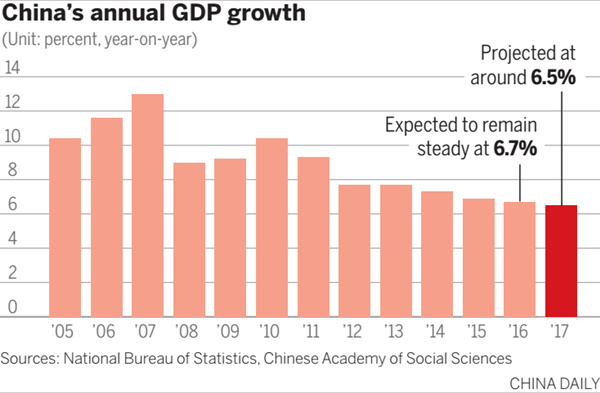

Growth around 6.5% seen for 2017

No hard landing expected, inflation to rise to 2.2%, think tank forecasts

China's economy will expand by around 6.5 percent year-on-year in 2017, and consumer inflation will moderately rise to 2.2 percent, according to forecasts in a book released by a top think tank on Monday.

No economic hard landing will occur, according to the book released by the Chinese Academy of Social Sciences.

The Chinese economy has grown by 6.7 percent for the first three quarters of this year, and the growth momentum will remain in the fourth quarter, according to economists participating in a forum after the release of the book.

The economy will grow by 6.5 percent in the first and second quarters, and 6.4 percent in the third and fourth quarters, according to the book.

Key indicators, such as fixed-asset investment and retail sales growth, will ease moderately next year, it said. But yuan-denominated export growth will pick up to from 4 percent to 6 percent in 2017, said Jin Baisong, a researcher from the Ministry of Commerce, at the forum.

In the first 11 months of this year, China's exports, in yuan terms, decreased by 1.8 percent year-on-year.

"The Chinese economy has hit the bottom area and is stabilizing," said Zhang Liqun, an economist at the State Council's Development Research Center. "However, the momentum needs to be consolidated."

Zhang said China's retail sales growth has remained stable since 2012, which has served as an important growth engine for the national economy.

The real estate sector, which saw relentless price rises in recent years, which has sparked concerns about unsustainable bubbles, will be better regulated by more targeted policies, Zhang said.

China wrapped up its tone-setting Central Economic Work Conference last week, when top leaders pledged to stabilize the property market, saying that homes "are for residential use, not speculation".

Zhang said, "At the next stage, more targeted regulatory policies that fit the conditions of different cities will come out to combat housing speculation and support real demand."

Against that backdrop, the sector may continue to see stable growth momentum, thanks to the country's urbanization process, thus supporting the growth of the overall economy, he said.

The trend of prices needs to be closely monitored, Zhang said.

China's Consumer Price Index, which measures inflation, rose by 2 percent year-on-year in the first 11 months. Zhang said the uptrend will continue, but the CPI may fall within the 2 percent to 3 percent range for all of next year.

The yuan may continue to drop against the US dollar, but the margin will be limited, said Jin of the Ministry of Commerce. "The yuan's depreciation may range from 3 percent to 5 percent next year, (but) seen from the middle and long term, the dollar may peak by 2018 and, after that, it will start to fall."

The CASS book also called for a more pro-active fiscal policy to stabilize growth next year. The fiscal deficit can be allowed to rise and more tax cuts should be available to enterprises, it suggested.

Economists also suggested that China should improve its production efficiency to raise its competitiveness.

The scale of the Chinese economy has expanded at a fast pace in recent years to push the country to become the world's second-largest economy, but its quality of growth needs to be improved to maintain growth momentum, said Li Ping, a CASS economist.