China's slowing growth will impact LatAm: Economist

Updated: 2014-10-13 03:58

By JACK FREIFELDER in New York(China Daily Latin America)

|

||||||||

The impact of economic deceleration in China is felt far beyond the Greater China Region and could have an impact on a number of Latin American nations, according to an economist with the World Bank.

"Deceleration is not specific or unique to Latin America," Augusto de la Torre, the World Bank's chief economist for Latin America and the Caribbean, said through a translator. "Most of the emerging countries in the world, including China, India and Eastern Europe, are seeing deceleration in their growth rates that are quite significant and even greater than what's seen in Latin America."

"The region as a whole is impacted by the three major countries: Argentina, Venezuela and Brazil," he said. "We will not have growth rates comparable to those we've had in the last decade. The average has been growth around 4 or 5 percent in the best of times, but that growth was highly impacted by factors that will not be repeated — external winds like favorable exchange rates, excessively low interest rates and very strong growth in the Chinese economy."

De la Torre made his comments on Tuesday during a press briefing in Washington announcing the release of the World Bank's October 2014 semiannual outlook report on Latin America and the Caribbean.

The report, Inequality in a Lower Growth Latin America, forecasts a growth rate of 1.2 percent in the fourth quarter of 2014 and a 2.2 percent clip for 2015.

"The two most important external factors adversely hitting LAC (Latin America and Caribbean) seem to be the falling commodity prices and the deceleration in China," the report said. "This is particularly important for LAC countries that depend on China for their exports and that have counted on China's investments in their own economies."

"One may even argue convincingly that LAC's growth over the golden years was artificially high," the report goes on. "It was boosted by very high growth in China, and historically low world interest rates. Trend and cycle for China does not seem to suggest an imminent pickup in growth."

A September 2013 article from JP Morgan Chase & Co, titled Corridors of Power: China's Latin American Linkage, said: "China's trade with Latin America has flourished over the past decade, hitting $261.2 billion in 2012 — up from $100 billion in 2009 and just $10 billion in 2000. Flows between the two are projected to hit $400 billion by 2017."

On Oct 7 the International Monetary Fund (IMF) released its October 2014 World Economic Outlook report, which estimates that the growth of the Chinese economy will slow to 7.4 percent in the fourth quarter of 2014 and 7.1 percent in 2015 as it "makes the transition to a more sustainable path".

China's economy has worked to recover from a poor start in 2014 and the Chinese government has indicated it is prepared to accept slower growth as it tries to wean the economy away from a dependence on investment and exports.

De la Torre said the World Bank report, issued ahead of the IMF-World Bank Group annual meetings that took place this weekend (Oct 10-12), shows a great deal of heterogeneity within the region, including 6.6 percent growth for the year in Panama and negative growth in Venezuela and Argentina, with -2.9 percent and -1.5 percent, respectively. Brazil is expected to grow at only 0.5 percent.

"Heterogeneity in the region helps us understand that the cycles are different from one country to the other," De la Torre said, adding that "not all countries have low growth".

jackfreifelder@chinadailyusa.com

Premier Li lays wreath at Tomb of the Unknown Soldier

Premier Li lays wreath at Tomb of the Unknown Soldier

School honored by governor

School honored by governor

Joint Scorpion venture soars in ratings

Joint Scorpion venture soars in ratings

Li opens doors on trade, energy

Li opens doors on trade, energy

Shanghai launches old-style cabs for special needs

Shanghai launches old-style cabs for special needs

Cold wave brings first snowfall this autumn to Gansu

Cold wave brings first snowfall this autumn to Gansu

27 Chinese hostages freed in Cameroon

27 Chinese hostages freed in Cameroon

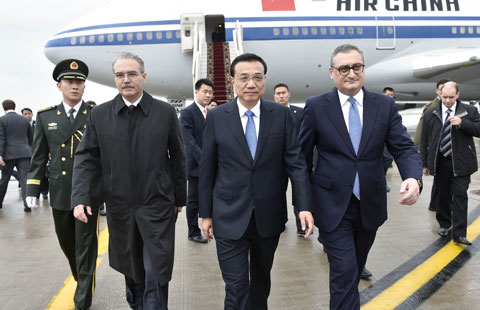

Premier Li begins his Russia visit

Premier Li begins his Russia visit

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China to promote all-round ties with Russia

Language school honored by governor

GM's sales in China rise 15%

Disney in China: Patience is its virtue

China slowdown is 'welcomed'

Joint Scorpion venture soars in ratings

School honored by governor

China's slowing growth will impact LatAm

US Weekly

|

|