'Doctors' in queue to fix hard put mainland hotels

Updated: 2015-06-19 15:12

By Selena Li in Hong Kong(China Daily USA)

|

|||||||||

|

|

Industry insiders say the private equity model applied by some “white knight” investors — to be the owner and operate the property using their own professional operation teams — may help to quench the thirst for senior hospitality talents and cash in the upside value difference between a squeezed buying price and the higher selling price after “turning it around”. [Brent Lewin / Bloomberg] |

International investors are exploring opportunities to unlock upside potential buried in the management of hotels on the mainland, as most international hotel brand-managed properties are underperforming.

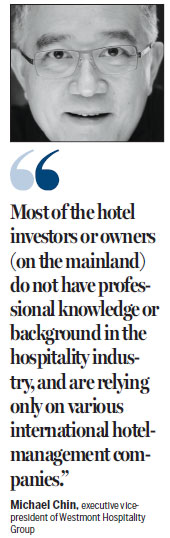

The upscale hotel sector, which has been hurt by the economic slowdown and the central government's anti-corruption drive, is suffering from selective oversupply, said Michael Chin, executive vice-president of the Westmont Hospitality Group (WHG) which is responsible for acquisition and development in the Asia Pacific.

"We've seen the market in Beijing, Shanghai, Chongqing and Tianjin getting close to saturation."

As a result, many of these hotel properties, regardless of whether they're located in gateway or secondary cities, have gone up on the block in recent years, presenting market potential for global buyers.

Brian King, associate dean of the School of Hotel and Tourism Management at Hong Kong Polytechnic University, agreed that the proliferation of new hotels in the past few years has spawned stiff competition, thus subduing the market.

"Some owners and developers do attempt to hold on to their projects, but many are anxious to exit," he said.

One major setback has been that the modus operandi of international hotel management companies (HMC) is off the mark.

"Most of the hotel investors or owners (on the mainland) do not have professional knowledge or background in the hospitality industry, and are relying only on various international hotel-management companies," said Chin.

King thinks that, in general, the involvement of hotel-management firms leads to "a constructive dialogue with owners".

However, hotel development has often attracted those interested in property development rather than hotel management or operations.

"As a result, they may have good business sense in general terms but lack sensitivity to the challenges of operating hotels and restaurants as multi-faceted businesses," King added.

The circumstances on the mainland are distinct. "Between them, the owners, with their lack of hotel knowledge, and the hotel management companies, with their limited sensitivity to mainland realities, don't necessarily succeed in addressing the key issues," he went on.

One of the factors for such inefficiency, according to Chin, is the dearth of capable senior hospitality talents who really know the job.

"Most leading HMCs are listed and need to open more new hotels for their performance record even without adequate senior executive manpower available on the Chinese mainland today."

Having worked for Horwath Asia Pacific and consultancy house PricewaterhouseCoopers, Chin has more than 30 years experience in the hotel and tourism sectors within the region.

King, however, believes that the acute shortage of senior executives can be solved, but slowly. "Talents are leaving the industry, while performance is failing to meet expectations. The response of hotel owners and managers to the crackdown on lavish spending by the government has not been creative enough," he said.

"We (WHG) only manage hotels in which we have equity. The key difference is that for most hotel management companies, their bread and butter is the collection of management fees," Chin said.

Industry insiders believe a paradigm shift in operation and investment pattern is not too distant when hospitality investment groups that are able to apply the private equity model, to be the owner and operate the property using their own professional operation teams, can earn the upside value difference between a squeezed buying price and the higher selling price after "turning it around".

WHG - the largest franchisee and co-owner of InterContinental Hotels and Hilton Hotels worldwide - is one of the largest international private hotel owners and operators with more than 600 hotels under its belt in the US, Canada, Europe and Japan. The group is now working with Chinese investors to acquire overseas viable hotel assets investment.

Westmont's typical business model is to acquire underperforming operating hospitality assets with undervalued market prices, and then upgrade their operations with rebranding via franchise international hotel brands and property renovation. Its next step is to turn it around and hold it for a good few years and then flip it later to earn the upside value difference.

"We are more like a hotel 'doctor'. If you have problem, you go to a doctor who will tell you (the cure). The difference here is that we also put our money into it," Chin said.

"The industry may also see the emergence of new ownership financing, such as time-share or multiple ownership. This has been foreshadowed for some years, but has been impeded by regulatory restrictions," King said.

Beijing has also shown a willingness to permit a wider variety of business models in the services sector.

selena@chinadailyhk.com

Liu visits Houston Museum of Natural Science

Liu visits Houston Museum of Natural Science

Liu meets Tsinghua Youth team in Houston

Liu meets Tsinghua Youth team in Houston

Men get into women's shoes for fun

Men get into women's shoes for fun

Millions in harmony on Yoga Day

Millions in harmony on Yoga Day

Liu visits CI in Pittsburgh

Liu visits CI in Pittsburgh

Shenzhen Maker Week kicks off

Shenzhen Maker Week kicks off

Chinese wrap up Zongzi to mark upcoming Dragon Boat Festival

Chinese wrap up Zongzi to mark upcoming Dragon Boat Festival

A Chinese Garden in a Sister City

A Chinese Garden in a Sister City

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liu Yandong plays basketball diplomacy

Wang Yang hails S&ED

Tsinghua students flying high

Official underlines national defense technology innovation

New anti-corruption app sparks instant flood of public reports

Chinese Premier emboldens state firms' int'l industrial cooperation

CI in Pittsburgh welcomes

vice-premier

Sichuan and Pittsburgh unveil

new school

US Weekly

|

|