Nobel laureate: Renminbi will help stabilize world currency

Updated: 2012-09-10 08:07

By Wei Tian in Xiamen, Fujian (China Daily)

|

||||||||

|

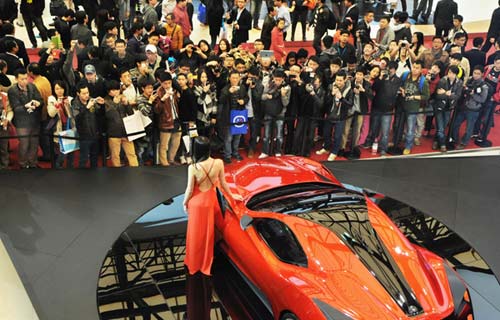

Robert Mundell (left), winner of the 1999 Nobel Prize in economics and "father of the euro", speaks at the China International Fair for Investment and Trade in Xiamen, Fujian province, on Saturday. Zou Zhongpin / China Daily |

The yuan will play a bigger role in stabilizing the global currency system and improving the prospects of the global economy, said Nobel laureate and the "father of the euro" Robert Mundell on Saturday.

Mundell, winner of the 1999 Nobel Prize in economics, said he is "mildly optimistic" about the prospects of the global economy now that the recession is nearly over, and he believes the financial system is now on a path toward stability.

Mundell's remarks were made at a forum of the China International Fair for Investment and Trade in Xiamen, Fujian province. The theme of the side forum was global economic revitalization and a new industrial revolution.

However, "sluggish recovery in the US and EU, debt problems in the eurozone, and instability in global exchange rates are still the major challenges facing the global economy" , he said.

Although he said it is unlikely the eurozone will collapse, issues caused by the fluctuating exchange rate, such as the instability of commodities prices, still pose a threat.

US monetary policy has been accommodating, but the appreciation of the euro will definitely bring harm, Mundell said.

As the dollar goes down and the euro goes up, the yuan will play a growing role in stabilizing global currency, he said.

The introduction of the euro ended the global monetary system's reliance on one major currency, the dollar, by creating a second, and Mundell said he expects the rising yuan could add a third pillar to the monetary system.

The US and Europe together represent 40 percent of the world's total economic output, and the proportion will be 50 percent if China's contribution is added.

"If the dollar, euro and renminbi maintain a stable rate, it will significantly bring down the volatility in global currencies. That's also what the Chinese authorities want," he said.

Commenting on a cooling Chinese economy, Mundell said China will not have a permanent slowdown.

After economic growth registered a three-year low of 7.6 percent in the second quarter, many speculated that the third quarter would be even weaker.

But Mundell said otherwise.

"China's urbanization level has currently reached the world's average level of 50 percent, but the government set its target at 80 percent," he said.

Further urbanization will continue to generate high growth, Mundell said.

To that end, China needs to increase consumption and further redistribute incomes.

Meanwhile, to deal with the challenges facing China's real economy, such as falling exports and outgoing foreign direct investment, Mundell suggested the country should make efforts to boost its private sector.

"The private sector has been short of capital, whereas State-owned enterprises have been enjoying favorable fiscal support, just like taking money from one pocket and putting it into the other," he said.

Mundell was echoed by Thomas Klotz, managing director of the Asian region for Roland Berger, who said China can learn from the steps Germany took to revitalize its manufacturing sector.

Such experiences include more investment in training for skilled workers as well as funding for research and development, said Klotz, who was also addressing at the forum.

weitian@chinadaily.com.cn

(China Daily 09/10/2012 page6)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|