China slowdown is 'welcomed'

Updated: 2014-10-13 11:53

By Chen Weihua in Washington(China Daily USA)

|

||||||||

Despite deep concerns over a prolonged low global economic growth ahead, senior officials from international financial organizations expressed their optimism over China's economic slowdown.

Zhu Min, deputy managing director of the International Monetary Fund (IMF), said people attending the discussions during the 2014 annual meetings of the IMF/World Bank Group held in Washington over the weekend described China's slower economic growth as a "welcomed slowdown".

"It is a good thing and it will ensure a more steady growth of the Chinese economy in the future," Zhu told a group of Chinese journalists on Sunday afternoon.

The IMF has forecast the Chinese economy to grow 7.4 percent this year and 7.1 percent next year. Although that is much higher than the IMF's forecast for global economic growth of around 3.3 percent, it has been relatively low compared to China's often double-digit growth over the last 30 years. China's GDP grew 7.7 percent in 2013, the lowest since 1999.

World Bank President Jim Yong Kim noted last Thursday that it was difficult for many people to watch China have lower growth rates. "But we feel that they're doing it in a way that's very much with tremendous awareness of what they're trying to accomplish," he said.

China has pledged to transform its economic growth model to be less driven by exports and investment and more by domestic consumption and moving up the supply chain. A slowdown is expected during the process.

Zhu, who was a senior official of Chinese banks before joining IMF in 2010 as the inaugural special advisor to the managing director, attributed the slowdown to Chinese government policies of tightening up the growth of lending, shadow banking and local government debt.

"The reduction of liquidity will slow down economic growth," Zhu said.

Shadow banking in China now accounts for 25 to 35 percent of GDP, the fifth-largest in the world, IMF Managing Director Christine Lagarde said last week.

Zhu also attributed the slowdown of the Chinese economy to high property prices and excessive stocks which force down real estate investment. As a result, the slowdown in the real estate sector is likely to bring down GDP growth by 1 percent this year, and will continue to bring down economic growth for the next year, according to Zhu.

He said that people at the annual meetings believe that China's efforts in the last 18 months to curb the growth of bank credit, local government debt and shadow banking and improve supervision has begun to bear fruit.

"Basically people are no longer talking about the eruption of China's debt crisis as people worried about 12 months ago," Zhu said. But he said high debt and shadow banking are still concerns and more efforts are needed.

Zhu said the "targeted stimulus" on railway, new product and public infrastructure in China has made progress.

Some 12 million jobs have been created in China so far this year. "This job creation number is not at all lackluster compared with an 8 or 9 percent GDP growth," Zhu said. China created a total of 13 million jobs in 2013.

Zhu also credited the fact that the service sector contributed more to the GDP than the manufacturing sector this year as a good result of China's economic restructuring.

He cautioned that continued restructuring of the real estate sector is still a major task, because the property market still contributes a large chuck of GDP growth.

He noted that the long supply chain of the real estate sector means it's both a difficult and important task.

Zhu said that people at the meetings praised the stable growth of the Chinese economy. "As the world's second largest economy, China's economic stability is especially important to global economic growth," Zhu said.

Markus Rodlauer, deputy director of IMF's Asia and Pacific Department, said in a recent talk that 1 percent point low growth in China would translate into about 0.1 percent point less global growth, with larger impacts on selected economies.

China and other emerging markets and developing countries have accounted for more than 80 percent of world growth since 2008. "Led by Asia, and China in particular, we expect that they will continue to drive global activity," Lagarde said last week.

"I hope the Chinese economy will continue to grow in a sustainable way," Zhu said.

chenweihua@chinadailyusa.com

Premier Li lays wreath at Tomb of the Unknown Soldier

Premier Li lays wreath at Tomb of the Unknown Soldier

School honored by governor

School honored by governor

Joint Scorpion venture soars in ratings

Joint Scorpion venture soars in ratings

Li opens doors on trade, energy

Li opens doors on trade, energy

Shanghai launches old-style cabs for special needs

Shanghai launches old-style cabs for special needs

Cold wave brings first snowfall this autumn to Gansu

Cold wave brings first snowfall this autumn to Gansu

27 Chinese hostages freed in Cameroon

27 Chinese hostages freed in Cameroon

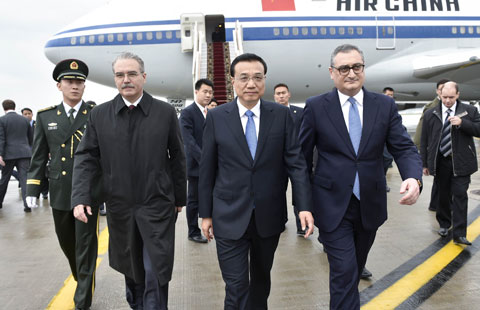

Premier Li begins his Russia visit

Premier Li begins his Russia visit

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China to promote all-round ties with Russia

Language school honored by governor

GM's sales in China rise 15%

Disney in China: Patience is its virtue

China slowdown is 'welcomed'

Joint Scorpion venture soars in ratings

School honored by governor

China's slowing growth will impact LatAm

US Weekly

|

|