Pork price expected to rise, and drive up CPI

Updated: 2012-08-14 07:56

By Li Jiabao (China Daily)

|

||||||||

|

Shoppers buy pork at a market in Xuchang, Henan province. Geng Guoqing / For China Daily |

Analysts even suggest drought in US could lead to shortages by early 2013

The price of pork in China is likely to edge higher in September until the end of the year, driven by a surge in world grain prices as a result of a record drought in the United States, and an end to a current domestic over supply of pigs, according to leading industry experts.

However, by early next year, some Chinese farmers could be facing losses because of the double pressure, meaning possible pork shortages.

China is the world's biggest meat consumer, and pork consumption is expected to hit 52 million metric tons this year, according to the latest industry figures.

The price of pork in the country is determined by a delicate balance of conditions involving the price of feed, the number of pigs, the levels of imported pork products, and domestic consumption at particular times of the year.

According to data released on Thursday by the National Bureau of Statistics, the price of pork dropped by 18.7 percent year-on-year in July, driving down China's overall CPI by 0.71 percentage point to 1.8 percent, compared with 2.2 percent in June.

But Ma Chuang, deputy secretary-general of the Chinese Association of Animal Science and Veterinary Medicine, told China Daily that he expected pork prices to start rising again "from late August or early September as domestic pork consumption rebounds in the coming months, cutting the current oversupply" of animals in the market.

Feng Yonghui, chief analyst at Soozhu.com, the specialist online pig market monitoring and analysis service, added that the ongoing US drought - the worst in more than 50 years - was also likely to drive the prices up, after a big spike in the prices of corn and soybean, both key feed for pigs.

"The hikes in corn and soybean have lifted the feed price to a historic high and could worsen losses for Chinese pig farmers," Feng said.

"But pork price growth in the following months will be relatively stable, because of the sufficient live pig populations here."

Ma added that China's pig farmers have also reported that the weakened economy had has affected pork consumption over the past four months, but that the oversupply should keep prices reasonably flat until the end of this year.

He predicted that pork prices will grow much faster in 2013 than for the rest of this year, which will "surely affect China's overall CPI volatility".

Chow Jean-Yves, a senior industry analyst with Rabobank International, explained that the US drought will be especially hard-felt in China as the country is world's largest importer of soybeans, with its dependency on such imports increasing by around 80 percent in recent times.

"China is expected to import 57 million tons of soybean of its total 70 million ton consumption for 2011/2012. Of that 57 million, half will be imported from the US," he said.

Given that the price of soybean is likely to remain high, the extra cost will be directly transferred to Chinese livestock production.

Chow said that feed costs account for 60 to 70 percent of farmers' production cost, in China

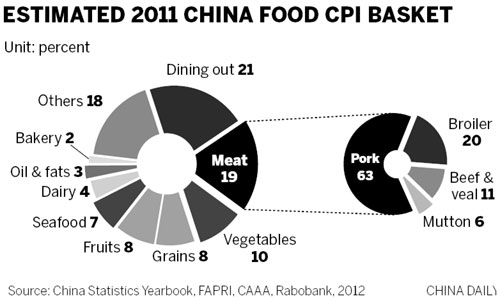

Although pork accounts for just 3 percent of the products used to measure CPI, wild fluctuations in pork prices can change CPI significantly, sometimes earning CPI the nickname "the China Pork Index".

Chow added: "China could experience significant food price inflation in the first quarter of 2013 for two main reasons: an increase in the price of soy will impact feed prices; and ultimately that will be transferred to pig prices.

"If the feed price rises too fast, small to medium-sized farms will not replenish their herds, as a result of lower profit expectations, or even losses, and so there could even be shortages of pork at this point," Chow said.

"I would not be at all surprised to see negative food CPI in the next two months. Pork and vegetable prices have continued to fall, driving the food CPI below zero. For the second half of 2012 we forecast a food CPI of circa negative 3 percent to 1 percent."

In the first half of 2013, the food CPI will start an upward trend, possibly even reaching more than 10 percent in the third quarter of 2013, at the top end of expectations, Chow said.

The People's Bank of China said on Aug 2 - within its latest monetary report for the second quarter - that it expected China's CPI to pick up after August compared with last year, and that current prices remain relatively sensitive to rises in domestic demand.

It added that government policies to boost the economy would be more likely to act as a significant stimulus on inflation rather than on overall economic growth.

The National Development and Reform Commission announced last week that it had launched a second round of domestic frozen pork purchases to prevent any further drops in the price of pork.

The commission had rolled out a first round in May, but did not specify the exact amounts and timing.

"Judging by the current state of the domestic pig farming industry, the low pig prices will keep going for a certain period because of the high productivity of pig farmers, who are being advised to weed out aged and low-production sows to reduce losses," it said in a website announcement.

Feng Yonghui from Soozhu.com added: "The government's purchase was mainly to stop further price falls and to protect the interest of farmers. But the amount of purchase will not be big enough to affect the domestic price of pork."

The rapid increase in pork imports, which doubled in the first half of this year compared with last year, have severely dampened the domestic pork market, he said.

"Imports of pork offal account for about 70 percent of China's pork imports, but the import price is 70 percent lower than the domestic pork offal price."

lijiabao@chinadaily.com.cn

(China Daily 08/14/2012 page16)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|