China sells off US Treasuries, for 2nd month

Updated: 2014-09-17 05:10

By AMY HE in New York(China Daily USA)

|

||||||||

|

|

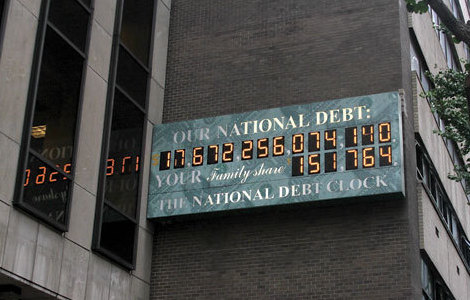

New York A billboard on Sixth Avenue in Times Square in New York shows the running US gross national debt.[Amy He/China Daily] |

China sold off US debt for the second-straight month in July, according to data from the US Treasury Department.

The world's second-largest economy reduced its holdings by $3.5 billion in July, which was down 0.3 percent compared to June, according to the Treasury International Capital (TIC) report released Tuesday. The monthly report reflects securities purchased and sold on a two-month lag, and the Sept 16 release shows activity from July.

China remained the largest buyer of US debt, with total holdings reaching $1.26 trillion. In the first half of the year, the country dropped holdings for three straight months before picking up again in May and then dropping again in June.

Japan is the second-biggest purchaser of US debt, and its total for July was $1.22 trillion, $500 million lower than for June, the report showed.

"Individual country holdings showed that both China and Japan were marginally better sellers of Treasuries in July, shedding $3.5 billion and $0.5 billion, respectively," said Gennadiy Goldberg, US strategist at TD Securities USA, in a research note. "The closely-watched ‘notes and bonds' purchases nevertheless showed some interesting trends, with China selling $11.9 billion — the first sale following six straight months of strong buying where China purchased a combined $131 billion."

Sophii Weng, an economist on global research at Standard Chartered Bank, said that China's acquisitions in the first half of 2014 were stable, despite the six-month average for total holdings this year being a little lower than the first half of last year.

"Improved US economic data in 2014 so far, and market expectations of Fed policy tightening in mid-2015 have weighed on the US Treasuries yield outlook, but US Treasuries remain attractive to China: the depth and liquidity of the US Treasury market cannot be replicated by any other asset," she told China Daily.

Chen Cheng, a US strategist at TD Securities USA, said that China's purchase of US Treasury notes and bonds is the country's "main effort to cheapen the currency". He predicted that in the second half of 2014 China's demand for Treasuries will "remain strong" when the Federal Reserve is expected to taper its $45 billion a month of Treasuries purchases and $40 billion a month of mortgages.

Foreign holdings of Treasuries fell in July by $16 billion, or 0.3 percent, to $6 trillion, the data showed, marking the first decline in a year as the Federal Reserve reduced monthly bond-buying amid gains in employment and accelerating economic growth

Overseas investors had increased their US debt holdings by $420.4 billion, or 7.5 percent, since the last decline in July 2013.

Though fforeign countries were net buyers of Treasuries in July, bringing a net inflow of $57.7 billion, "taking into account transactions in both foreign and US securities", foreign countries were net sellers of long-term securities, with TIC recording an outflow of $18.6 billion, the report said.

"July TIC flows came in considerably below market expectations, registering an outflow of $18.6 billion following a nearly identical $18.7 billion outflow in the prior month," said Goldberg. "Despite considerable flight to safety flows due to renewed geopolitical concerns late in the month, the report showed that Treasuries actually saw marginally better net foreign selling to the tune of $0.8 billion."

amyhe@chinadailyusa.com

Chinese companies in US urged to know employment law

Chinese companies in US urged to know employment law

Get together in space: experts

Get together in space: experts

FTA high on agenda of China, Sri Lanka

FTA high on agenda of China, Sri Lanka

ZTE's ZMAX makes debut

ZTE's ZMAX makes debut

China sells off US Treasuries, for 2nd month

China sells off US Treasuries, for 2nd month

Ma touts tower of 'BABA' in HK

Ma touts tower of 'BABA' in HK Typhoon Kalmaegi lands in South China's Hainan province

Typhoon Kalmaegi lands in South China's Hainan province

Top destinations in China for autumn photography

Top destinations in China for autumn photography

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Baidu speeds up online commerce

Xi, Modi set formality aside, setting friendly tone for visit

Ma named 'Asia Game Changer of the Year'

FDI dips for 2nd straight month

SF airport launches bilingual website for Chinese tourists

iPhone 6 spawns Chinese satire

China to help Maldives build 1,500 homes

Improved quality 'key to growth', says Li

US Weekly

|

|