Two-speed economy creates balance

Updated: 2015-12-05 03:52

(China Daily USA)

|

||||||||

Tan Min Lan believes China’s old and newer economies will create a new sustainable and balanced growth model. Cecily liu / China daily

China is growing as a two-speed economy, with the slower sectors of the old economy gradually giving away to sectors of the newer economy. Together they’re creating a sustainable and balanced growth model, said Tan Min Lan, head of the Asia-Pacific investment office of UBS Wealth Management.

This unique system of two-speed growth behind China’s headline GDP figures will have significant international implications as it allows China to have more stable growth.

The more stable and sustainable growth brought about by the new leading sectors will help to boost confidence of other Asian economies, although China’s reduced commodity demand will continue to hit commodity exporters, Tan said.

“I think it leads China to a lower path of growth but a more stable one. The old sectors are falling apart, but at the same time the government wants to create growth in more stable sectors that are less damaging to the environment,” she said.

Within this new growth structure, the heavy, older, traditional industries such as coal, cement, glass and steel are slowing down fast, while emerging industries like healthcare insurance, the Internet and alternative energies are rapidly becoming the backbone of China’s economic growth.

To put this into context, the MSCI China Index for the first half of this year measured China’s growth at about 5 percent, but this growth rate would have been 10 percent if the measurement stripped out the effects of the banking sector, and 25 percent if the energy sector also was deducted.

The MSCI China Index captures large and mid-cap stocks across China H shares, B shares, red chips and P chips. The index covers about 85 percent of China’s equity universe.

Meanwhile, electricity consumption figures, which are reliant on heavy industry, grew only at 0.3 percent year on year, suggesting that the old drivers of China’s GDP growth are nearly, if not already, in recession.

This diversity of growth rates points to the importance of analyzing specific sectors within China’s economy rather than judging its economic growth based on headline GDP figures.

The two-speed model is the one that helps China achieve the economic rebalancing it desires, which puts China in transition from a manufacturing focus to service-based growth, from investment to consumption, and from labor-intensive production to high- technology and advanced manufacturing.

Within this context, industries like e-commerce, Internet industries and healthcare insurance are growing fast because of the emergence of China’s middle class and the growing spending power of this population.

China’s service purchasing managers index measured 50.5 in September, compared with 49.8 for manufacturing in the same month. PMI is an indicator of business activity. It is a survey-based measure that asks respondents about changes in their perception of some key business variables from the month before.

In addition, many of China’s other economic indicators also paint an optimistic picture of the economy, including wage inflation and retail sector growth.

Salaries are growing at about 10 percent a year, while retail is registering 11 percent growth, according to official data.

“These all show a bullish story on China, and things are not as bad as industrial data will suggest,” Tan said, adding that her office estimates that China’s growth next year will be around 6.2 percent, which is not far off the 6.5 percent target set by the Chinese government.

Out of this 6.2 percent, around 3.5 percent growth is predicted to be driven by consumption, 0.5 percent by net export and between 2 and 2.5 percent by investment, depending on how quickly the Chinese government implements infrastructure expansion plans.

However, Tan pointed out that it is also important for China to maintain its manufacturing industry, as opposed to letting it go completely or reducing it to a tiny part of GDP.

In this respect, the economic model China evolves into may be more like that of Singapore, where the government is consciously implementing policies to encourage the growth of the manufacturing sector and avoid hollowing out. It contrasts with the Western model of a service-based economy, led by countries like the United States. Currently manufacturing accounts for about one-fourth of Singapore’s GDP growth.

One important reason for China to maintain its manufacturing sector is that Chinese companies would have a better opportunity to learn international best practices through manufacturing, which has a bigger export component, said Tan.

“With the provision of services, you tend to do them locally, so the growth of China’s service industry would be focused on provision of services in China. But manufacturing industries will more often lead to exports abroad, meaning that Chinese companies can learn from counterparts overseas to become internationally competitive.”

This learning process would involve acquiring management skills and expertise, and improving the quality of manufacturing. This manufacturing work should focus on high-end and advanced technology industries, she said.

The growth of both advanced technology and services would lead to more sustainable growth, and foreign investments in China would be remodeled with calculations based on lower risk premiums when the risk return profile is considered, Tan said. “The loss in earnings growth will be associated with a reduction in risk premiums, so the valuation of Chinese investment opportunities will not go down.”

An additional reason that a developed Asian economy like Singapore is able to provide more inspiration to China than the US and other Western economies is the role its strong government plays in its economy.

“China is historically a planned economy, so within this cultural context, China is more similar to Singapore, where the government determines key industries to focus on, rather than letting private sector market forces take the lead,” Tan said.

She said to move closer to this desired model, China needs to readjust the amount of central government and local government influence on its economy. In aspects like the provision of universal healthcare insurance, provision of basic housing and the pension system, the central government needs to take more control.

“China is an interesting economy, as sometimes it has too much government intervention and sometimes too little. Sometimes a lot of big decisions are taken at the central level, but local governments are left to implement these policies, while they often do not take into account the externalities of their policies,” Tan said.

Externalities are flows based on effects of certain policies, such as environmental degradation associated with production, and economists argue they should be taken into account by governments when making economic policies.

“China’s central government needs to manage the externalities of growth better, rather than just set the GDP figure and expect local governments to follow them,” she said.

Meanwhile, the growth of China’s economy will be encouraged by its financial market liberalization, and the milestone of the renminbi being included in the International Monetary Fund’s special drawing rights basket of currencies, a symbol of its global reserve currency status and an encouraging catalyst for further reform.

Tan said the direct impact of the inclusion would be small because the world’s SDR currencies amount to a total of only $300 million, a small figure compared with global money circulation. For example, China’s own foreign reserves alone amount to $3.5 trillion.

But the financial reforms of China’s market, and improved circulation and liquidity of the renminbi, would allow the renminbi to be much more widely used, and this would lead China to delivering its target of currency convertibility in 2020, Tan said.

Now the renminbi is included in the SDR, “it will become a real global reserve currency and the access to Chinese assets will be wider”, she said.

Contact the reporter at cecily.liu@mail.chinadailyuk.com

- Locals have tradition of drying foods during harvest season

- Beijing-Tianjin-Hebei govts to cooperate on emissions control

- Web promotion of prostitution to be targeted

- Two more spells of smog predicted to sweep North China

- Glass bridge in grand canyon of Zhangjiajie under construction

- Road rage cases pose huge safety challenge

Can Chinese ‘white lightning’ make it in US?

Can Chinese ‘white lightning’ make it in US?

Gunmen go on a killing spree in Southern California

Gunmen go on a killing spree in Southern California

Chinese, South African presidents hold talks to cement partnership

Chinese, South African presidents hold talks to cement partnership

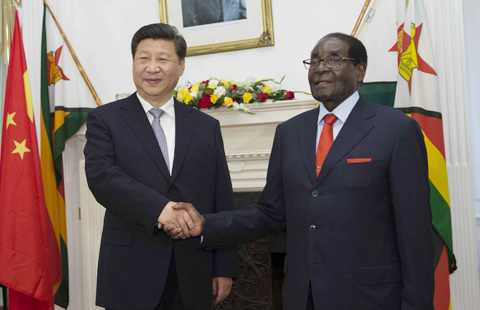

China, Zimbabwe agree to boost cooperation

China, Zimbabwe agree to boost cooperation

First lady visits Africa's 'new window' on China

First lady visits Africa's 'new window' on China

BRICS media leaders to secure louder global voice

BRICS media leaders to secure louder global voice

Western science in the eyes of Chinese emperors

Western science in the eyes of Chinese emperors

Top 10 smartphone vendors with highest shipments in Q3 2015

Top 10 smartphone vendors with highest shipments in Q3 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|