Wall Street positive on China's e-commerce amid Alibaba enthusiasm

Updated: 2014-09-18 16:25

(Xinhua)

|

||||||||

|

|

Alibaba's IPO will produce an advertising effect, said Lijie Zhu, managing director at Dragon Gate Investment Partners LLC, a New York-based investor relations firm.

"As a result, I think global investors could have a better understanding of US-listed Chinese shares and increase their willingness to invest in China," she said.

Nicholas Colas, chief market strategist at ConvergEx Group, said: "Investors who have made investment in this sector really like the sector. They really like the growth prospect. I don't think they are going to sell similar companies, because they already like (their) fundamentals very much."

Investors might sell slower-growth sectors or even sell US stocks in similar businesses, said Colas.

"But as far as other Chinese companies, this is really a very unique set of stories. And investors who like the stories, they are not going to sell to buy Alibaba, they are going to find something else to sell," he added.

Commenting on the recent performance of Chinese e-commerce stocks, Otto said they are trading mixed. "Some are really outperforming others. Year to date, some are actually up significantly."

Optimistic on growth potential

Global investors have shown optimism toward China's lucrative e-commerce sector due to the country's fast growing consumer demand and the untapped potential of the Internet, which was evidenced by the immense appetite toward Alibaba shares during its roadshow.

Alibaba reportedly sold out all the shares it plans to offer within the first couple of days of its roadshow, and raised its estimated IPO price range on Monday.

"I can tell you that a lot of the investors are very drawn to the growth of the sector and the long-term promise," said Colas.

"It really is the intersection of two very important trends: the first is the power of the Internet and the second is the growth of Chinese economy. Companies that can exploit that intersection have much higher growth prospect than the average," Colas commented.

Zhu said China's e-commerce companies enjoy huge growth potential. Currently, the number of Chinese consumers using the Internet to make their purchases is increasing at an explosive rate.

"We believe that this will be a new demographic dividend for China's economic development," she said.

Moreover, as the Chinese market becomes more and more internationalized, it will attract more capital to focus on this trend, she added.

Chinese companies in US urged to know employment law

Chinese companies in US urged to know employment law

Get together in space: experts

Get together in space: experts

FTA high on agenda of China, Sri Lanka

FTA high on agenda of China, Sri Lanka

ZTE's ZMAX makes debut

ZTE's ZMAX makes debut

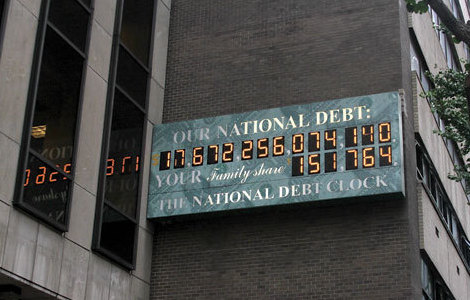

China sells off US Treasuries, for 2nd month

China sells off US Treasuries, for 2nd month

Ma touts tower of 'BABA' in HK

Ma touts tower of 'BABA' in HK Typhoon Kalmaegi lands in South China's Hainan province

Typhoon Kalmaegi lands in South China's Hainan province

Top destinations in China for autumn photography

Top destinations in China for autumn photography

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Baidu speeds up online commerce

Xi, Modi set formality aside, setting friendly tone for visit

Ma named 'Asia Game Changer of the Year'

FDI dips for 2nd straight month

SF airport launches bilingual website for Chinese tourists

iPhone 6 spawns Chinese satire

China to help Maldives build 1,500 homes

Improved quality 'key to growth', says Li

US Weekly

|

|