Central bank in a monetary dilemma

Updated: 2014-04-03 09:02

By Chen Jia (China Daily)

|

||||||||

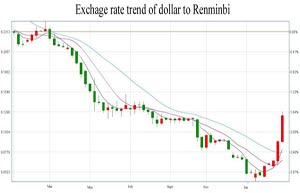

The repo rate is the discount rate at which a central bank repurchases government securities from commercial banks, depending on the level of money supply it decides to maintain in the country's monetary system. To temporarily expand the money supply, the central bank decreases repo rates (so that banks can swap their holdings of government securities for cash). To contract the money supply it increases the repo rates.

|

|

|

|

Yuan Yiqiu, a financial analyst at Ping An Bank, said the central bank is not likely to cut the reserve requirement ratio in the short term because liquidity in the Chinese financial market is not tight now. "Recent repo purchases show the government continually takes deleveraging measures and it is cautious about potential debt risk," he said.

But Yao from Societe Generale is still looking for a 50 basis points cut in the reserve requirement ratio in the second quarter. The purpose would be to offset the impact of potential capital flows, rather than a signal of credit easing, she said.

"Going forward, the PBOC is likely to anchor interbank rates at about the current level, but it is unlikely to allow interbank repo rates to fall below 2 percent for any sustained period of time. Specifically, the overnight rate will probably move in a range of 2 to 3 percent, lower than the 3 to 4 percent in the second half of 2013 but higher than the 1 to 2 percent in 2009 and 2010," said Yao.

A lower-than-expected inflation level so far also leaves more room for policymakers to easy monetary policy, analysts said.

"It appears that inflation will likely again come in significantly below the government target of 3.5 percent this year. We have recently revised down the 2014 Consumer Price Index inflation forecast to 2 percent from 2.6 percent," said Zhu Haibin, chief economist in China at JPMorgan. "Meanwhile, the benign inflation picture leaves room for potential monetary policy maneuvers if necessary."

In February, the CPI decreased to 2 percent from 2.5 percent in January. China's 2013 CPI inflation, at 2.6 percent, undershot the official target for the second consecutive year.

"An RRR cut could happen in the second half but we expect the PBOC will continue the credit tapering process," said Zhu. "The objective of economic rebalancing implies that monetary policy is more likely to remain neutral, with a tightening bias, in 2014."

|

|

|

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting reported at US Army base in Texas

Asiana admits pilot error in crash

Sina Weibo picks Nasdaq for IPO

Chinese tourist abducted in Malaysia

Japan removes export ban on military goods

5 dead in 8.2 quake off Chile

NY Councilman meets 'the press'

MH370 'unlikely' to hurt ties

US Weekly

|

|