Coming of age

China's private equity sector is becoming a global force and playing a role in the country's economic transformation

Just over a decade ago, private equity was relatively unheard of in China. That is no longer the case.

Chinese private equity firms such as Legend Capital, AGIC Capital and Golden Brick Capital Management have emerged as major players, especially for small and medium-sized privately owned enterprises.

Private equity is playing a major role in the growth of the technology sector, which is a key plank in China's economic transformation.

China's private equity sector is coming of age, fueled by the country's growing wealth, the increasing sophistication of its investors and their desire to gain exposure to overseas assets.

It has grown from what some analysts used to describe as a "buy and flip" industry to one that is well regulated and on par with many of the world's major private equity players.

Despite recent growth concerns, investors still view China among the most important investment destinations globally.

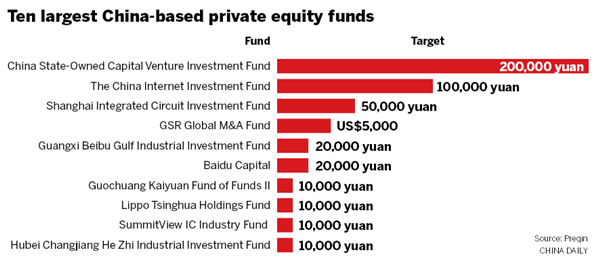

"Private equity fundraising has become even more competitive at the top end of the industry, especially with the emergence of State-backed vehicles in the Chinese market," according to Christopher Elvin, head of private equity products at Preqin, a data and analysis group for the alternative assets industry.

"The development of the venture capital industry in China has played a key role in the growth of the Asian market, and the country is now beginning to rival Silicon Valley as a hub of activity," Elvin told China Daily.

"The Chinese government has looked to encourage entrepreneurship by providing support and financing for startups alongside private firms," he said.

"Managers will have to prove that they can provide the strong returns that investors demand in order to ensure that the current boom in fundraising can translate into a long-term ascendancy."

Mei-ni Yang, private equity specialist with Mercer Private Markets, said: "Overall private equity manager sophistication has been increasing, driven by the need to add value post-investment, manage risks and become creative in generating exits.

"In addition to traditional sector-agnostic (not industry-specific) growth capital funds which have been prevalent in the last 10 years, we have observed the emergence of sector-specialist teams in areas such as technology, healthcare and the consumer sector," she said.

"Consumption-driven investment themes continue to be the focus of most managers, both sector-agnostic and sector-specific, given the continual expansion of the Chinese middle class and urbanization, coupled with traditionally high household savings that are gradually channeled toward a more liberal consumer profile."

Yang said that while in years past, listings have been the main mode of divestment for Chinese general partners (another term for private equity firms), government intervention has led to relatively unreliable initial public offering windows.

"Significant developments in the Chinese economy have also driven an increase in cross-border private equity deals, as well as outbound investments of Chinese managers overseas, to capitalize on new knowledge domains and skill sets," she said.

"The local investor community is also becoming more institutionalized, underpinned by more progressive regulations and the proliferation of more suitable investment opportunities."

Last year, Chinese private equity firms took part in the $3.6 billion takeover of US printer company Lexmark International, the $2.75 billion purchase of Dutch chipmaker NXP Semiconductors' standard products unit, and the $600 million acquisition of Oslo-based Opera Software's Web browser business.

In 2016, for the first time, the sum of overseas transactions by Chinese private equity firms was higher than that of Asian deals by foreign private equity players, according to Asian Venture Capital Journal.

"These Chinese funds are already beginning to alter the calculus for buyout deals worldwide," Peter Fuhrman, chairman and CEO of China First Capital, a Shenzhen-based investment banking and advisory firm, told Bloomberg.

"It's about buying companies that, once they have Chinese owners, can start making really big money selling products in China," he said. "The big cats of the buyout jungle are mainly sitting on their haunches. They aren't currently built to engage in these kinds of deals."

Chinese private equity firms are gaining significant power from the nation's growing army of high-net-worth individuals.

There is a lot of domestic capital available, obviously looking for a home, and that is fueling the emergence of these funds, according to Bain & Co, a Boston-based consulting firm.

Bain said private equity deals last year in China, including the Chinese mainland, Macao, Hong Kong and Taiwan, were valued at $49 billion. This was down on the previous year's figure of $72 billion, although 2015 was considered to be a blockbuster year. And internet-related deals accounted for 48 percent of that deal volume last year, compared to just 16 percent in 2012.

Growth in deal activity has been driven by a number of large deals in excess of $100 million, Kiki Yang, a partner in Bain's Hong Kong office and a leader in the firm's Greater China Private Equity practice, told China Daily. She said deal sizes have increased, growing from $93 million in 2012 to $112 million last year.

"Alternative capital" such as State-backed funds and financial services companies have been especially active in Asia Pacific and China, she said.

China private equity deal momentum will likely remain strong, Kiki Yang said. "Alternative capital shows no signs of slowing down as investors have significant cash to deploy."

She added: "Intensifying competition will likely keep valuations high, which may dampen activity and post risk to returns."

According to Bain, a majority of the US and Europe-based funds that, individually, raised an accumulated $5 billion or more in 2012-16 have a focus on China.

It is included in the mandates of some 70 percent of US-based large funds and 83 percent of Europe-based large funds, Kiki Yang said, and remains highly attractive due to the "large and growing economy, solid history of returns, and multiple success stories of successful foreign private equity funds".

She said that with the growth of China's private equity sector, foreign funds have lost market share. In 2012 they participated in 44 percent of deal value in China, but that slid to just 23 percent last year.

"The Greater China private equity deal market is increasingly dominated by large Asian sovereign wealth funds and domestic players," Yang said, adding that risks for global funds included this intensifying competition as well as the more volatile exit market.

Signs point toward a bigger role for Chinese private equity firms, both at home and abroad.

Given that China is still growing faster than most major countries, any private equity firm with the ability to help companies thrive there will have a leg up on international competitors, said Henry Cai, the former Deutsche Bank investment banker who started AGIC Capital.

"Few companies nowadays would care about the money or how much you pay them," Cai told Bloomberg. "They care if the investor can help them break into the Greater China market."

Some of the biggest deals so far this year involving Chinese private equity companies have been in the internet space, and involving limited partners.

Key examples include the $4.5 billion investment in Alibaba affiliate Ant Financial Services Group led by China Investment Corp; the $4.4 billion merger and privatization of Chinese travel website operator Qunar by Ocean Management; LeEco unit LeSports' $1.2 billion Series B funding round led by HNA Capital; and the $1 billion investment in JD.com subsidiary JD Finance by Sequoia China, China Harvest Investments and China Taiping Insurance.