Investors anticipate flurry of bilateral opportunities

Russia and China have achieved positive results through cooperation on infrastructure construction, and investors are anticipating more opportunities, according to the CEO of the Russian Direct Investment Fund.

Kirill Dmitriev said efforts by Russia and China to coordinate the Eurasian Economic Union with the Belt and Road Initiative will stimulate business development by minimizing risk and reducing red tape.

|

|

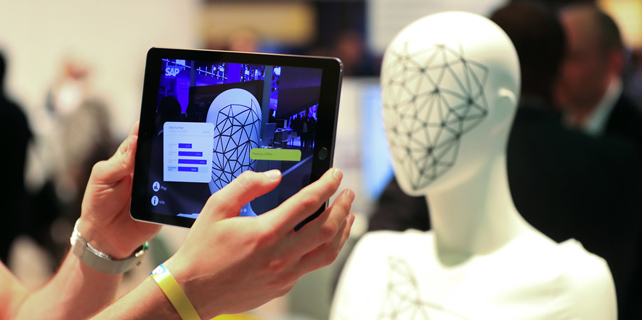

Kirill Dmitriev, CEO of the Russian Direct Investment Fund. [Photo provided to China Daily] |

"If our leaders continue to inspire and promote this cooperation, governments and companies will follow suit," he said. "However, to achieve this we need specially designed vehicles, such as the Russia-China Investment Fund, the Russia-China Intergovernmental Investment Cooperation Commission and the Russia-China Business Advisory Committee, to convert the positive and proactive attitudes of our leaders into tangible mutual benefits for both economies."

In 2011, the Russian government established the $10 billion Russian Direct Investment Fund to make equity investments in high-growth sectors. The fund, together with China Investment Corp, established the Russia-China Investment Fund in 2012, with each committing $2 billion.

The fund has identified five key areas with the potential to generate returns: natural resources; infrastructure; agriculture; consumer goods; and the service sector.

"We target the opportunities created by the rapid developments in economic cooperation, fast-growing trade and the rising purchasing power of the Russian and Chinese middle classes," Dmitriev said. "This approach allows the fund to generate attractive returns for investors."

The fund's projects in China include investments in the ride-hailing app Didi Chuxing, the Tutor Group and the Amur International Rail Bridge, which links Nizhneleninskoye in Russia and Tongjiang, Heilongjiang province, in China.

Recently, the fund and Tus-Holdings agreed to establish the Russia-China Venture Fund to promote trade, economic investment and scientific and technological cooperation.

"The fund's target size will be $100 million," Dmitriev said. "The Russian Direct Investment Fund and Tus-Holdings will be anchor investors, with the likely participation of other Russian and Chinese institutional investors."

The Belt and Road Initiative is important for Russia because it may provide sources of additional growth: "Russia's strategic location between China and Europe means it is ideally situated to support this initiative and improve connectivity between East and West."

The Russian Direct Investment Fund is looking for more Belt and Road investment opportunities, and has signed a partnership agreement with the Silk Road Fund, a Chinese government vehicle, to foster increased investment along the routes.

Dmitriev said the rail bridge across the Amur River demonstrates how the Belt and Road Initiative can connect with the EEU.

The bridge will benefit both countries because it creates a new export corridor and alleviates transport infrastructure constraints between new sectors being developed in Eastern Siberia and the Russian Far East, he said.