Consumer spending set to power future growth

|

|

By China Daily |

|

|

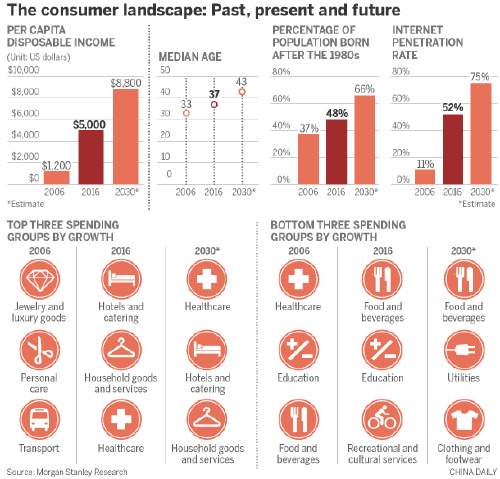

The consumer landscape: Past, present and future. [Infographics by China Daily] |

The free-spending younger generation is fueling China's transition from an export-led economy to one driven by domestic consumption. Wang Yanfei reports.

Concerns about China's slowing growth rate may be overplayed, according to economists and analysts, who said long-term growth will be driven by industrial upgrades steered by changing patterns of domestic consumption and constantly rising consumer spending as a percentage of GDP.

Last year, consumer spending accounted for 65 percent of China's GDP, far higher than the 42 percent recorded a decade ago, data from the National Bureau of Statistics show. By comparison, domestic consumption accounted for about 61 percent of GDP in Japan and 68 percent in the United States.

A report released in February by Nielsen, a global market research company, showed that although last year economic growth registered its slowest rate in 26 years, consumer confidence hit a four-year high in the fourth quarter, mainly driven by optimism about job prospects and future income growth.

On Sunday, Premier Li Keqiang announced that the government was cutting the annual growth target to 6.5 percent.

The modern consumer

Wang Yuan, a 27-year-old saleswoman at an electronic products store in Beijing's Haidian district, is a typical modern consumer.She recently went shopping after work at a mall a block away from her store, looking for a brightly colored dress for a Friday night matchmaking event.

"I hope I will make a good first impression," she said, holding a dress that cost 520 yuan ($75), far above her budget. Despite the cost, Wang didn't hesitate too long before deciding to buy it.

"I will try to earn more money next month. Maybe I'll find a part-time job as a waitress at a restaurant after work," she said. "I don't really mind if I am unable to save much this month-if I hadn't bought the dress I wanted, I would probably have spent the money on other things, anyway."

Born in 1989, when China was reaping the early rewards of the reform and opening-up policy, Wang's views on saving money are very different to her parents' ideas.

"I didn't save much at first because I didn't earn much. I don't think I would be happy if I copied my parents' experience-they saved carefully for several decades, but did not end up becoming richer," she said.

Her mindset reflects the changes in China's macro consumption story in recent years. The younger generation has become a leading force in the ever-growing role of consumption as a driver of economic growth, one that will power China's economy for decades to come, according to analysts.

'New generation'

People born in the 1980s, estimated to number about 210 million, have become the biggest consumer group, accounting for 16 percent of consumers nationwide, followed by those born in the 70s, 90s, and 60s, the Nielsen report said.

Moreover, according to report by analysts at Morgan Stanley called "Why we are bullish on China", published in February, these "new generation" consumers generally spend more than the pre-1980s generations, who experienced much harsher living conditions.

Morgan Stanley expects consumer spending to reach $9.7 trillion by 2030, from $4.4 trillion last year, and people will spend a greater proportion of their incomes on healthcare, hotels and catering, household goods and services."China is already on the track of a gradual transition toward a consumption- and services-led growth model," the analysts wrote, in an emailed response to questions from China Daily about the sustainability of consumer-led growth.

Increasing reliance on consumption as a growth driver is an irreversible trend, they added, which means the guardians of the economy are unlikely to revert to old management methods, such as achieving double-digit growth via a range of stimulus measures and exports.

The Morgan Stanley report predicted that the composition of China's consumption pattern will continue to change as consumers become older, wealthier and more tech-savvy. That is expected to fuel a proportionate increase in sectors such as leisure, entertainment, travel and healthcare.

Disposable incomes rise

Data from the National Bureau of Statistics show that last year, the per capita disposable income of urban residents rose by 7.8 percent year-on-year to 33,616 yuan, while the figure for rural residents rose to 12,363 yuan, an increase of 8.2 percent from the previous year.

The changing pattern of consumption is likely to provide more business opportunities and industrial upgrades on the supply side.

Some observers are ready to exploit the changing conditions.

Liu Mengyuan, CEO of Ycloset, an online platform that rents designer clothing at far below retail prices, first identified the opportunities offered by the emerging consumer class in 2015. That was the year consumption outstripped investment for the first time and became the major driver of economic growth, contributing more than 50 percent of China's GDP for the first time in history.

Liu, who previously worked in public relations for the fashion industry, sensed the potential business opportunities and backed her own judgment that women ages 25 to 30-her target customers-were likely to become a major force in consumer spending.

"Young women tend to have a sudden increased demand for office-friendly, party and date outfits after they graduate from college," she said.

Unlike Rent the Runway, a US startup that was one of the first to provide high-end clothing for rent, Liu's platform provides cheaper outfits to better serve the needs of young Chinese, such as Wang, the electronics saleswoman.

"You cannot imagine how consumption power has grown among young people," Liu said. "A young woman who earns 6,000 yuan a month might spend the same amount on clothes as a woman who earns double that income. There are a lot of untapped opportunities in the industry."

Her company mainly serves customers in first-tier cities, including Beijing, Shanghai and Guangzhou, the capital of Guangdong province, because she feels coastal cities, where incomes are high and the rate of internet penetration is greater, tend to have more demand for services such as hers.

Looking ahead, she said the clothing-rental market is likely to see further expansion: "Rising demand for better services and products will push us and the whole industry to upgrade."

Job creation

Hu Angang, a professor of economics at Tsinghua University, said the growing number of job opportunities created every year in industries such as fashion, services and technology means consumption will be a sustained driver that will help the economy move toward a healthier and better-balanced growth model.

Ruan Fang, a partner at Boston Consulting Group, said traditional manufacturing industries would also benefit from the rebalancing process, driven by consumer spending rather than investment and exports.

Although some traditional manufacturing jobs, especially unskilled ones, will disappear as demand for low-end products falls, business models created by emerging industries, such as the digital economy, will soften and balance the impact, she added.

A report released by Boston Consulting Group in January predicted that the nation's digital economy will create more than 400 million jobs by 2035, with the e-commerce giant Alibaba alone expected to generate 100 million jobs, according to Ruan.

To better adapt to the transition, she said China must improve and update the education system, because only multi-skilled college graduates will stand out during the process of economic transformation.

Contact the writer at wangyanfei@chinadaily.com.cn