Iron ore stocks hit record high

Updated: 2012-07-20 07:54

By Du Juan (China Daily)

|

||||||||

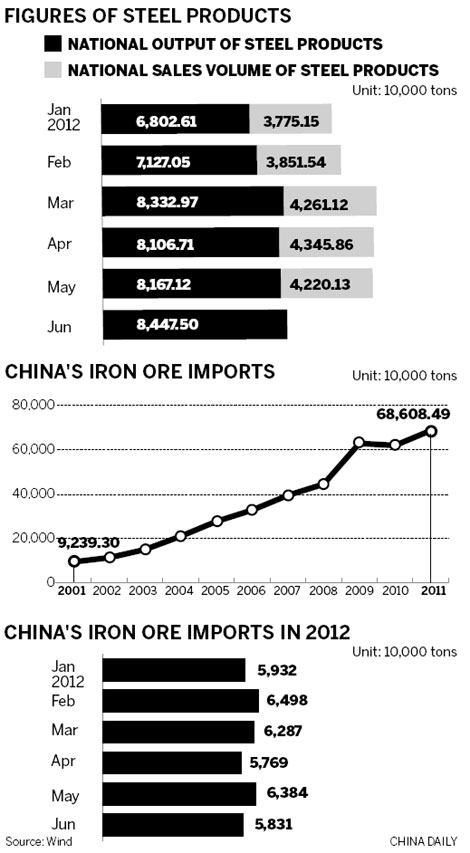

Iron ore inventories in China reached a record high of about 100 million metric tons due to shrinking downstream demand, but major global suppliers are still increasing output.

The 30 major ports in China have total iron ore stocks of 97.92 million tons, according to figures from mysteel.com, a steel industry information provider.

High stocks and declining prices have increased the risks for iron ore traders, who are facing increasing financial pressure to repay loans. Meanwhile, steel factories are more cautious when purchasing raw materials.

However, China still imported 58.31 million tons of iron ore in June, a slight decline compared with the 63.84 million tons imported in May.

"China has always played the role of savior of foreign iron ore miners," said Zhang Lin, senior analyst at the Lange Steel Information Research Center. "The steel market is weak, which leads to falling iron ore prices. However, the price is not below $100 yet."

China's stable imports of large quantities of iron ore may be the source of the foreign giant miners' confidence, Zhang said.

Rio Tinto Plc said on Tuesday that the company had a record-high output of 120 million tons of iron ore in the first half of the year, up 4 percent year-on-year. The company estimated that it will produce 250 million tons of iron ore in 2012.

BHP Billiton Ltd, another giant mining company, said on Wednesday that its iron ore output in June increased 15 percent to 40.9 million tons.

It said it will have a total output of 159 million tons this year, also a record figure for the company. BHP Billiton is making efforts to achieve its annual output target of 220 million tons in 2014.

Fortescue Metals Group, the third-largest Australian iron ore producer, said its output increased 54.7 percent to 19.16 million tons in the second quarter. The company plans to sell 55.8 million tons of iron ore in the 2011-2012 fiscal year, a 40 percent year-on-year increase.

As the largest iron ore importer in the world, 60 percent of China's consumption depends on imports. Brazil exports up to half of its iron ore production to the Chinese market. Last year, Brazil's iron ore exports to China increased 7.8 percent, while its exports to Europe decreased 20 percent.

Although the increasing iron ore output in the international market indicates foreign miners' confidence in China's economy, prices will not rebound, analysts said.

According to a report by LCA Consultancy, the international average iron ore price dropped 16 percent compared with last year to $140 a ton. However, it is still much higher than the $80 a ton registered in 2009.

The consultancy said the decline of iron ore prices is closely related to China's economy. The country's growth rate has dropped from an average of 10 percent in past years to 7 percent or 8 percent this year, which will influence iron ore demand and prices in the international market.

Iron ore prices passed $100 a ton in March 2010 and kept increasing to $175 in September 2011. However, because of the severe oversupply in the market in the fourth quarter of 2011 and also due to China's macro policies on the real estate industry, both the iron ore and steel markets have seen a declining trend since then.

Most listed steel companies in China reported losses for the first half of the year and some of them have lowered both their steel product prices and sales targets this year.

Wuhan Iron and Steel Group Co, one of the major steel producers in China, cut its full-year profit goal from 3 billion yuan to 1.6 billion yuan on Wednesday.

Deng Qilin, general manager of the company, said they made the adjustment looking at the expected factors in the second half of the year.

The company had revenues of 98.9 billion yuan and profits of 1.38 billion yuan in the first half.

dujuan@chinadaily.com.cn

(China Daily 07/20/2012 page16)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|