What the future holds: China's 2016 economy

Updated: 2016-01-01 11:04

(China Daily)

|

||||||||

China's economic slowdown in 2015 was one of the world's top stories. What will 2016 bring? China Daily asked economists and others for their views, which ranged from the need for more financial-sector reforms to eliminating "zombie" companies, reports Paul Welitzkin in New York.

China's influence on the global economy continued to grow in 2015 as the nation's transformation from export and manufacturing to more consumer spending combined with slower-than expected growth not only rocked the mainland, but the world.

In 2015 economic growth in China slowed from the frenetic pace of double-digit increases of just a few years earlier. The country's gross domestic product (GDP) will probably have expanded at a rate of about 7 percent or slightly less when final statistics are released. However, many economists believe that GDP growth in China was actually closer to 5 or 6 percent.

The Associated Press selected China's less-than-expected economic advancement as the top business story of 2015.

China's slow-motion growth played a major role in the commodity bust that saw plunging prices for oil, copper and other raw materials which harmed emerging-market economies like Brazil in 2015.

The US central bank delayed an interest-rate increase until December in anticipation of a potential fallout from slower Chinese growth.

China's stock market continued to soar in early 2015 before moving sharply lower in the summer prompting extraordinary support measures from the government and the People's Bank of China (PBOC), the country's central bank.

Even before the stock market turbulence, the PBOC and the government acted to counter an economic slowdown that seemed poised to exceed original targets.

All of this sets the stage for 2016 and what should be another fascinating year for China's economy. Here is what economic observers see for China in 2016 in their answers to three questions.

Meg Lundsager

Public policy fellow, the Wilson Center and a former US executive director at the International Monetary Fund

A1:

Vice-Minister of Finance Zhu Guangyao recently stated that for China to meet its goal of doubling GDP between 2010 and 2020, annual growth rates must reach 6.5 percent for the rest of the decade.

A2:

The recent comments of officials attending the central economic work conference indicate that China will be following expansionary monetary and fiscal policies in 2016, to maintain a satisfactory rate of growth. Localities will find it easier to issue debt to finance spending, the People's Bank of China will keep financing flowing, at least to the larger state-owned industries. But for long run viability beyond next year, a broader sustained increase in the share of GDP generated by consumption will be key. The government appears to appreciate this and is taking steps to encourage consumption. In addition, adequate financing for smaller companies throughout the country should be a focus, to help draw labor away from the over-invested state sector into services and diversified manufacturing. Such efforts will be necessary to compensate for what likely will be weaker export growth, given slowdowns in much of the emerging world and continued slow growth in Europe and Japan.

A3:

China's large size means it can no longer depend on exports as the impetus for growth. Domestic demand must be the driver. High investment rates indicate that officials are aware of the need to shift to domestic demand, but over-investment in several areas had led to its own problems, such as a large inventory of unoccupied housing. Shifting to more consumption, more services, more small- and medium-sized enterprise production can help strengthen and diversify domestic demand. To succeed, further financial sector reforms throughout the country will be required. At the same time, demographic changes and pollution abatement priorities will pose challenges, but also opportunities for economic diversification.

Louis Kuijs

Head of Asia economics, Oxford Economics, Oxford University

A1:

Despite further measures to support domestic demand, we forecast GDP growth to ease from 6.9 percent in 2015 to 6.3 percent in 2016.

A2:

Currently, investment growth in China is quite weak, dragged down by the continued downturn

in real estate construction. Consumption is holding up better, supported by robust wage growth. We expect the current investment and consumption momentum trends to broadly continue for much of 2016.

A3:

The key problems in China's economy are the structural excess capacity in several parts of heavy industry. There are too many firms in sectors such as steel - often state-owned enterprises (SOEs) - that do not sufficiently respond to falling prices and low or negative rates of return. China needs to move convincingly to harden budget constraints, allow structurally loss-making firms to go bankrupt and level the playing field between SOEs and other firms.

Jock O'Connell

International trade adviser, Beacon Economics in Los Angeles and San Francisco

A1:

I am forecasting an `official' 6.5 percent growth.

A2:

I think China's economy is already at or just below a 6.5 percent growth rate and that next year will see real growth dip below 6 percent.

A3:

I am chiefly troubled by the difficulties Chinese authorities continue to encounter in managing an orderly transition to an economy based more on domestic consumption. Allowing market forces to play a more decisive role in the allocation of resources appears to run directly counter to Beijing's instinctive desire to maintain tight control over the society. Policymaking seems constrained by a heightened fear that economic reform would ultimately entail political reform. The resulting policymaking dilemma probably explains the aura of desperation that surrounded efforts earlier this year to respond to collapsing stock prices and mounting evidence.

Jianjun Miao

Professor of economics, Boston University

A1:

The Chinese government revised the growth-rate target to 6.9 percent this year. According to the Suggestions on the 13th Five-Year Plan of Chinese Economic Development passed on Nov 3, the government proposed that the lowest average growth-rate target from 2016 to 2020 is 6.5 percent. So I believe China's GDP growth will be around 6.5 percent in 2016.

A2:

I think China's economy will still grow, but will not grow at previous rates like 8 percent or 10 percent. The industrial, housing, services and financial sectors will all face pressure.

A3:

One main problem is that China lacks technological innovation. The government does not provide enough support for research and development (R&D). The research environment in colleges and universities as well as research institutions is bad. Academic misconduct is widespread. Patents are not well protected and people have no incentives to do high-quality research or to innovate.

Another main problem is the conflict between the anti-corruption political movements and the economic growth. On the one hand, the government tries to transform the economy from industrial-oriented to consumption- and services-oriented development. On the other hand, people are afraid of consumption, especially of luxury goods.

Jian Yang

Professor of finance, University of Colorado in Denver

A1:

Despite many signs of economic woes in China, I think China's GDP growth in 2016 probably will be about 6.7 percent, and quite unlikely to go below 6.5 percent.

A2:

China's economy will face several serious challenges in 2016 and the road could be quite bumpy. These challenges include maintaining economic growth without further cost of environmental degradation, developing or forming new growth poles while the real estate sector is slowing down and the high real estate price is not sustainable or desirable in the long run, rising provincial and local government debt, etc. The positive sign is that due to recent heavy investments on R&D from the government and the private sector, many Chinese firms have generally been more innovative than before. Also, due to the brain gain from hires with foreign experience in recent years, China is more capable of handling economic challenges. Thus, the recent improvement in technology and human capital in China hopefully would help at least partially offset the negative impact of higher labor cost and more expensive supply of capital on economic growth in China in 2016.

A3:

The main problem with China's economy in 2016 is how the Chinese government can strike a careful balance between continuing to carry out structural reforms to achieve more sustainable GDP growth in the future at the cost of lower GDP growth rate in 2016, and achieving a reasonably high GDP growth rate with sufficient stimulus in 2016 so that it would not shape or confirm the very unfavorable expectation about China's economy that can be later translated into real shocks to the Chinese financial system and the Chinese corporate sector. The economic policy risk is particularly relevant in 2016 and might manifest it one way or another, because China will move to 2016 with a substantially more open financial system integrated with the rest of the world, to which is it is still a novice. In my opinion, in the near future (e.g., next two or three years), serious economic policy mistakes in the area of financial market intervention and regulation would be among the few scenarios, which can lead to substantially less resources available to the Chinese government and, thus, its reduced power in promoting economic growth. Such a scenario would be disastrous.

Nicholas Hope

Director, the Stanford Center for International Development and China research program, Stanford University

A1:

I would be disappointed if China grew less than 6.5 percent.

A2:

Even with the likelihood of slow growth in international trade, the Chinese economy is positioned to perform well in 2016, though the often bumpy ride that characterized 2015 is likely to continue and the government has to be cautious about the way it responds to short-term setbacks to growth. I believe that some of its policy initiatives in 2015 were inconsistent with the longer goals that were announced in the Party meetings late in 2013 and 2014.

A3:

My concerns are that the government will over-emphasize investment in infrastructure and other construction in 2016, responding to continuing under-utilization of capacity in steel production as well as other construction materials, and adopt policies to reduce the inventory of unsold residential properties in an attempt to boost the housing sector. I worry also that by identifying several high-tech areas as prospective growth drivers for the new five-year plan, sub-national governments will be encouraged to over-invest in ultimately unsuccessful projects, once again repeating the wasteful investments associated in the past with everything from textiles to solar panels.

David Roland-Holst

Professor in the agricultural and resource economics department, University of California-Berkeley

A1:

Barring unexpected surprises, China's GDP growth will continue to moderate, likely above 6.5 percent but not likely to exceed 7 percent.

A2:

China's economic performance in the near term will depend crucially on external and domestic demand. External prospects (apart from exports to the US) are not too encouraging. Domestically, the government has reaffirmed its readiness to use fiscal and monetary stimulus, but this must be done in a way that facilitates transition to a consumer-driven economy. The old tactics of the last adverse macro cycle, including heavy investment stimulus and credit-intensive investment by state entities, will only aggravate existing risks and imbalances.

A3:

In the medium and longer term, sustained growth for China requires building the center of society and an economy propelled by an ever-growing middle class. China may have more billionaires than any other country, but these people alone cannot sustain China's growth. The key to sustained increases in both urban and rural incomes will be effective investment for productivity growth. To deliver this, the enterprise sector in China will need great confidence, but that in turn depends on its perceptions of the reform process. For many reasons, there appears to be growing uncertainty in this context, which could seriously undermine private sector determination.

Marshall Sonenshine

Chairman, investment banking firm Sonenshine Partners, and an adjunct professor at Columbia University Business School

A1:

The key issue to focus on right now is that the range of opinions on China's growth outlook is now wider than it has been in years. Bulls (typically inside China) still maintain expected growth rates in the high single digits while bears have moved below 5 percent. At the moment, we tend to expect about 6 percent, broadly in line with recent IMF data.

A2:

In a word - mixed. The focus on services sector is important, but it is also a long complex road ahead. The manufacturing base needs to strengthen.

A3:

The key problems facing China remain cyclical slowdown, overhang from over-investment and rising internal indebtedness, perhaps exceeding official data. That is a source of concern for international investors. Further, China needs to see continued increase in domestic consumer spending. All that said, China remains the single most-important story of our time. Its biggest challenge is to invest in education and middle-class growth without over-investment and internal leverage, which has become a challenge during this period of dramatic growth.

Henry Mo

Deputy chief economist, AIG, in New York

A1:

We expect China's economic growth to be about 6.5 percent over the next two years, down from the expected 6.8 percent in 2015.

A2:

While China still faces a long process of unwinding overcapacity in the industrial sector, a relatively fast expansion in the services sector is likely to be sustained. The resilient services sector will help put a floor under China's economic growth.

A3:

Rapid credit expansion remains the major risk to the Chinese economy. Credit to the nonfinancial private sector continues to expand, now at 195 percent of GDP in Q2 this year, up from 184 percent a year before. The increase is mainly concentrated in the corporate sector (159 percent of GDP), while that for households remains largely stable (about 36 percent). To be fair, credit growth also has slowed down over the past few years, but it still outstripped nominal GDP growth. The problem is that it is getting increasingly more difficult to boost growth with credit expansion. Nominal GDP per unit of new credit has been declining since 2005. Credit has to grow faster than GDP in order to stabilize the economy. We expect continuous increases in the debt-to-GDP ratio and rising non-performing loans next year.

Sung Won Sohn

Professor of economics, California State University Channel Islands, in Camarillo, California

A1:

Overall growth will be 6 percent with the first half stronger than the second half.

A2:

The first half will benefit from recent easing moves by the PBOC in 2015. The drop in investment including real estate and infrastructure should stabilize somewhat as land sales will increase, allowing local governments to increase spending. During the second half, the benefits from PBOC easing and land sales will peter out. More government stimulus will be needed to keep economic growth on a stable trajectory.

A3:

The overall economic growth rate does not tell the whole story. Rebalancing of the economy is well on its way. Industrial production is de-emphasized in favor of consumption. The service component of consumption is rising nicely even though it is hard to measure. Migration from rural to smaller cities is progressing, ultimately boosting consumption including healthcare, education, social services, etc. However, there are challenges. The economy is getting more leveraged as individuals, businesses and local governments increase debt. As the leverage ratio rises, there is a greater likelihood of volatility in the economy and the financial markets. The SOEs, which include many "zombie companies", will continue to be a major challenge. The zombies take precious resources away from efficient companies, create excess capacity and reduce the economy's overall productivity and growth. It will be interesting to see how rapidly the government will tackle the structural problems.

Contact the writer at paulwelitzkin@chinadailyusa.com

- Top planner targets 40% cut in PM2.5 for Beijing-Tianjin-Hebei cluster

- Yearender: Predictions for 2016 through 20 questions

- Asia's largest underground railway station opens in Shenzhen

- Shanghai bans drug-using actors, drivers

- Clamping down to clean up the air

- Yearender: Ten most talked-about newsmakers in 2015

- Over 1 million refugees have fled to Europe by sea in 2015: UN

- Turbulence injures multiple Air Canada passengers, diverts flight

- NASA releases stunning images of our planet from space station

- US-led air strikes kill IS leaders linked to Paris attacks

- DPRK senior party official Kim Yang Gon killed in car accident

- Former Israeli PM Olmert's jail term cut, cleared of main charge

Yearender: China's proposals on world's biggest issues

Yearender: China's proposals on world's biggest issues

NASA reveals entire alphabet but F in satellite images

NASA reveals entire alphabet but F in satellite images

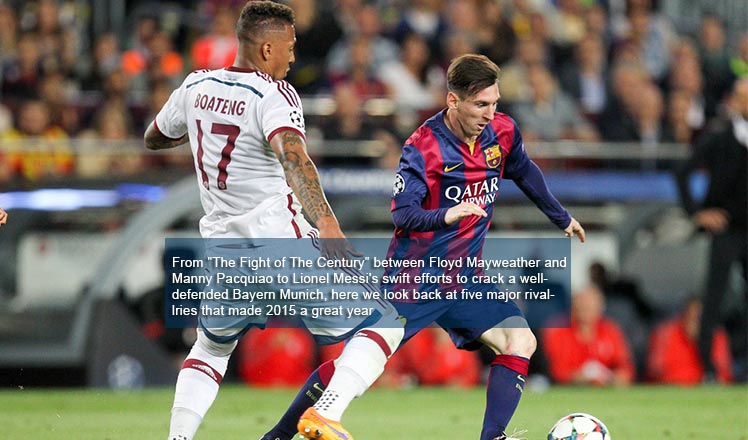

Yearender: Five major sporting rivalries during 2015

Yearender: Five major sporting rivalries during 2015

China counts down to the New Year

China counts down to the New Year

Asia's largest underground railway station opens in Shenzhen

Asia's largest underground railway station opens in Shenzhen

Yearender: Predictions for 2016 through 20 questions

Yearender: Predictions for 2016 through 20 questions

World's first high-speed train line circling an island opens in Hainan

World's first high-speed train line circling an island opens in Hainan

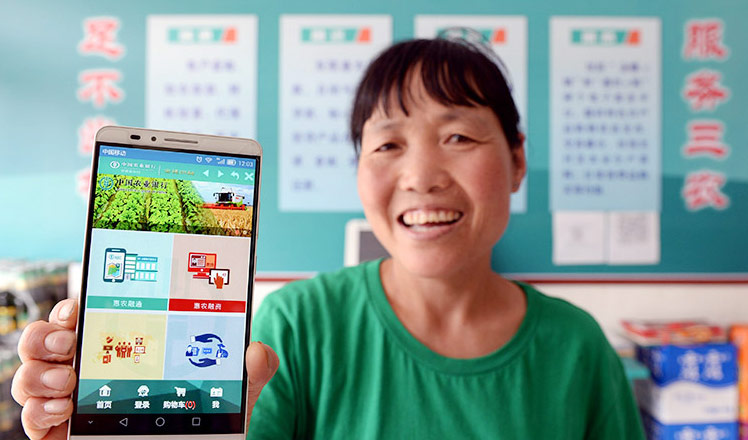

'Internet Plus' changes people's lifestyles in China

'Internet Plus' changes people's lifestyles in China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|