Penalty expected in Bank of China contempt case

Updated: 2015-11-27 23:52

By PAUL WELITZKIN in New York(China Daily USA)

|

|||||||||

Bank of China Ltd, which was held in contempt of court for failing to disclose account records from Chinese suspects accused of selling counterfeit luxury goods, could learn early next week what type of financial penalty it faces.

US District Court Judge Richard Sullivan ruled on Tuesday in Manhattan that Bank of China (BOC) was in contempt for defying subpoenas requesting the account records.

The ruling stems from a lawsuit filed by luxury goods maker Gucci and other luxury brands in 2010, seeking account records belonging to the alleged sellers of counterfeit merchandise. Gucci has urged Sullivan to fine Bank of China $12 million.

The plaintiffs asked Sullivan to compel the bank to pay the $12 million they said they lost due to the counterfeiting or have it pay a daily fine until it produces the records. Sullivan said he was leaning toward the latter option and would likely decide on a penalty by Nov 30, Reuters reported.

Sullivan told BOC’s counsel that the bank was “basically preventing the plaintiffs and the court from being able to … bring justice to people who have violated US law,” The Wall Street Journal reported on Tuesday.

“Bank of China has not been accused of wrongdoing and is not a defendant in this case,” said a statement from Allen & Overy LLP, counsel for BOC. “As we have explained to the court, it would be unlawful under Chinese law for Bank of China to disclose bank account information without permission from Chinese authorities.”

BOC believes that the US court does not have jurisdiction to order the bank to produce the documents.

James Feinerman, a professor of law at Georgetown University in Washington, said previous court decisions have been divided on the issue.

“Another issue is where the records (sought by Gucci) are located. If the records are in China or if they are in the US could have an effect,” he told China Daily.

Feinerman also said that BOC may be worried that it could violate bank secrecy laws in China if it complies with the request to turn over records.

BOC believes that Gucci should request the records through an international legal process called the Hague Convention, which was used successfully by jewelry retailer Tiffany & Co in a similar case several years ago.

Under the Hague Convention, forms are filed in a US court requesting information. After the court approves the request, it is then forwarded to the Ministry of Justice in China. The Chinese agency then decides what, if any, records will be released.

“I think one of the problems with the Hague Convention is that it can be protracted, and sometimes the results are not satisfactory,” Feinerman said.

BOC said it had to avoid complying with the order so it could appeal the ruling. Sullivan had ordered BOC to turn over the records in 2011.

An appeals court ordered him to reconsider, and in October he again ordered the records released.

Feinerman said the case also points to national sovereignty issues that crop up as business becomes more globalized.

“As China becomes more a player on the international stage, they are worried that they will be subjected to numerous lawsuits filed against their companies in foreign countries,” he said.

Countries prefer to have legal outcomes involving their companies decided in their own countries and not in an overseas court, Feinerman added.

paulwelitzkin@chinadailyusa.com

- Britain's Cameron says time to bomb militants in Syria

- Russia accept full suspension from athletics

- Turkish and Russian FMs to meet in Belgrade

- S.Korea, DPRK agree to hold vice ministers' meeting for improved ties

- Avoiding escalation over Russian warplane downing

- Rights panel presses US over scientists' cases

A day in the life of a deliveryman

A day in the life of a deliveryman

Orphanage shows love and compassion across borders

Orphanage shows love and compassion across borders

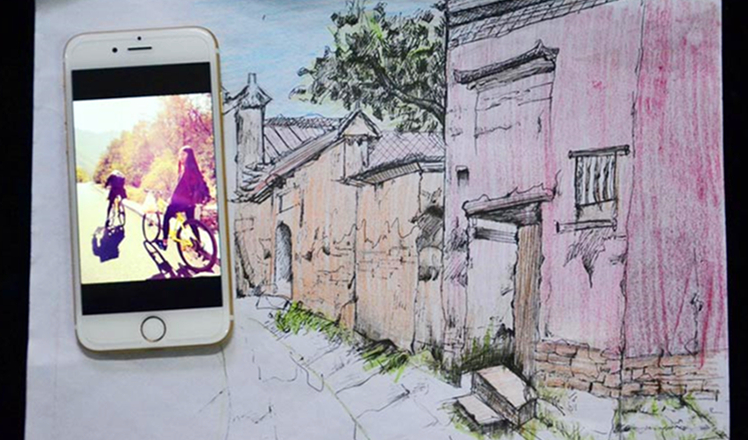

College student paints creative travelogue

College student paints creative travelogue

Macy's Thanksgiving Day Parade colors NYC

Macy's Thanksgiving Day Parade colors NYC

Obama pardons National Thanksgiving Turkey 'Abe'

Obama pardons National Thanksgiving Turkey 'Abe'

Premier road show: Li takes CEE leaders on high-speed train ride

Premier road show: Li takes CEE leaders on high-speed train ride

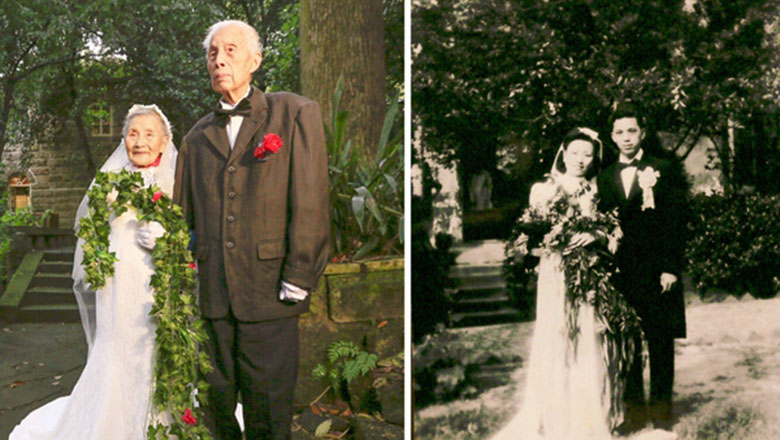

Trending: Love through war and peace

Trending: Love through war and peace

Miss World 2015 to be crowned in Sanya

Miss World 2015 to be crowned in Sanya

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US Weekly

|

|