Chinese-backed Lucid has obstacles to US vehicle plans

Lucid Motors' luxury electric sedan faces obstacles moving from being a prototype into production and mounting a challenge to Tesla, observers said.

Menlo Park, California-based Lucid revealed its first electric car, called the Air, on Dec 15, not far from Tesla's factory. The Air is designed to take on Tesla's Model S.

Peter Rawlinson, Lucid's chief technology officer, was the chief engineer for the Model S.

Rawlinson told TheStreet.com that Lucid's investors include Beijing Auto and the Chinese online video company LeEco, which is also a backer of Faraday Future, another electric vehicle (EV) startup that has plans to produce vehicles in the US.

Lucid plans to break ground on a $700 million assembly plant in Casa Grande, Arizona, early next year, with production set to begin in 2018. Similar to how Tesla started with the Model S, Lucid plans to build 10,000 Airs in the first year and eventually increase production to 60,000 cars a year.

Zach Edson, Lucid's director of supply chain, told the Phoenix Business Journal that the company has the funds to get through the design and permitting stages and into the construction stage. The company will also begin sourcing its supplies and partners.

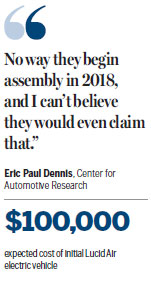

Eric Paul Dennis with the Center for Automotive Research in Ann Arbor, Michigan, is skeptical that Lucid can meet that schedule.

"They have not yet even designed the factory? They haven't begun permitting? They haven't even started establishing a supply chain? No way they begin assembly in 2018, and I can't believe they would even claim that," he wrote in an email.

Lucid's David Salguero told China Daily in an email that the company's factory program is on track. "We will break ground in 2017 and start production in late 2018. The Arizona facility will be funded by a combination of current and future investment and will be constructed in phases."

EV companies need a lot of cash. Tesla, which reported sales of a little more than 50,000 vehicles in 2015, burned through $611 million in the first half of 2016 and $2.2 billion in 2015, according to a report in Investor's Business Daily.

"Whether they (Lucid) succeed will depend on continued access to capital over the next few years, a challenge for any startup automaker, as it's a capital-intensive business. They still need to ramp up to meaningful volume beyond production start to get scale, and Tesla isn't even there yet, so it does not make the odds of success high," said David Whiston, auto analyst for Morningstar Inc.

"Lucid is a well funded company. We have raised hundreds of millions of dollars in three rounds of funding from a worldwide group of investors. There are no majority shareholders," Lucid's Salguero said in response.

Initial Lucid Airs are expected to cost more than $100,000, with a special launch edition costing up to $160,000. The company hopes to offer less-expensive versions in the future and has started taking deposits of $2,500.

Dennis said that to sell a $100,000 electric vehicle the US, where the market is in the hundreds, possibly thousands of units, the company must "convince people it's better than a Tesla of similar price. So it will be competing with Tesla X and heavily-optioned S.

"At that cost, Teslas are wicked fast and have their industry-leading automation features. I would not want the task of trying to get a foothold in such a market with a startup," he said.

Salguero said the Air will retail for more than $100,000, but future models will start at $65,000. "We intend to sell approximately 10,000 units in the first year and will ramp up production to the point where we are making 130,000 cars by the end of 2022 (about 60,000 Air, 70,000 future models)," he said.

While initially focusing on the US, Salguero said Lucid will expand to China and the Europe.