Competitive gaming grows in popularity in China

The concept of sports is evidently no longer limited to displays of athleticism in a stadium or on a football pitch.

After all, Xie Shuangcheng, vice mayor of Hangzhou in Zhejiang province, announced during the opening ceremony of China Joy that e-sports will become an official medal sport for the 2022 Asian Games that the city is hosting.

E-sports had a considerably expanded presence at this year's China Joy held in Shanghai from July 27 to 30, with one of the highlights being the launch of Game.Tmall.com, a new e-commerce platform by Tmall and US tech company Intel that screens e-sports content and sells hardware for professional gamers.

Chip manufacturer AMD also set up an e-sports area at its booth to showcase products such as laptops, chairs and jerseys. Taiwan's second largest motherboard manufacturer Gigabyte Technology even named its booth Aorus E-sports Amusement Park.

An e-sports competition for League of Legends, Dota 2 and Overwatch was also added to this year's China Joy lineup. The competition, which had a prize pool of 540,000 yuan ($80,400), kicked off in 10 Chinese cities in May.

The final was held on July 30, with Team 666 from Shanghai winning the championship for Dota 2. Meanwhile, Team WuW from Guangzhou of Guangdong province grabbed the title for League of Legends while Team CQUPT triumphed in Overwatch.

According to the China Gaming Industry Report jointly released on July 25 by Beijing-based Game Publishing Commission and market consultancies CNG and IDC, the sales revenue of China's e-sports market surged 43.2 percent year-on-year to 36 billion yuan during the first half of 2017. This amount is equal to 36 percent of the total income of China's gaming industry during the same period, up 4.2 percentage points from a year earlier.

The report added that the popularity of mobile games such as King of Glory, which was developed by internet giant Tencent, has boosted e-sports competitions for mobile games, in turn uplifting the competitive gaming scene in general.

Meanwhile, global market research firm IDC said that there were more than 500 professional e-sports teams by the end of 2016 while the number of amateur teams that have applied for online e-sports competitions have exceeded 10,000.

Top e-sports players can earn over 1 million yuan in annual salaries while the top e-sports commentators — most of them are usually former professional gamers — can rake in over 10 million yuan, according to industry insiders.

Zhou Zhaoning, an analyst at IDC, concluded that China's e-sports market had matured and diversified in 2016. He added that the country's e-sports industry will reach its prime this year.

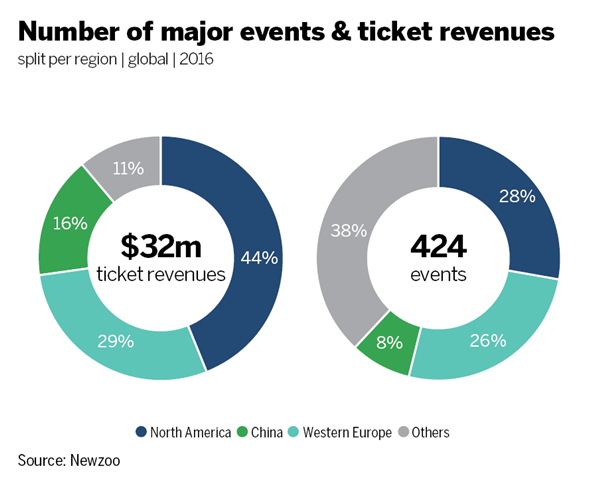

Statistics provided by game industry intelligence provider Newzoo shows that China accounted for 16 percent of the $32 million in ticket revenues of e-sports games globally last year, dislodged only by North America and Western Europe.

In addition, China accounted for 13 percent of the $93.3 million global e-sports prize pool in 2016, making it the second largest contributor worldwide only next to North America.

Presently, there are nearly 2,000 e-sports game organizers in China, including the Information Center of General Administration of Sports and the local governments of Yinchuan in Northwest China's Ningxia Hui autonomous region and Yiwu in East China's Zhejiang province.

E-sports first took shape in China in 1998, propelled by the massively popular Starcraft by Blizzard Entertainment. The game later became an official sports item listed by the General Administration of Sports in 2003.

Wang Sicong, son of China's richest man Wang Jianlin, set up the IG E-sports Club and the Association of China E-sports in 2011. The two entities have played an integral role in creating a set of unified rules in the industry and regulating the management of e-sports clubs.

While e-sports looks to be thriving in China, Wang Ji, chief executive officer of Zhejiang Century Huatong Group — it is the biggest shareholder of Shanda Games — pointed out that there are some problems with the industry that need to be addressed.

One of these problems is that e-sports events are too reliant on a single game. As a result, game companies have too much say in the events, relegating league organizers to the sidelines.

Zheng Nan, research director of China Gaming Industry Report, pointed out that there is actually a lack of talent despite the growing popularity of e-sports.

Presently, most of the e-sports candidates in the market are game players or hosts, while the market has a need for other types of talents including trainers, data analysts, professional league managers, game planners, program directors and even psychologists, he said.

Zheng noted that though China's Education Ministry has given universities the green light to introduce e-sports management majors, it would nevertheless take time before students enrolled in these majors graduate.

"The e-sports market currently lacks a professional and systematic supply of e-sports talents, and this will in turn affect the industry's long-term development," he said.