China's ODI drops as review process tightens

|

|

Chinese workers operate a shield tunneling machine at a light-rail construction site in Tel Aviv, Israel.[Photo/Xinhua] |

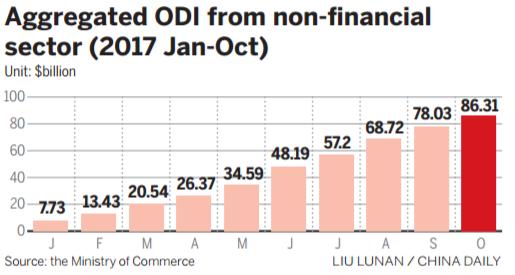

The drop in the country's ODI during this period narrowed 1 percentage point from the first three quarters of this year, indicating that China continued making investments in manufacturing and modern service-related business in global markets.

Investment in leasing and commercial services, manufacturing, and retail and information-related businesses accounted for 32.4 percent, 17 percent, 12.3 percent and 9.9 percent of the country's total ODI, respectively, during the nine-month period, said the ministry.

Companies from China invested in 5,410 companies in 160 countries and regions from January to October and signed $184.3 billion in new contracts for overseas projects, a rise of 11.3 percent year-on-year.

The ministry said China would continue to tighten its review of the authenticity of overseas investment and compliance with regulations, and guide more investment into the real economy and reduce investment in sectors in which Chinese companies are not proficient at managing.

Meanwhile, outbound investment in 53 economies related to the Belt and Road Initiative stood at $11.18 billion, accounting for 13 percent of total ODI, up 4.7 percentage points year-on-year.

Xu Hongcai, an economist with the China Center for International Economic Exchanges, said the government would encourage ODI activities that can assist the development of the Belt and Road Initiative and resolve overcapacity issues in global markets.

Zhou Mi, a researcher at the Chinese Academy of International Trade and Economic Cooperation, said Chinese companies will continue to reaffirm their strategies in both developed and developing markets in the long term.

"The industrial, consumer, services and technology sectors will most likely be the focus of Chinese investors, which in part reflects China's ongoing economic transformation to a consumer-driven and service-oriented country," said Zhou.

Even though private-sector companies have a big appetite for fast-appreciating assets in overseas markets, they need to focus on implementing their strategy and execution carefully.

"Insufficient understanding of local cultures may lead to labor disputes for Chinese companies. They should also be aware of the concerns of local communities and nongovernmental organizations while maintaining good partnerships with host governments," said Zhou.