Container fleet to get $1.78 billion upgrade

|

|

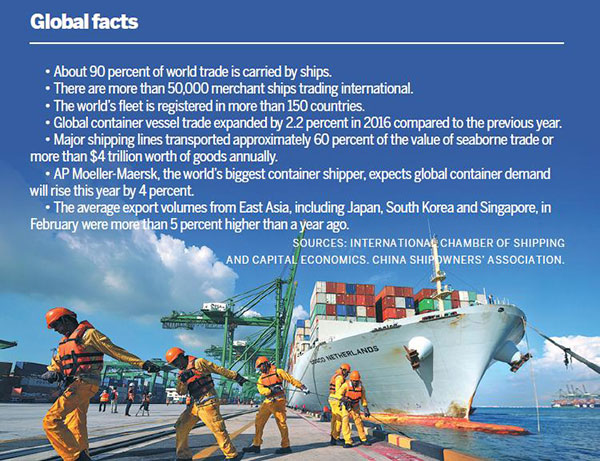

The container ship COSCO Netherlands docks in Singapore port, the largest port in Southeast Asia.[Photo/Xinhua] |

China COSCO Shipping Corp is extending its container fleet as the company expands its sea routes.

The group, through its subsidiary China COSCO Shipping Holding Co Ltd, plans to buy six mega container ships from Shanghai Waigaoqiao Shipbuilding Co Ltd.

Another eight container vessels will be purchased from Shanghai Jiangnan Shipyard (Group) Co Ltd.

The two deals will be worth about $1.78 billion.

Deliver dates for the 14 container ships have been penciled in for the next two years, and they will raise the group's operational TEU, or twenty-foot equivalent units, capacity to more than 2 million by the end of 2018.

"Traditionally, Chinese shipping companies mainly transported containers on shipping lines between Asia and Africa, and China and Southeast Asia," said Wan Min, general manager of China COSCO Shipping Corp.

"But we are now focusing on major shipping lines between Asia and Europe, and Asia and North and South America."

Denmark's Maersk Line, Switzerland's Mediterranean Shipping Co SA and French group CMA CGM SA are the world's top three container operators, with up to a 40 percent market share worldwide.

"Chinese companies hold a relatively small share in comparison," Wan said.

By the end of February, COSCO Shipping Lines Co, another subsidiary of the sprawling State-owned China COSCO Shipping Corp, operated 311 container ships.

They have a total TEU capacity of 1.64 million, making the company the fourth largest player in world by size of its container fleet.

In addition, the group has placed orders for 33 container vessels, with a TEU carrying capacity of more than half a million.

"Free trade arrangements, including the Regional Comprehensive Economic Partnership, the China-Association of Southeast Asian Nations Free Trade Agreement and China-Australia FTA, will also offer new growth opportunities for China COSCO Shipping's container cargo services in the Asia-Pacific region," Wan said.

Analysts stressed that new orders for container ships will boost the company's presence, but it could have a negative effect on the industry.

"The race for larger container vessels will delay the recovery of the industry as the global shipping sector has experienced rocky times in recent years," said Cheng Zhiwei, an analyst with Changjiang Securities Co.

But Wang Mingzhi, deputy director-general of the Waterborne Transport Bureau at the Ministry of Transport, felt the decision by China COSCO Shipping Corp to upgrade its fleet was a positive move.

"Better-equipped ships will help the company compete against international rivals," Wang said.

"It will also encourage them to work on new products, such as liquefied natural gas and liquefied petroleum gas carriers," Wang added.