Net forex purchases for fourth month

Updated: 2013-04-23 08:07

By Wang Xiaotian (China Daily)

|

||||||||

|

A Bank of China branch in Beijing. Banks brought in nearly 236.3 billion yuan ($38.25 billion) worth of foreign exchange in March on a net basis, boosting the total yuan holdings for purchasing foreign currency to nearly 27.1 trillion yuan. Zhu Xingxin / for China Daily |

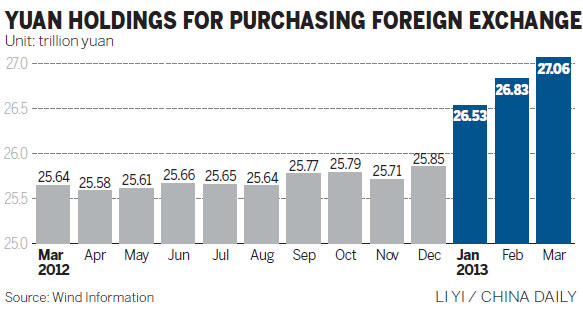

Nation's RMB holdings for foreign currency hit 27.1 trillion yuan: PBOC

China witnessed a fourth straight month of net foreign exchange purchases among the central bank and commercial lenders, which suggests continuous capital inflows, as shown by data released by the People's Bank of China (PBOC) on Monday.

Banks brought in nearly 236.3 billion yuan ($38.25 billion) worth of foreign exchange last month on a net basis, boosting the total yuan holdings for purchasing foreign currency to nearly 27.1 trillion yuan.

Net purchases in March, however, moderated from 295.4 billion yuan in February and a record 683.7 billion yuan in January.

Banks made total net purchases of less than 500 billion yuan throughout 2012.

"The net purchase in March is not because of a trade surplus, it's mainly due to the increase of money inflows following the higher expectation of yuan appreciation," said Zhong Zhengsheng, an analyst at Everbright Securities Co Ltd.

March witnessed China's first trade deficit since February 2012, as imports surged by 14.1 percent from a year previously, according to data released by the Ministry of Commerce earlier this month.

The deficit means that money inflows under capital accounts have increased compared with previous months, said Ding Zhijie, dean of the School of Banking and Finance at the University of International Business and Economics.

"It proves that capital inflow pressure has sustained since Japan announced quantitative easing policies, and yuan appreciation expectation remains strong."

On Monday, the PBOC, or the central bank, set a weaker reference rate at 6.2415 per dollar. The yuan later strengthened 0.08 percent to 6.1826 per dollar in Shanghai, according to the China Foreign Exchange Trade System.

The currency gained 0.24 percent last week, the most since the period ended Oct 14, according to data compiled by Bloomberg.

The spot yuan touched a record high of 6.1723 per dollar last Wednesday when the central bank set its midpoint at the strongest level of 6.2342.

Apart from international "hot money" inflows, the rising willingness of Chinese enterprises, especially property developers, to sell dollar-denominated bonds in overseas markets also contributed to increasing cross-border money inflows, Ding said.

"Money collected through such bond sales in the first quarter has exceeded that of the full 2012."

He said the ongoing capital inflows would continue for a while as the difference between financing costs in China and overseas has further widened.

According to central bank data, in the first quarter China's stock of foreign exchange reserves rose by $130 billion, in contrast with the fourth quarter's increase of $25 billion.

From January to March, China reported a trade surplus of nearly $43.1 billion, compared with $210 million during the same period in 2012.

The expectation of the yuan's appreciation has strengthened as China's band-widening discussions heated up again following recent comments from the PBOC officials that the yuan trading band will be further widened "in the near future".

The spot dollar against the onshore yuan continues to trade near the extreme low end of the 1 percent band around the official daily fix, while the spot dollar against offshore yuan has broadly traded around 14 basis points below that over the past three months, which "highlights the appreciation pressure on the RMB", said Nomura Securities International Inc in a report.

"While widening the band may trigger appreciation in the short term, we believe this does not mean sharper yuan appreciation against the dollar by the end of year," the report said.

The renminbi has appreciated by 29.3 percent in US dollar terms since it was de-pegged in mid-2005. Moreover, China's current account surplus has shrunk substantially over this period from a peak of 10.1 percent of GDP in 2007 to 2.4 percent in 2012, it said.

wangxiaotian@chinadaily.com.cn

(China Daily 04/23/2013 page13)

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Earthquake leaves family shattered

Earthquake leaves family shattered

Boston Marathon bombing suspect charged

Boston Marathon bombing suspect charged

Chasing vestiges of the Great Wall

Chasing vestiges of the Great Wall

Weekly Photos: April 15-21

Weekly Photos: April 15-21

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Russia criticizes US reports on human rights

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

Nation's IPR suits see spike in 2012

H7N9 not spread between humans: WHO

Health new priority for quake zone

Sino-US shared interests emphasized

China, ROK criticize visits to shrine

US Weekly

|

|