New loans rise to 919.8b yuan in June

Updated: 2012-07-13 07:37

By Chen Jia (China Daily)

|

||||||||

China's market liquidity is increasing slightly amid monetary policy relaxation, with growth in new loans and the broad money supply sending positive signals that the world's second-largest economy may rebound in the second half supported by accelerated investment.

By the end of June, the yuan loan balance had increased by 16 percent this year compared with a year earlier, to 59.64 trillion yuan ($9.36 trillion).

This was 0.3 percentage points higher than the year-on-year growth rate in May, a statement from the People's Bank of China said on Thursday.

The amount of yuan loans in the first half has increased by 4.86 trillion yuan, with a 7.58 trillion yuan rise in yuan deposits, it said.

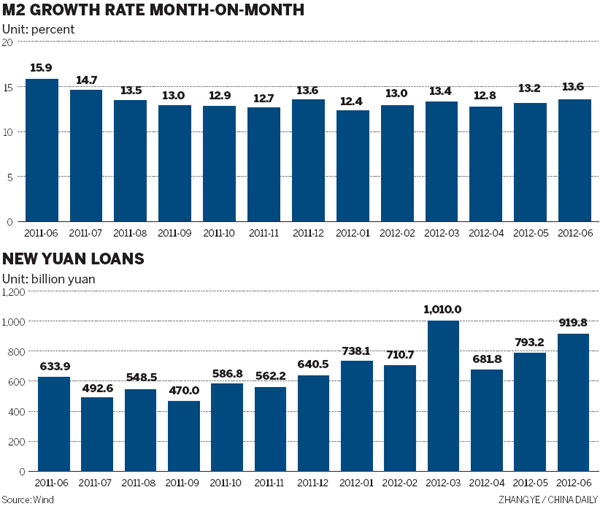

Last month saw new yuan loans of 919.8 billion yuan, up 16 percent on May, according to the central bank.

"The increased pace of new loans is consistent with market expectations," said Ba Shusong, an economist with the Development Research Center of the State Council, who expected bank lending to continually rise in the second half to support investment.

The uptick in new loans was mainly due to a rebound in market demand, and the recent increase in housing sales, said E Yongjian, an analyst with the Bank of Communications.

According to the central bank's data, the year-on-year growth of broad money supply, which is known as M2, was 13.6 percent in June, 0.4 percentage points higher than that in May, indicating slightly boosted market liquidity.

Liu Ligang, head of China economics study at the Australia and New Zealand Banking Group, said that the central bank has consecutively injected money in terms of reverse repurchases.

"But the method cannot solve the problem of liquidity shortage in the long term, so we expect another cut in the reserve requirement ratio soon," Liu said.

"That data set is another positive signal that we believe confirms that policy easing is indeed on its way, reinforcing our view that growth will bottom out in the second quarter and rebound in the second half," said Zhang Zhiwei, chief economist with Nomura Securities Co Ltd.

"Speeches by Premier Wen Jiabao in the last few days have indicated that policy easing will pick up speed and that the government will likely further promote investment growth," Zhang added.

The central bank also said that the country's foreign exchange reserves, the world's largest, decreased to $3.24 trillion at the end of last month from $3.3 trillion at the end of the first quarter.

The decline in the nation's foreign exchange reserves accompanied a slight rebound in the trade surplus and a decline in foreign direct investment, said the Bank of Communications analyst. "It is possible that the foreign capital is flowing out."

In the next six months, bank loans may steadily increase supported by further monetary policy easing, and reach a total amount of 8.5 trillion yuan for the whole year, as the approval of some important major projects may accelerate, he said.

The National Bureau of Statistics plans to release second-quarter GDP and other main economic indicators on Friday, with many economists predicting that the nation's economic growth may slow to its lowest level since the first quarter of 2009.

The central bank reduced benchmark interest rates on July 5, its second cut in a month. It has also reduced commercial bank reserve requirement ratios three times since November.

As consumer inflation may continually decrease in the third quarter, the central bank is likely to lower benchmark interest rates again to cut business financing costs and support the development of the "real economy", said the Bank of Communications.

chenjia1@chinadaily.com.cn

(China Daily 07/13/2012 page13)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|