China's economy is on the right track

|

|

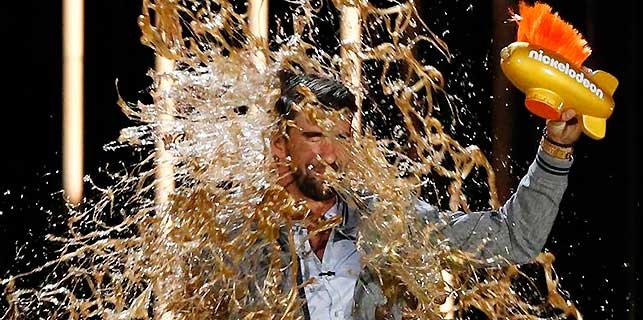

Catherine Yeung, investment director at Fidelity International. [Photo/China Daily] |

Neither risk happened and it's likely we have seen the peak of PPI in this current cycle.

Consumption, especially mass market demand, has continued this year and we expect this trend to remain in place, especially given healthy incomes and continued urbanization.

The growth of the consumer in conjunction with the changes in the way that people consume will continue to be an important economic driver during the next five to 10 years.

A2: The Chinese economy has been in a "muddling through" stage since the investment cycle peaked in 2010.We are seeing the government focus on the twin objectives of growth-stabilization and reforms.

Since the second quarter of 2016, we have seen an improvement in the real economy aided by corporate capital expenditures, consumption and exports.

Supply-side reforms have helped in removing excess capacity. So far, we have seen these State-led capacity cuts in coal and steel. Now, expect industries such as glass, cement, paper and refining to also adopt these reforms.

From an earnings perspective, we have likely seen a trough and expect further upward revisions. What is very important is that we are seeing a shift in the outlook toward shareholder returns. For instance, China does not have a dividend culture, but we saw signs of change early this year when China Shenhua issued a special dividend for the first time in its history.

A3: There are many supportive drivers to boost growth. Strategies such as "Made in China 2025" underpins companies climbing up the value chain and becoming more innovative.

Labor market supply has also changed and with an increase of undergraduates, innovation is a key area of structural growth. While the market has moved up, valuations on the whole remain compeling when viewed in a global context.

A relatively stable and predictable policy environment in China compared to much of the West might also start to be reflected in valuations.

The gap between China's share of the world's economy and its share of global stock markets remains significant, and it is more than likely that this will close over time.

It was not a surprise to see A-shares move into global indices, while the prospect for an acceleration in regulatory reforms is expected.

A4: China's proposed reforms agenda needs to continue to be implemented if we are to see sustainable growth.