Chinese factories to face strong headwinds from enlarged TPP

Updated: 2013-04-25 11:01

By Yu Ran in Shanghai (China Daily)

|

||||||||

Chinese manufacturers are bracing for stronger competition from Southeast Asian production bases that are expected to benefit from a free trade agreement involving the United States and Japan.

The US has invited Japan and some Southeast Asian countries to join the Trans-Pacific Partnership Agreement, which embraces 11 countries, including Chile, Mexico, Australia and Vietnam.

Japan is expected to begin negotiations to join the TPP in late July.

An expanded TPP could trigger a flow of industrial investment in new member states. Analysts said they expect much of that investment will come from Japan, which just launched an aggressive monetary expansion policy to jump-start a recovery.

The Bank of Japan announced on April 4 that it would pump $1.4 trillion into the Japanese economy to stimulate investment and consumption.

The TPP could give Japanese companies an incentive to invest the cheap money available at home in production facilities in new member states in the region, where labor costs are significantly lower than in China. This, analysts said, could pose a strong challenge to Chinese manufacturers, especially those at the lower end of the market.

"Panasonic plans to move up to 50 percent of its production lines in China to emerging Southeast Asian economies such as Thailand between 2006 and 2020," said Yu Weihao, a manager of Panasonic Electric Works (China) Co Ltd.

Yu added that the same products could be manufactured in those developing economies at lower costs.

Seeing their traditional advantages diminishing, Chinese manufacturers are also planning to diversify their production to emerging markets. Of course, this is not a new strategy. But the pace is seen to be increasing as domestic costs continue to rise.

"We've realized that our products with respectively low prices are no longer able to attract new clients as more factories in emerging economies like Vietnam and Thailand are making cheaper items thanks to lower labor costs," said Zhang Beilei, the owner of Wenzhou Gaotian Shoe Co Ltd.

Nearly 50 percent of Zhang's shoes are exported to regular clients in Japan, who have gradually reduced their orders since the end of 2009.

"The proportion of our output exported to Japan has fallen from 70 to 50 percent, and is likely to get even smaller if Japan joins the TPP," Zhang said.

Manufacturers with an advantage in making specific products also plan to leave China in search of lower costs.

"We plan to move three basic production lines from China to Vietnam in May to lower the costs and attract more clients with cheaper prices," said Huang Fajing, chairman of Zhejiang Rifeng Lighter Co Ltd. Most of his products are exported to Japan. Huang added that although his company has yet to be affected by the TPP, it will definitely have a negative impact on his business.

In addition, experts also suggested it would be a trend that more companies would choose to buy factories in Southeast Asian countries for improved profits.

"China's export volume will probably decrease gradually due to the agreement, which is an economic measure by the US to strengthen its influence in the Asia-Pacific region," said Shen Guilong, a professor of economics at Shanghai Academy of Social Sciences.

Shen added that Chinese companies moving some production lines out of China for lower expenses would ease the tending tougher situation.

yuran@chinadaily.com.cn

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Sluggish growth takes its toll on foreign lenders

Investors find a home in overseas real estate

More Chinese travel overseas, study reveals

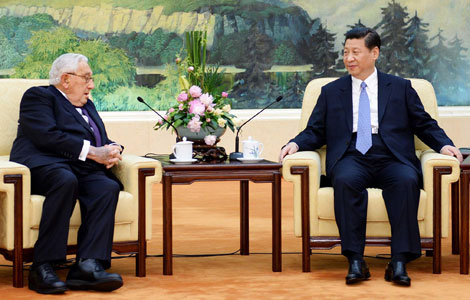

Xi meets former US heavyweights

Li in plea to quake rescuers

Canada to return illegal assets

Beijing vows to ease Korean tensions

Order restored after deadly terrorist ambush

US Weekly

|

|