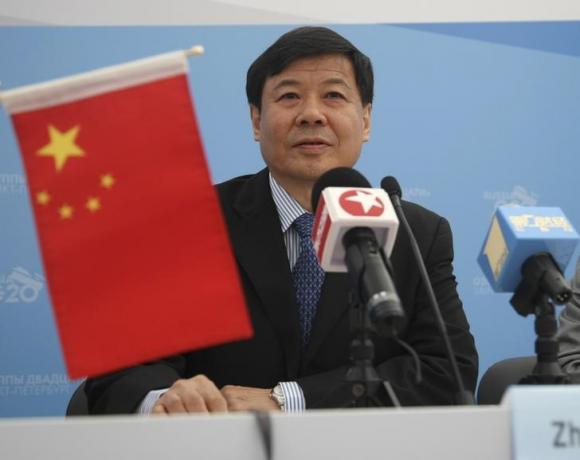

China's Vice-Finance Minister Zhu Guangyao attends a briefing at the G20 Summit in Strelna near St. Petersburg, September 5, 2013. [Photo/Agencies] |

China and the United States will discuss the yuan's value as well as the impact of US monetary policy at a meeting this week, Chinese Vice-Finance Minister Zhu Guangyao said on Monday.

Top Chinese and US officials, including US Treasury Secretary Jack Lew, will hold their annual talks in Beijing on July 9-10 at a meeting known as the Strategic and Economic Dialogue.

"Both sides will conduct candid and deep policy dialogues on the RMB (yuan) issue and issues concerning China's domestic financial reforms," Zhu told reporters at a briefing.

Zhu said China had urged Washington to pay attention to the possible "spillover effect" of changes in its monetary policy on the world economy, as the Federal Reserve unwinds its quantitative easing.

"We hope the monetary policy of the United States, as the largest developed country and main reserve currency issuer, would be responsible," Zhu said.

"As the quantitative easing ends and the process of rising interest rates - or monetary policy normalization - starts, we will have candid discussions with the US side on its impact on the US economy, the global economy, including China," he added.

|

|

|

|

|

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese envoy: 'Time is ripe' for BRICS' bank

China, US to discuss yuan, monetary policy

`God father’ of HK art honored for Smithsonian exhibit

IBM will try to curb Beijing's air pollution

Double agent 'contradicts' trust with US

China urges US to stop abusing remedy measures

Guo Degang to buy US network?

WWII memorial announced for Bay Area

US Weekly

|

|