China to manage liquidity without RRR cut: economist

Updated: 2016-01-23 17:32

(Xinhua)

|

||||||||

BEIJING - By injecting the most cash in three years in open-market operations, China is using various tools to ensure ample liquidity without cutting banks' reserve requirement ratios (RRR), according to a UBS economist.

The People's Bank of China (PBOC), the country's central bank, plans to use a variety of facilities rather than RRR cuts to ensure liquidity and stable short-term rates in the near term, UBS economist Wang Tao said in a research note.

Liquidity conditions often tighten ahead of the week-long Chinese Lunar New Year holiday, which falls on Feb. 8, and the central bank usually injects large amounts of cash into the money market to keep interest rates steady.

"The central bank plans to fully cover any additional holiday cash demand during the Chinese New Year period," Wang said in the note.

RRR cuts are a relatively effective tool to replenish liquidity and are favored by commercial banks, but the central bank believes they could send too strong an easing policy signal, which may lead to lower short-term rates and put downward pressure on the Chinese currency, she said.

In open-market operations on Thursday, the PBOC conducted 110 billion yuan ($16.8 billion) of seven-day reverse-repurchase agreements and 290 billion yuan of 28-day contracts, it said in a statement on its website.

Earlier on Tuesday, the PBOC said it would inject at least 600 billion yuan to provide liquidity through tools such as standing lending facility (SLF), medium-term lending facility (MLF) and pledged supplementary lending (PSL).

The Chinese central bank released around 1.18 trillion yuan of liquidity into the money market in the past week, according to Wang Tao.

Although the central bank seems to be very clear in its policy intentions at the moment, Wang said she still expected the PBOC to conduct multiple RRR cuts in 2016.

Last year, China made five cuts on the percentage of deposits that lenders are required to set aside.

- Netizen backlash 'ugly' Spring Festival Gala mascot

- China builds Mongolian language corpus

- China's urban unemployment rate steady at 4.05 pct

- German ecologist helps relieve poverty in Sichuan

- 'Unhurried' Guizhou village makes NY Times list of places to visit

- Railway police nab 40,315 fugitives in 2015

- 7 policemen, 3 civilians killed in Egypt's Giza blast

- Former US Marine held in Iran arrives home after swap

- Powerful snowstorm threatens US East Coast; flights canceled

- 2015 Earth's hottest year on record: US agencies

- 8 killed in car bomb near Russian Embassy in Kabul

- Researchers find possible ninth planet beyond Neptune

Art exhibitions in 2016 worth seeing

Art exhibitions in 2016 worth seeing

Winter flexes its muscles as cold snap makes its way

Winter flexes its muscles as cold snap makes its way

Bright Temple of Heaven shines in winter

Bright Temple of Heaven shines in winter

Netizen backlash 'ugly' Spring Festival Gala mascot

Netizen backlash 'ugly' Spring Festival Gala mascot

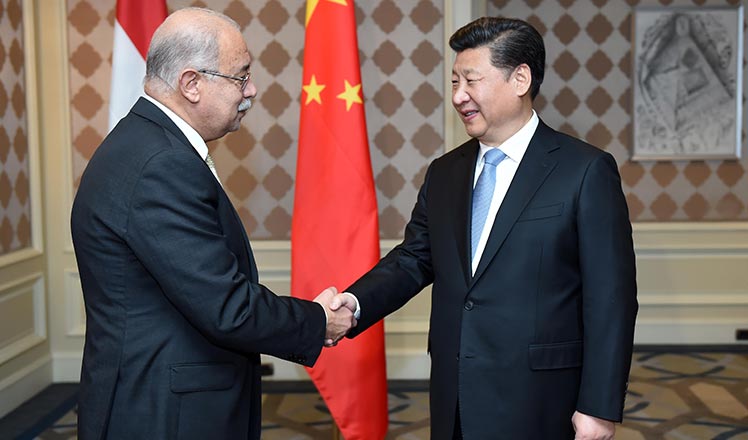

Egyptian welcome for Chinese President Xi Jinping

Egyptian welcome for Chinese President Xi Jinping

Robots reads China Daily to stay up to date with news in Davos

Robots reads China Daily to stay up to date with news in Davos

China's Yao honored with Crystal Award in Davos

China's Yao honored with Crystal Award in Davos

Happy memories warm the winter

Happy memories warm the winter

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|