Enabling trust: San Francisco broker aims to please clients from China

Updated: 2012-07-13 11:08

By Chang jun in San Francisco (China Daily)

|

||||||||

|

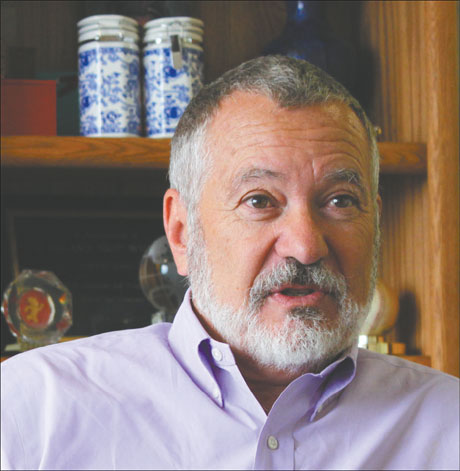

Skip Whitney has engaged in business involving China since the 1970s, starting with real estate in Hong Kong. Chang Jun / China Daily |

Bottles of California wine stand on the bookshelf alongside Maotai, a popular Chinese liquor. Souvenirs collected during trips to China are scattered about, and crimson knots hang on the wall.

"I was a Chinese in my past life," Skip Whitney muses with a smile during an interview in his comfortable office just blocks from San Francisco Bay.

In this life, China certainly has had an impact on Whitney, who is a partner and executive vice-president at Kidder Mathews, a commercial real estate firm on the US West Coast.

He began his career three decades ago in Hong Kong, specializing in leases and investment involving properties overseas. He later expanded his business to the mainland as China was opening up during the late 1970s.

Whitney can't recall how many trips he has made to China, or the names of every place he visited. But he reminded himself of the friends he has made - and kept.

"Friends will help friends someday somehow," he says.

Business acumen plus high-quality service won't necessarily get a deal with Chinese clients, Whitney has found. But being their "trust enabler" in the United States has led to the signing of numerous contracts.

A believer in the Chinese adage "First make friends, then do business", Whitney has taken time to become acquainted with China as well as its people, culture, feng shui and interpersonal relationships, known as guanxi in Mandarin.

The California businessman's guanxi is exemplified by his friendship with Gavin Newsom, the lieutenant governor of the state and a former mayor of San Francisco. "It has been instrumental in building business connections between San Francisco and China," Whitney says.

As for understanding Chinese culture, Whitney pays extra attention to details. For example, he makes sure there is no number 4 visible in the building or elevator when showing a Chinese client a property. (The Mandarin word for "four" is pronounced like the word for "death," making the number unlucky among the superstitious.)

The San Francisco native says the Bay Area sells itself with its scenic beauty, the Golden Gate Bridge, fine wine and, as home to Silicon Valley, a reputation as the global center of technology innovation and entrepreneurship. "People come to us because we have something to offer," he says.

Since 2004, Whitney has helped set up various China-related programs. He co-founded ChinaSF and the Bay Area Council's China Initiative. The former, a public-private organization affiliated with the San Francisco mayor's office, aims to attract Chinese investment. In October 2010, then-mayor Newsom announced the opening of a ChinaSF office in Beijing, saying a presence in the capital would help San Francisco capture some of China's growing market.

In March, Kidder Mathews tasked Whitney with creating an inbound/outbound portal for its China Services Group, or CSG, which responds to increased demand for advisory, brokerage and property-management services from Chinese and American investors pursuing opportunities in each other's country.

Kidder Mathews, one of the biggest commercial-property agents on the West Coast, has $1.9 billion in annual turnover and manages more than 22 million square feet of space.

Over the past two years, Whitney and his firm have helped a dozen Chinese companies obtain leases in the Bay Area: GCL-Poly Energy Holdings Ltd, which makes solar-power panels, and Shanghai-based Bank of Communications Co both opened San Francisco offices in 2011; InnoSpring in April became the first US-Chinese technology incubator in Silicon Valley.

Philip Wong, vice-president of business development at BoCom's San Francisco office, said Whitney has been essential to the bank. "He took the time to coordinate with Shanghai and New York headquarters, and helped us find a home in San Francisco" by coordinating meetings with layers of people in government to expedite the November 2011 opening.

In addition to its China Services Group, Kidder Mathews has teamed with Binswanger, a Philadelphia-based broker of real estate worldwide, and Synergis, a property-management firm listed on the Hong Kong Stock Exchange, to fill a void in services for locating sites in China for manufacturing, distribution and construction.

The venture will focus on markets in major metropolises such as Beijing, Shanghai, Guangzhou, Hong Kong, as well as large cities Shenzhen, Qingdao, Foshan, Dalian, Handan, Xi'an and Suzhou.

In February, San Francisco Mayor Ed Lee announced his innovation portfolio for 2012 and described himself as a "technology mayor." Whitney believes Lee's commitment will foster more innovation exchanges between Chinese cities and his own.

Following the launch of InnoSpring, which is backed by Tsinghua University, Beijing Hanhai Zhiye Investment Management Group on June 20 opened its US subsidiary, Hanhai Investment Inc, a business incubator. The firm bought 80,000 square feet of new office space in San Jose, the biggest city in Silicon Valley. The Feb 17 contract-signing in Los Angeles was attended by visiting Vice-President Xi Jinping and his US counterpart, Joe Biden, during an economic and trade forum.

Five years ago, Whitney says, he couldn't have imagined the large influx of Chinese companies to the Bay Area. Kidder Mathews had no Chinese-speaking employees two years ago, but since then Whitney has hired three native-born Chinese to help run the CSG desk in San Francisco.

Sharon Dai, Whitney's assistant, described her typical day as chock-full of e-mails, calls, arranging of visits and meetings, and greeting and seeing off Chinese guests. She finds the work for CSG "meaningful and rewarding," an opportunity to draw on her Chinese background and US education to assist clients.

Whitney groups Chinese clients into segments - older, younger, English-speaking and non-English-speaking - in order to customize the firm's services.

"For those clients not fluent in English, it's very important to help them feel comfortable," he says. "We need to show them the good places to eat, to shop, and what are the good schools to send their kids to."

Chinese clients are likely to be affluent individuals who have come to the US with their families on an EB-5 visa, which the US government issues to immigrant investors who establish a business.

"I have been working closely with accountants, attorneys, education consultants and personal-finance planners in the past year," says Whitney. "My job is to make sure those Chinese families are well taken care of."

In the past six months, he has noticed interest from Chinese in vineyards and wineries in California's Napa Valley - another lucrative business opportunity. Some of Whitney's clients are from Xinjiang, where wine-quality grapes grow but technology and equipment lag behind that of the US industry.

"I have been doing business in Napa for many years and it is partnering with some of the wine industry titans," Whitney says with a smile. "We will offer a full suite of concierge-type services."

junechang@chinadailyusa.com

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|