Woman's death sentence rouses public debate

Updated: 2012-01-20 08:06

By Wu Yiyao (China Daily)

|

|||||||||

Verdict could affect private lending market

SHANGHAI - The death sentence given an ex-millionaire businesswoman found guilty of fraudulent fundraising has provoked widespread discussions on capital punishment for illegal fundraising, as well as on private lending.

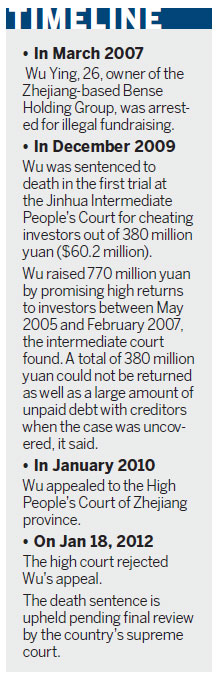

Wu Ying, 31, the former owner of Zhejiang-based Bense Holding Group, lost her appeal to the Zhejiang Provincial High People's Court on Wednesday, which upheld the verdict and death penalty of a local court in 2009.

The high court rejected Wu's appeal as she "brought huge losses to the nation and people with her serious crimes and should therefore be severely punished".

Wu was found to have illegally raised 770 million yuan ($122 million) by promising investors high returns between May 2005 and February 2007.

Of the money fraudulently pooled, 380 million yuan could not be returned and large amounts of other debts were unpaid, according to the court.

Wu said she was not guilty at the first trial but admitted in the second that she had "illegally pooled public deposits", a crime punishable by up to 10 years in prison.

However, the heaviest penalty for "fraudulent fundraising" is death, under the Criminal Law.

Zhang Yanfeng, Wu's defense lawyer, said that he and his colleagues were shocked when they heard the second verdict and that they will make every effort to plea for a lesser sentence while waiting for the necessary review by the Supreme People's Court in Beijing.

All death sentences in China require a final review by the top court before being carried out.

The crimes of "illegal pooling of public deposits" and "fraudulent fundraising" have similar definitions but divergent sentencing standards, said Wu Dong, a lawyer and partner of the M&A Law Firm in Shanghai.

On Thursday, many netizens were also calling for a more lenient sentence for Wu. By 8:30 pm, about 64 percent of 398,885 respondents to an online survey at ifeng.com considered the death penalty too harsh for Wu and named the overabundance of hot money and lack of investment channels as the main reason she committed the crime.

China repealed the death penalty for 13 non-violent economic crimes in its 8th Amendment to the Criminal Law, which took effect on May 1. But capital punishment remained the most severe penalty for fraudulent fundraising.

Keeping the death penalty for fraudulent fundraising could be a sign of authorities' determination to crack down on illicit private lending, which can affect many people and have a huge social impact, Wu Dong said.

He said the verdict in Wu's case might serve as a warning to people involved in private lending markets, but the measure might not prove effective in the long run.

"It is better to make clear policies and laws to legalize, regulate and guide private financing than suppressing it, because there is always a need for borrowing and investing outside banks or financial institutions," he said.

The verdict also sparked widespread controversy over private financing and underground lending in Zhejiang, a bustling coastal province flush with cash, which has also witnessed increasing crime related to private lending and borrowing in recent years.

In Jinhua, where Wu set up the business, cases of illegal pooling of public deposits surged from seven in 2008 to 34 in 2009, and the number of crimes of fraudulent fundraising cases jumped from one in 2008 to five in 2009, according to a Zhejiang University report on private financing in Zhejiang province.

At the same time, more small loan companies were set up as residents tried to avoid undocumented private lending in Jinhua and other cities in Zhejiang, according to the report.

In Wenzhou, private lending reached to about 110 billion yuan, according to a study by Wenzhou financial management authorities in September 2011.

Money lenders said they are paying close attention to Wu's case because the verdict may affect future trends in underground lending markets.

Hua Xiang, an underground money lender in Wenzhou, said she stopped lending money in November. "About 7 billion yuan was unpaid, because the borrowers either ran away or simply have no money," Hua said.

However, Hua said the severe punishment would not help lenders.

"The gone money is gone. Even if the borrowers are sentenced to death, I won't get it back," Hua said.

Tu Shanshan (not her real name), a businesswoman in Lishui, Zhejiang province, who used to borrow from underground lending markets, said Wu's case has deadlocked money borrowers.

"In the past, borrowing money was all about investment and business, but now if you fail to run the business well, you might be charged with cheating and get jailed or even sentenced to death," Tu said.

Yu Ran contributed to this story.

China Daily

(China Daily 01/20/2012 page3)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|