Domestic startups challenging foreign condom brands

A number of new companies are attempting to seize a greater share of the country's potentially huge market, as Yang Wanli reports.

When choosing condoms, most Chinese remain resolutely "old school" and go for trusted or well-known international brands. Now, though, a number of domestic startups are striving to seize a larger share of the market from the foreign brands that have dominated sales for decades.

In June, Zhongchuan, a manufacturer based in Gansu province, released its latest product - a condom made from waterborne polyurethane, a relatively new material. The prophylactic is just 0.01 millimeters thick, which means it is thinner than a strand of human hair (which usually has a diameter of 0.08 mm), and is aimed at taking market share from two Japanese manufacturers, Okamoto and Sigami, who claim to make the thinnest sheaths.

A month later, Beilile, a condom manufacturer in the Guangxi Zhuang autonomous region, announced a new series of condoms made from a mixture of latex and graphene - a type of carbon that has been dubbed a "super material" - to create condoms that are thinner, stronger and more elastic. The technology was first adopted for the manufacture of condoms in 2013 by scientists at the University of Manchester in England.

In the past three years, China's condom market has witnessed significant changes, according to Xu Tianmin, former chairman of the China Sexology Association. In 2014, there were only about 50 condom production lines spread across several provinces and municipalities, including Shanghai, Tianjin, and the provinces of Guangdong and Shandong according to Xu.

"Now, more domestic brands have entered the industry with new technologies and fresh marketing ideas as their driving forces. Made-in-China condoms are no longer synonymous with low prices and poor quality. You can now find worldleading quality condoms made by domestic brands, and we also have great variety," he said.

Market potential

With a population of more than 1.3 billion, China is one of the world's largest markets for condom makers, and some experts estimate that it is worth about 5 billion yuan ($756 million) a year.

According to statistics from the National Health and Family Planning Commission, the numbers for both condom use and production place the country at No 4 in the world, after the United States, the United Kingdom and Japan. About 2 billion condoms are sold every year, and the number has risen by 15 percent annually since 2014.

Transparency Market Research, a US market researcher, estimates that annual growth will be about 12 percent until 2024. The NHFPC says more than 3 billion condoms are produced every year and the country is now home to about 300 facilities that either manufacture or package prophylactics.

Data supplied by A.C. Nielsen, a global information, data and measurement company, suggest that the market potential in China is huge, with double-digit growth registered in both of the past two years, according to Vincent Wong, marketing director of RB and Manon Business, a Sino-British joint venture that is the exclusive agent for Durex in China.

"Consumers are now choosing condoms on the basis of greater diversity and personalization. That means that in addition to the basic safety aspects, consumers now have a wider choice of condoms - for example, the ultrathin series, the fun series (dots and ribs), and the longer-lasting series," Wong said.

"Moreover, consumers now care more about sensation; so men prefer thinner condoms while women focus on adequate lubrication. With regard to personalizing the products, since consumers are getting younger they have their own unique opinions about product positioning and packaging, and identify with the products they buy. In other words, the idea of 'a product for me' is the reason they choose a certain item."

Emerging brands

The health authorities have been supplying free contraceptive devices and pills since the 1970s, when the government began promoting the family planning policy nationwide and contraception was included as part of the basic public health service program.

Every year, the National Health and Family Planning Commission purchases more than 1 billion condoms to distribute free of charge under a program designed to prevent sexually transmitted diseases and unwanted pregnancies.

However, in 2014, the commission replaced fixed-supplier purchases with a public tender system, which resulted in the emergence of domestic condom brands.

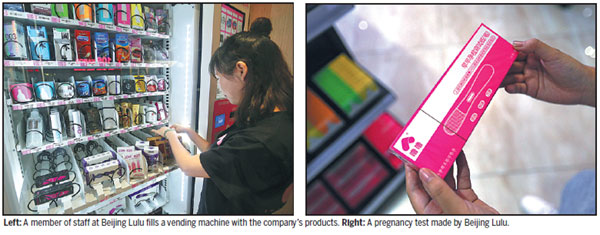

"The market in China has been dominated by overseas brands for years. Now, it's time to show the great potential of Chinese-made condoms," said Feng Huaping, CEO of Beijing Lulu Technology, which was founded in 2015 and provides high-quality products for the younger generation, including condoms, sex toys and erotic underwear.

The company has nearly 100 stores in various provinces and municipalities, including Beijing and Hubei province in the north, and Guangzhou, capital of Guangdong province, in the south.

Some of the stores are self-service, not only to keep operating costs low, but also to protect customers' privacy.

Beijing Lulu's best-selling product is a condom made to its own patented, innovative design, boasting thicker rubber at the tip to reduce sensitivity and prolong intercourse.

Feng said the design has been adopted in two of the company's main condom series - one is manufactured domestically while the other is made in Malaysia, the world's largest producer of high-quality rubber. In the coming months, condoms made in Japan and boasting the thicker top will also enter the market.

"Unlike the older generation, which still regards sex as a taboo subject, the younger generation has an open mind," Feng said. "We are experiencing an era of consumption upgrades. Young people will pay for these products not only because they are high quality, but also because they illustrate life attitudes. They expect something interesting from these products."

The younger generation

In June, Beijing Lulu opened a flagship store next to the Chaoyangmen subway station on the capital's East Second Ring Road. Its two pink-themed advertising billboards, depicting young women clad in elegant, erotic underwear or pajamas, immediately caught the eyes of people browsing the forest of shopping malls and luxury hotels.

After three months with the company, Huang Renzu has become the store's star sales assistant, having previously made his name at a large shopping mall in the capital.

"Sex-related products have become widely accepted by members of the younger generation, who are not afraid to try new things and enjoy the pleasure of intimate relationships. I believe the market has a promising future," the 27-year-old said.

To attract more young people and show respect to gender diversity - a concept that is increasingly recognized by young Chinese - many domestic condom makers, including Beijing Lulu, Zhongchuan and Elephant, are making condoms especially for the LGBTQ market.

In tandem with Marie Stopes International China - a nongovernmental organization that specializes in sexual and reproductive health work - Beijing Lulu launched a competition to design condom packaging this year, collecting ideas from across the country.

"Young people want to be identified as individuals, to be different from others. We encourage them to enjoy fun and pleasure through tailor-made packaging," Feng said.

The market potential has also prompted condom manufacturers from overseas, such as Durex, to focus on China's younger generation. In addition to the Air series, promoted as the thinnest-ever condoms, Durex is offering a more diverse range of products featuring customized packaging.

"Members of the younger generation have a different understanding of, and demand for, sex and sexual relationships. They seek pleasure and physical and spiritual liberation, with a more flexible and looser relationship between sex and love. Their core sexual values are independence, equality, flexibility, diversified and daily," said Wong of RB and Manon Business.

Contact the writer at yangwanli@chinadaily.com.cn

(China Daily 11/03/2017 page6)