Searching for the body beautiful

Updated: 2012-08-10 07:54

By Liu Jie (China Daily)

|

||||||||

|

Women participate in a spin class in a gym in Xingtai, Hebei province. Yue Lizhong / For China Daily |

Gyms are closing, prices are dropping, promotions abound in a suffering sector

Fitness fanatic Tao Yingjian is considering a change of club, again.

"People here are giving me the hard sell.

"They have even asked me to try and sell memberships to my friends, and offered me commission.

"My coach has been trying to persuade me to add more hours to my training schedule. But I really don't like this kind of promotion," said Tao, a 30-year-old accountant.

She's currently a member of CSI-Bally Total Fitness in northern Beijing. She had moved there after Nirvana Fitness & Spa's Beijing Anzhen outlet suddenly closed last January.

"Although it reopened, I could never trust the brand again, and I quit," she said.

Before Nirvana, Tao had tried Hosa Fitness and some other smaller gyms - but none could satisfy her fully for long.

There's always been something not quite right, she said, whether it's been the equipment installed, the management of the courses being offered, or the quality of coaching.

CSI-Bally, Nirvana and Hosa are all among China's top 10 fitness chains, each with several outlets.

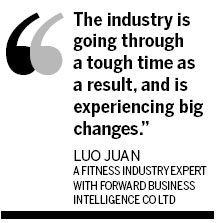

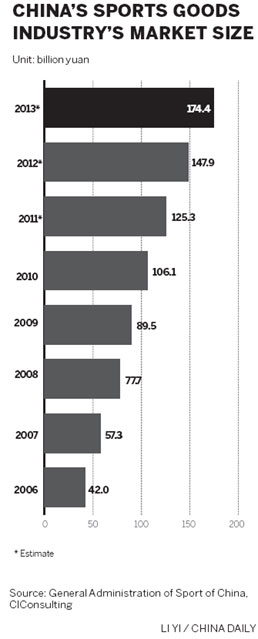

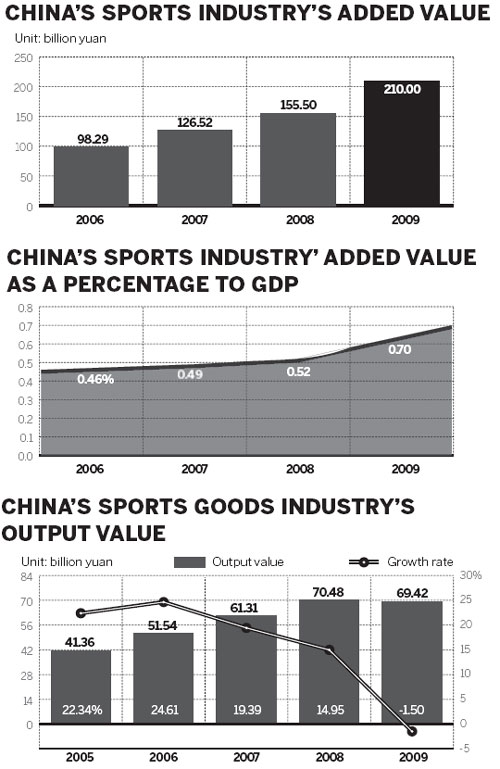

The desire for fitness is booming in China, but as more and more open, the sector is also becoming highly competitive.

According to experts, there may well be a growing appetite for the body beautiful, and many of the larger chains have invested heavily in their hope of attracting business - but at the same time, the rate of expansion has now tipped the industry into one of over-supply.

That's great news for consumers, of course, but bad news for the many companies now scrambling for business - and many are having to take urgent measures to survive.

Luo Juan, an expert on the sector with Forward Business Intelligence Co Ltd, explained: "The country's fitness industry has huge potential, and there are many investors who see that - but the demands of customers, with so much choice becoming available all the time, are becoming very sophisticated for such a fledgling industry.

"The industry is going through a tough time as a result, and is experiencing big changes."

A 2011 survey of 60 key cities in China - by the Asian Academy for Sports and Fitness Professionals, a Hong Kong-based fitness professional training center and study institute - showed that 1.05 percent of the population were members of a fitness club, compared with 18.1 percent in the United States, showing just how much potential there is for the fitness sector in China.

However, the survey also revealed that the number of gyms being run by fitness chains in those key cities actually dropped 10 percent year-on-year in 2011 - the first fall since gyms first emerged in China in the early 2000s.

In Beijing, for example, the number of outlets owned by large fitness chains declined 46 year-on-year, to 483 last year.

At the other end of the scale, there has been a gradual increase in the numbers of privately run individual fitness centers.

The result of this conflict between the larger and smaller operators isn't surprising - falling prices, hefty promotions, and sudden closures for those unable to keep up with the pace.

In the red

Given their overheads, the more seriously affected have been the chains.

In the decade since first appearing on the scene in 2001, CSI-Bally, a joint venture between State-owned China Sports Industry Group Co Ltd and US-based Bally Total Fitness Co, was reported to have become a company with sales exceeding 100 million yuan ($15.69 million).

But by 2009, that turnover had dropped to 65 million yuan and was still dropping.

CSI-Bally's gross profit margin dropped to 3.87 percent last year, from 43 percent in 2006.

It currently has 24 gyms in 13 cities in China, but was spending a lot more than it was making, experiencing an operating deficit of 64 percent in 2010.

Similarly, rival Nirvana has suffered and was reported to have recorded losses of 17 million yuan in 2009 and 9 million yuan in 2010.

Operators claim the increased losses are coming from higher rents - which account for about half the cost of a typical gym - and increased wages, according to Wang Cheng, general manager of Nirvana, which has 13 outlets in eight cities.

Using the example of Nirvana's outlet on Beijing's Chang'an Avenue, rental there was reported to have jumped to 7 million yuan last year, from 2.5 million yuan in 2007.

The monthly cost of the type of qualified coach needed to be employed in the larger chains has also doubled in the past five years, to 1,000 yuan, said one Hosa manager who refused to be named.

At the same time, the arrival of many smaller players onto the market has sparked a price war that is squeezing margins further.

The latest industry estimates suggest there were more than 1,000 fitness centers registered in Beijing between 2006 and 2008, but four years on, large numbers have disappeared.

Discounting has become the major tool of the fitness industry to win back business.

"Price wars were first kicked by the small operators, and they forced middle-level players to follow, then the big companies had to adopt the strategy too.

"We soon realized that Chinese consumers have very little brand loyalty when it comes to fitness," said Luo Juan, "and many were simply following price".

Tao Yingjian says her price of fitness - as opposed to many other trappings of a good life - has been dropping in the years she's been going to a gym.

"I bought my first yearly membership in 2006 at Hosa Fitness Club and it cost 8,000 yuan; today you don't have to spend any more than 4,000 yuan, even for the big fitness chains, including Nirvana, CIS-Bally and Powerhouse (International Fitness Chain)," she said.

The fitness chains all offer promotional campaigns, such as "buy-two-get-one-free", group purchasing, holiday discounts, and free trials.

Luo added that the need to keep fit hasn't changed among Chinese consumers, but many are realizing they don't have to pay a lot for it, and very often, if people look hard enough, what's on offer can be free.

Despite rising popularity of gyms, the vast majority of those taking regular exercise remains the over-50s, he said, who don't use gyms, preferring instead to jog or do exercise in groups in public parks.

All over the country, the central government has been installing free exercise equipment in many residential communities, which attract all kinds of people who want to exercise, but have no time or are reluctant to go to gyms.

Consolidation likely

The pressures now being felt in the private-sector fitness industry, suggest industry watchers, mean that rapid consolidation is likely, and that operators will be more willing to offer tailored products, and be looking to diversify into other services as well as straight fitness.

Liu Guoyong, vice-director with the public sports department under the General Administration of Sport of China, said that while no strict industry regulation exists, there are always going to be small-scale centers willing to set up businesses with a few treadmills and part-time coaches.

"The industry threshold is still low, but I do think that consolidation in the industry is likely to be a trend in the coming years, as consumers become more selective when choosing fitness facilities.

"The professional resources and expertise of the larger companies will also help them attract and retain clientele, but there will be some mergers and acquisitions too in the short term, " Liu said.

He also noted that the government is looking at ways of raising and maintaining industry standards, and there are plans to introduce rules and regulations.

As commercial property rentals continue to rise, Wu Shengping, general manager of Hosa Fitness China, said his company is now planning to launch community gyms, in cooperation with various residential organizations.

The government also now requires new residential communities in key cities to have their own fitness facilities, and such a cooperation between public and private sectors could help companies such as Hosa reduce costs.

Wu said Hosa plans to have more than 300 outlets in China by the end of this year, and a large part of them will be in residential areas.

On the other hand, Forward Intelligence's Luo suggested some players are still turning their attention to the high-end market, providing services aimed squarely at attracting wealthy, and corporate clients.

Besides basic gym facilities, other services might include scientific body examination, tailored lifestyle consulting and family health and lifestyle management.

But again, these kinds of top-end club are likely to be opened in more residential, suburban areas to cater to high-income consumers, as well as costing less to rent.

Another type of business model being closely looked at by some operators is to develop facilities based in offices and factories, aimed at helping specific corporate clients offer their employers something in terms of health and welfare.

Tao Yingjian said that's certainly something she would welcome, as she searches for her next gym.

"I'd love my company to offer me something like this," she said, "I could work out in the afternoon break, or straight from work.

"But in the meantime, I'll keep looking.

"I know there's plenty of choice out there, and the prices are dropping, so I'm sure I'll find somewhere new."

liujie@chinadaily.com.cn

(China Daily 08/10/2012 page15)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|