China adopts local government debt ceiling

Updated: 2015-08-30 07:22

|

||||||||

Liu Shangxi, senior researcher at the Ministry of Finance, said the the 86-percent is safe, but some local debt ratio has sharply exceeded the alert level.

Wang also warned of fiscal even financial risks if local government debt is out of control, saying the debt mainly comes from banks which need to be caution about surging non-performing loans.

On Thursday, Chinese Finance Minister Lou Jiwei said China's top legislature has approved the expansion of a debt swap program for local governments in 2015.

The bond-for-debt swap program for local governments will be expanded to 3.2 trillion yuan from 2 trillion yuan. China in March, and then in June, granted a quota of 2 trillion yuan under which local governments could issue new low-cost bonds to replace high-yielding legacy debt.

In addition, new local government bonds worth 600 billion yuan in 2015 was also approved, Lou said, adding that the move will help ease pressure on local governments to pay debts.

The bond-for-debt swap program allows local governments to convert their debt to low interest bonds, a move aimed at easing local governments' debt burden without disrupting the broader economy.

Analysts regarded such program as a relief measure but not a solution, saying that if debt problem cannot be radically solved, long-term risk will become more dangerous.

Wang suggested that priority shall be given to the reforms of local governmental structure and fiscal system.

Bolt 'somersaults' after cameraman takes him down

Bolt 'somersaults' after cameraman takes him down

A peek into daily drill of ceremonial artillery unit

A peek into daily drill of ceremonial artillery unit

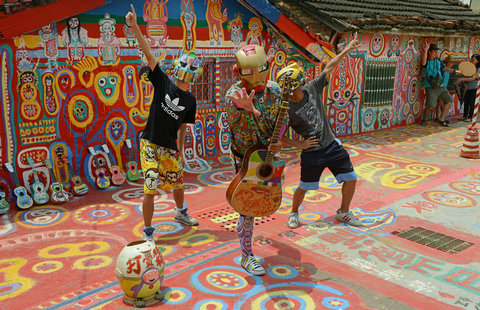

93-year-old's murals save Taiwan's 'Rainbow Village'

93-year-old's murals save Taiwan's 'Rainbow Village'

Top 8 novel career choices in China

Top 8 novel career choices in China

Hairdos steal the limelight at the Beijing World Championships

Hairdos steal the limelight at the Beijing World Championships

Chorus of the PLA gears up for Sept 3 parade

Chorus of the PLA gears up for Sept 3 parade

Iconic Jewish cafe 'White Horse Coffee' reopens for business

Iconic Jewish cafe 'White Horse Coffee' reopens for business

Beijing int'l book fair opens new page

Beijing int'l book fair opens new page

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China takes historical silver in men's 4x100m

Surviving panda cub at National Zoo is male

China eases rules for foreigners to buy property

Ministry denies troops sent to reinforce DPRK border

Stem cell donor offers ray of hope for US boy with leukemia

All creatures great and small help keep V-Day parade safe

China not the only reason global stock markets are in a tailspin

Market woes expected to delay Fed hike

US Weekly

|

|