Expats in US pay high price

Updated: 2012-01-10 08:24

By Zheng Yangpeng (China Daily)

|

||||||||

BEIJING - Just three months after becoming a permanent resident of the United States, Zhang Jianwu (not his real name) has already begun to feel the pain of being wealthy in his new country of residence.

As a businessman in the foil making industry, he is frequently exhausted from his trips between the US and China, where he must wine and dine his clients and associates to maintain the health of his business.

What burdens him the most, however, are the heavy taxes imposed on the country's top earners. According to the US tax code, he must pay nearly 30 percent of his income to the Internal Revenue Service (IRS), the country's taxation authority.

In addition, the IRS's new requirement for the 2011 tax year will add another headache for him and thousands of other Chinese citizens who invested in the US with the promise of permanent resident permits, or "green cards".

Foreign assets

Under the new requirement, US citizens and permanent residents must disclose detailed information about their foreign assets, including stock holdings, retirement pensions and life insurance policies. The policy directly affects Chinese immigrant investors, who usually hold considerable assets in China.

Taxing the worldwide income of its citizens and permanent residents has long been a practice of the US government. But the Foreign Account Tax Compliance Act (FATCA), in an effort to prevent overseas tax evasion, and stipulates harsh punitive measures for those who fail to report their foreign assets, intentionally or not.

What's more, the law demands foreign financial institutions register with the IRS by 2013, release account holder information and annually declare their compliance. Noncompliance will be punished with up to 30 percent on income and capital payments the company gets from the US, the New York Times reported.

"As result, some foreign financial institutions may no longer wish to have customers who are US residents or citizens," Mark Goldsmith, practice group leader and partner of the tax division at Troutman Sanders LLP, told China Daily. "Immigrants to the US from China may find that the Chinese financial institution with whom they did business for many years no longer wants them as a customer."

There has already been an outcry from US expatriate advocacy groups, claiming the new rules will cause foreign financial institutions to view them as "pariahs".

But for investors such as Zhang, who applied for US green cards with the hope of providing a better education for their kids and a safer place to park their tremendous capital, the act threatens to scoop their assets from underneath, making those seeking US green cards consider alternative destinations for emigration.

"Given the tense economic situation in the US, I think it's understandable that the government wants to increase its fiscal revenue by implementing a much stricter tax policy," Guo Zhihui, executive president of the US-China Legal Exchange Foundation, told China Daily.

According to Goldsmith, pursuant to the exchange of information article in the income tax treaty between China and the US, Chinese immigrant investors might also be concerned that they will be required to disclose information previously not available even to the Chinese government.

Qi Lixin, president of the Beijing Entry and Exit Service Association and president of East J&P Star Consulting Co Ltd, an emigration consulting company, said FATCA highlights the risks of being an immigrant investor in the US - risks that most actual and potential applicants are unaware of.

"Unlike other wealthy economies, the US' immigration policy is exceptionally one-sided," Qi said.

"The details of the new requirement publicized to an unprecedented degree the once-hidden risk of being a US immigrant investor," he said.

Risky process

In 2008, following in the footsteps of other immigrant investors from his hometown, Yiwu, Zhejiang province, a hotbed for private entrepreneurs, Zhang made an investment in the US and applied for the EB-5 visa.

The visa, created by the Immigration Act of 1990, provides conditional permanent residency to foreign nationals who invest a total of $1 million in the US, or at least $500,000 in an area with a depressed employment rate, and create or preserve at least 10 jobs. After the applicants successfully prove that 10 jobs have been maintained or created, a green card is issued.

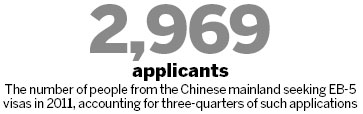

A total of 2,969 Chinese people applied for the EB-5 visa in the fiscal year that ended Sept 30, accounting for three-fourths of the total applicants, according to figures released by the United States Citizenship and Immigration Services (USCIS). In 2007, only 270 people from China applied.

The process is not without risk. The US government, unlike other emigration destinations, does not guarantee against investment loss, which means that applicants might lose their seed capital and, in some cases, eligibility.

"We rarely take US immigrant investor cases as there are significant uncertainties," Ma Yuan, a consultant with East J&P Star, told China Daily.

"We mainly deal with Canadian immigrant investors as the return of the seed capital is guaranteed. For US cases, a contract has to be signed and we cannot guarantee the investor's seed capital," Ma said. "As a result, we rarely proceed with US cases."

Despite the risks, Zhang applied, convinced the US would offer his two daughters the best education, and received his green card in October.

But he was quickly frustrated by the frequent travel between China and the US, his inability to communicate in English and the vast culture gap, which he struggled to narrow.

"I was deaf and dumb in the US. I told my wife I was inviting bitterness upon myself," Zhang said.

Some emigration consulting companies, fearful of losing business, did not fulfill their obligation to fully inform applicants of the tax burdens as a US immigrant, Qi said.

But that was not Zhang's case."I was told of the risk of application rejection as well as the tax obligations. But not until I lived there did I keenly experience the words I was told," he said.

Unaffected majority

But for the majority of emigrants who study and work in the US, they are unaffected by the FATCA requirement.

Huo Xiaoyuan, who currently works at the branch of a multinational insurance company in Chengdu and expects to acquire a green card soon, said she is not bothered by the FATCA as her assets do not meet the reporting threshold.

Having studied and worked in the US for 10 years, she said the reporting obligation was not new to her. Even if her assets meet the FATCA conditions someday, she will not be concerned, she said.

However, unlike Huo, most Chinese nationals are not used to having taxes imposed on them, according to Qi.

"In China, people consider tax to be a moral issue, whereas in the US, it's a legal issue," Qi said.

However, Chinese nationals can take some comfort from an agreement between China and the US to avoid double taxation. Huo said she plans to offset some of her US tax obligations with the Chinese taxes she already paid.

Huo admitted that some of her friends were fearful that their overseas assets would be exposed to the IRS and decided that their spouses would not apply for US residency or transfer their assets to their parents, as the common assets of a couple are also subject to US tax.

One of Huo's friends in the US had initially planned to test the IRS and not report his property and bonds in Taiwan, which were inherited from his mother.

"I think reporting honestly is the rational option for him, because the punishment for failing to report is too expensive to bear," Huo said.

According to the IRS, taxpayers who duck the new reporting requirement could face up to $50,000 in penalties and also be sent to prison if found to have done so intentionally.

Frustrated by the inconvenience, Zhang said he is already considering giving up his green card, even if it means losing the large amount of money he had invested.

But according to Qi, even a loss of US permanent residency does not mean Zhang can evade his tax obligations, as assets and income earned for the five years before green card abandonment are required to be reported.

"Hopefully, the zeal to emigrate will dampen a little and people can apply for EB-5 visas more rationally," Qi said.

Zhao Yanrong and Qin Zhongwei contributed to this story.

China Daily

(China Daily 01/10/2012 page11)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|